Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CHAP7 .10 Allocating Joint Costs Using the Net Realizable Value Method A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each

CHAP7 .10

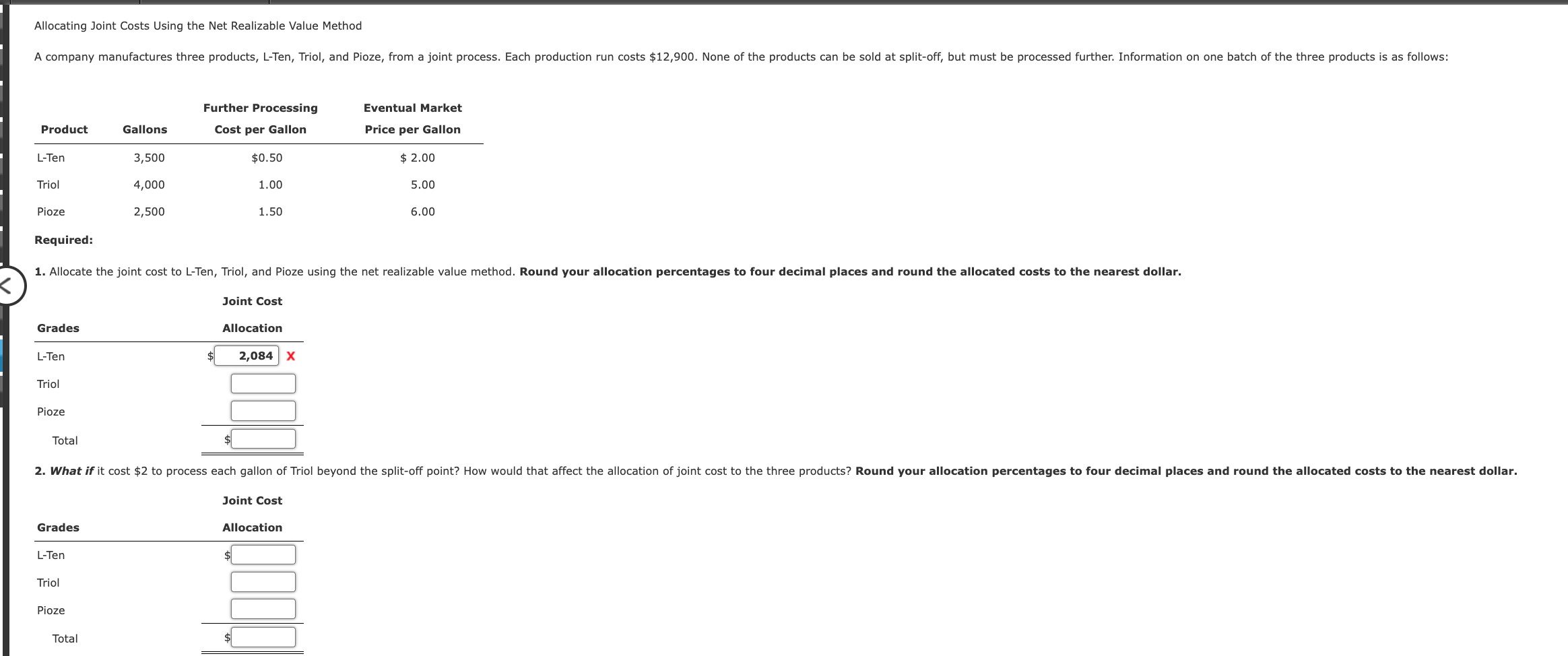

Allocating Joint Costs Using the Net Realizable Value Method A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs $12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Eventual Market Further Processing Cost per Gallon Product Gallons Price per Gallon L-Ten 3,500 $0.50 $ 2.00 Triol 4,000 1.00 5.00 Pioze 2,500 1.50 6.00 Required: 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. Joint Cost Grades Allocation L-Ten 2,084 x Triol Pioze Total 2. What if it cost $2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products? Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. Joint Cost Grades Allocation L-Ten Triol Pioze TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started