Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chap 13 q2 urgent help needed SI A Font AaBbc Bb AaBb Bbet Aalbo . . . . Normal No Spac.. Heading! HeadinyHet VO TE

chap 13 q2 urgent help needed

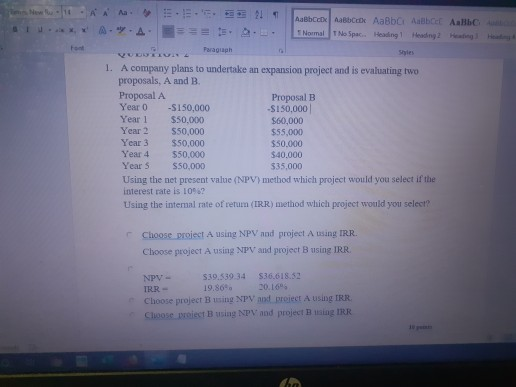

SI A Font AaBbc Bb AaBb Bbet Aalbo . . . . Normal No Spac.. Heading! HeadinyHet VO TE Paragraph 1. A company plans to undertake an expansion project and is evaluating two proposals, A and B. Proposal A Proposal B Year 0 -S150,000 -S150,000 Year 1 $50,000 $60,000 Year 2 550,000 $55,000 Year 3 $50,000 $50.000 Year 4 $50.000 $40.000 Year 5 S50,000 $35,000 Using the net present value (NPV) method which project would you select if the interest rate is 1096? Using the intemal rate of retum (IRR) method which project would you select? Choose project A using NPV and project A using IRR. Choose project A using NPV and project Busing IRR NPV - $39.339.34 36.618.52 TRR 19.869. 20.166 Choose project B using NPV and project A using IRR Close project Busing NPV and project B ig IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started