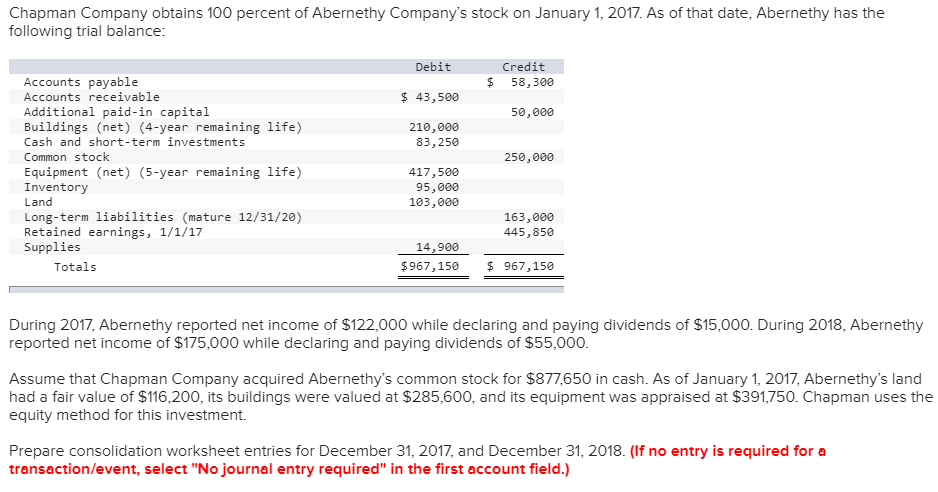

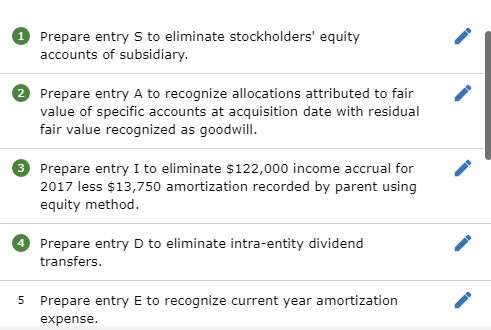

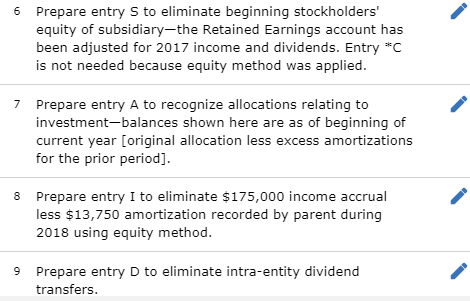

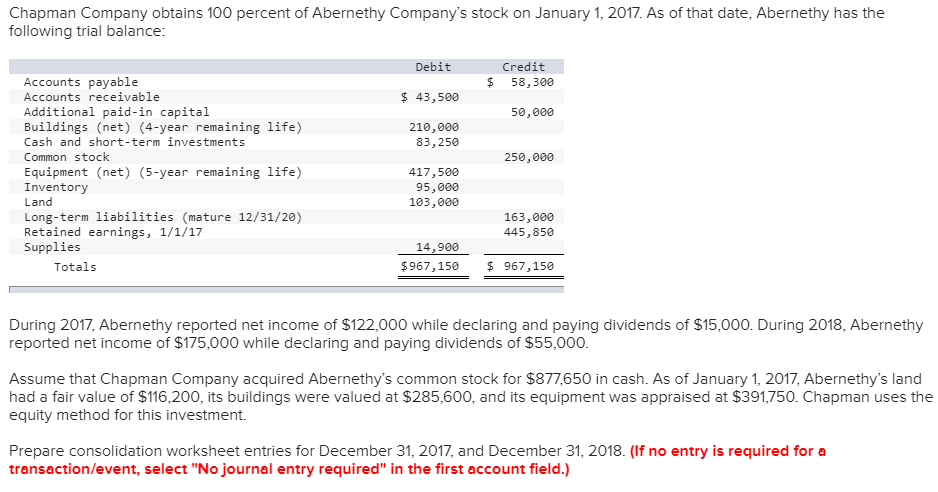

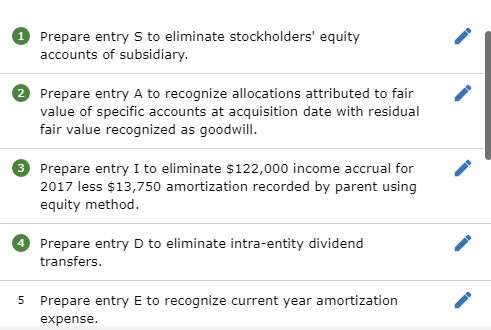

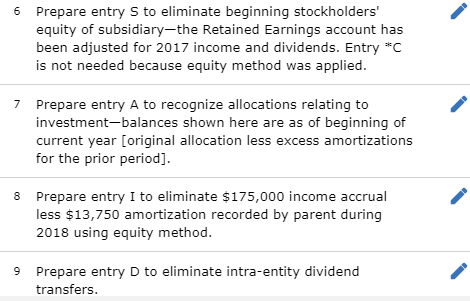

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that date, Abernethy has the following trial balance: Debit $ Credit 58,300 $ 43,500 50,000 210,000 83,250 250,000 Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year remaining life) Cash and short-term investments Common stock Equipment (net) (5-year remaining life) Inventory Land Long-term liabilities (mature 12/31/20) Retained earnings, 1/1/17 Supplies Totals 417,500 95,000 103,000 163,000 445,850 14,900 $967,150 $ 967,150 During 2017, Abernethy reported net income of $122,000 while declaring and paying dividends of $15,000. During 2018, Abernethy reported net income of $175,000 while declaring and paying dividends of $55,000. Assume that Chapman Company acquired Abernethy's common stock for $877,650 in cash. As of January 1, 2017, Abernethy's land had a fair value of $116,200, its buildings were valued at $285,600, and its equipment was appraised at $391,750. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2017, and December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Prepare entry S to eliminate stockholders' equity accounts of subsidiary. 2 Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. Prepare entry I to eliminate $122,000 income accrual for 2017 less $13,750 amortization recorded by parent using equity method. 4 Prepare entry D to eliminate intra-entity dividend transfers. 5 Prepare entry E to recognize current year amortization expense. 6 Prepare entry s to eliminate beginning stockholders' equity of subsidiary-the Retained Earnings account has been adjusted for 2017 income and dividends. Entry *C is not needed because equity method was applied. 7 Prepare entry A to recognize allocations relating to investment-balances shown here are as of beginning of current year (original allocation less excess amortizations for the prior period). 8 Prepare entry I to eliminate $175,000 income accrual less $13,750 amortization recorded by parent during 2018 using equity method. 9 Prepare entry D to eliminate intra-entity dividend transfers. 10 Prepare entry E to recognize current year amortization expense