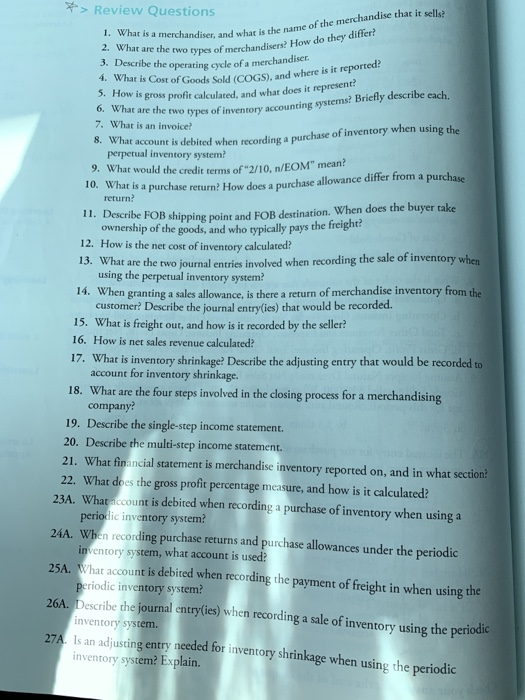

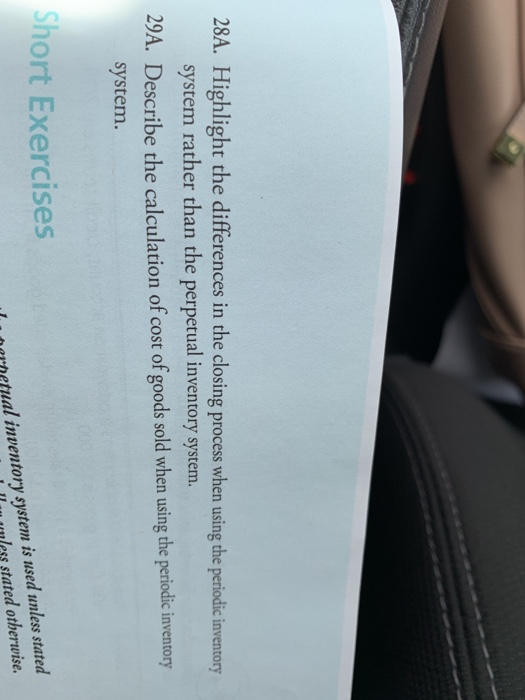

chandiser, and what is the name of the merchandise that it sells merchandisers? How do they differ? is Cost of Goods Sold (COGS), and where is it reported: me the two types of inventory accounting systems? Briefly describe each. *> Review Questions 1. What is a merchandiser, and what is 2. What are the two types of merchandisers? How do 3. Describe the operating cycle of a merchandiser 4. What is Cost of Goods Sold (COGS). 3. How is gross profit calculated, and what does it repres 6. What are the two types of in 7. What is an invoice? 8. What account is debited when recording a purchase of inventory when using the perpetual inventory system? 9. What would the credit terms of "2/10, n/EOM" mean? nee differ from a purchase 10. What is a purchase return? How does a purchase allowance di return? 11. Describe FOB shipping point and FOB destination. When does the buyer take ownership of the goods, and who typically pays the freight? 12. How is the net cost of inventory calculated? 13. What are the two journal entries involved when recording the sale of inventory when using the perpetual inventory system? 14. When granting a sales allowance, is there a return of merchandise inventory from the customer? Describe the journal entry(ies) that would be recorded. 15. What is freight out, and how is it recorded by the seller? 16. How is net sales revenue calculated? 17. What is inventory shrinkage? Describe the adjusting entry that would be recorded to account for inventory shrinkage. 18. What are the four steps involved in the closing process for a merchandising company? 19. Describe the single-step income statement. 20. Describe the multi-step income statement. 21. What financial statement is merchandise inventory reported on, and in what section 22. What does the gross profit percentage measure, and how is it calculated? 23A. What account is debited when recording a purchase of inventory when using a periodic inventory system? 24A. When recording purchase returns and purchase allowances under the periodic inventory system, what account is used? 25A. What account is debited when recording the payment of freight in when using the periodic inventory system? 26A. Describe the journal entry(ies) when recording a sale of inventory using the periodic inventory system. 274. Is an adiusting entry needed for inventory shrinkage when using the periodic inventory system? Explain. 28A. Highlight the differences in the closing process when using the periodic inventory system rather than the perpetual inventory system. 29A. Describe the calculation of cost of goods sold when using the periodic inventory system. Short Exercises ernetual inventory system is used unless stated Il l ess stated otherwise