Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the the financial statement of cash flows and the accounting statement of cash flows. Also these questions.. 1. How would you describe Warf Computer's

Prepare the the financial statement of cash flows and the accounting statement of cash flows. Also these questions..

1. How would you describe Warf Computer's cash flow?

2. Which cash flow statement more accurately describes the cash flows at the company?

3. In light of your previous answers, comment on Nick's expansion plans.

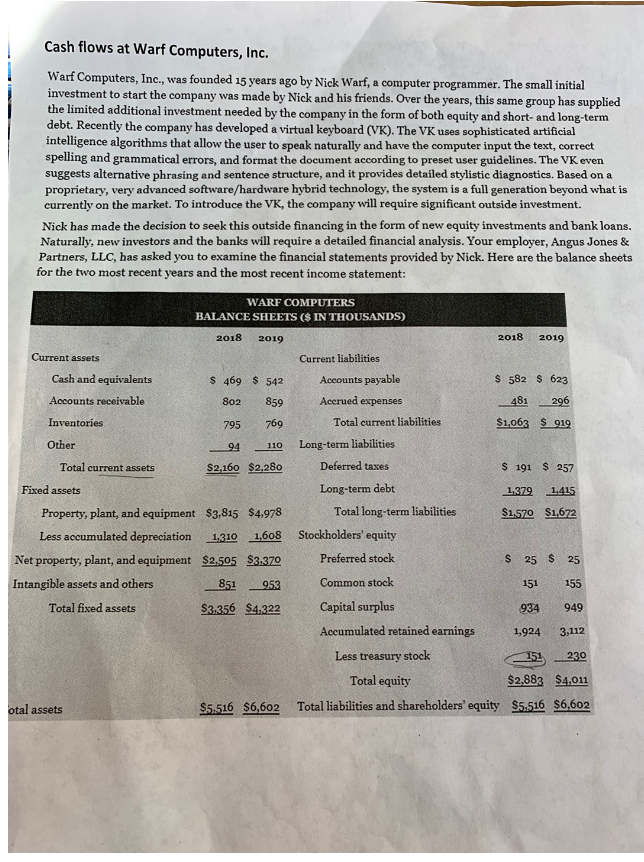

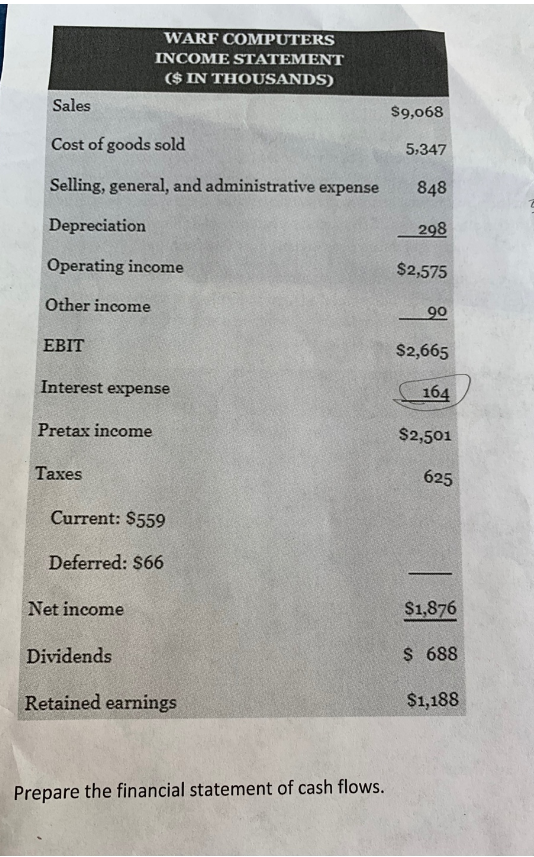

Cash flows at Warf Computers, Inc. Warf Computers, Inc., was founded 15 years ago by Nick Warf, a computer programmer. The small initial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed by the company in the form of both equity and short- and long-term debt. Recently the company has developed a virtual keyboard (VK). The VK uses sophisticated artificial intelligence algorithms that allow the user to speak naturally and have the computer input the text, correct spelling and grammatical errors, and format the document according to preset user guidelines. The VK even suggests alternative phrasing and sentence structure, and it provides detailed stylistic diagnostics. Based on a proprietary, very advanced software/hardware hybrid technology, the system is a full generation beyond what is currently on the market. To introduce the VK, the company will require significant outside investment. Nick has made the decision to seek this outside financing in the form of new equity investments and bank loans. Naturally, new investors and the banks will require a detailed financial analysis. Your employer, Angus Jones & Partners, LLC, has asked you to examine the financial statements provided by Nick. Here are the balance sheets for the two most recent years and the most recent income statement: WARF COMPUTERS BALANCE SHEETS ($ IN THOUSANDS) 2018 2018 2019 2019 Current assets Current liabilities Cash and equivalents S 582 $ 623 Accounts payable 469 $ 542 Acerued expenses Accounts receivable 859 481 296 802 $1,063 S 919 Total current liabilities Inventories 769 795 Long-term liabilities Other 110 94 Deferred taxes Total current assets $ 191 $257 $2,160 $2,280 Long-term debt Fixed assets 1379 1,415 Total long-term liabilities Property, plant, and equipment $3,815 $4.978 $1570 $1,672 Stockholders' equity Less accumulated depreciation 1,608 1,310 Preferred stock $ 25 S25 Net property, plant, and equipment $2,505 $3.370 Intangible assets and others Common stock 851 155 151 953 Capital surplus Total fixed assets S3.356 $4.322 949 934 Accumulated retained earnings 3,112 1,924 Less treasury stock 151 230 Total equity $2,883 $4,011 Total liabilities and shareholders' equity $5,516 $6,602 $5.516 $6,602 otal assets WARF COMPUTERS INCOME STATEMENT ($ IN THOUSANDS) Sales $9,068 Cost of goods sold 5:347 Selling, general, and administrative expense 848 Depreciation 298 Operating income $2,575 Other income 90 EBIT $2,665 Interest expense 164 Pretax income $2,501 es 625 Current: $559 Deferred: $66 Net income $1,876 $ 688 Dividends Retained earnings $1,188 Prepare the financial statement of cash flows. Cash flows at Warf Computers, Inc. Warf Computers, Inc., was founded 15 years ago by Nick Warf, a computer programmer. The small initial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed by the company in the form of both equity and short- and long-term debt. Recently the company has developed a virtual keyboard (VK). The VK uses sophisticated artificial intelligence algorithms that allow the user to speak naturally and have the computer input the text, correct spelling and grammatical errors, and format the document according to preset user guidelines. The VK even suggests alternative phrasing and sentence structure, and it provides detailed stylistic diagnostics. Based on a proprietary, very advanced software/hardware hybrid technology, the system is a full generation beyond what is currently on the market. To introduce the VK, the company will require significant outside investment. Nick has made the decision to seek this outside financing in the form of new equity investments and bank loans. Naturally, new investors and the banks will require a detailed financial analysis. Your employer, Angus Jones & Partners, LLC, has asked you to examine the financial statements provided by Nick. Here are the balance sheets for the two most recent years and the most recent income statement: WARF COMPUTERS BALANCE SHEETS ($ IN THOUSANDS) 2018 2018 2019 2019 Current assets Current liabilities Cash and equivalents S 582 $ 623 Accounts payable 469 $ 542 Acerued expenses Accounts receivable 859 481 296 802 $1,063 S 919 Total current liabilities Inventories 769 795 Long-term liabilities Other 110 94 Deferred taxes Total current assets $ 191 $257 $2,160 $2,280 Long-term debt Fixed assets 1379 1,415 Total long-term liabilities Property, plant, and equipment $3,815 $4.978 $1570 $1,672 Stockholders' equity Less accumulated depreciation 1,608 1,310 Preferred stock $ 25 S25 Net property, plant, and equipment $2,505 $3.370 Intangible assets and others Common stock 851 155 151 953 Capital surplus Total fixed assets S3.356 $4.322 949 934 Accumulated retained earnings 3,112 1,924 Less treasury stock 151 230 Total equity $2,883 $4,011 Total liabilities and shareholders' equity $5,516 $6,602 $5.516 $6,602 otal assets WARF COMPUTERS INCOME STATEMENT ($ IN THOUSANDS) Sales $9,068 Cost of goods sold 5:347 Selling, general, and administrative expense 848 Depreciation 298 Operating income $2,575 Other income 90 EBIT $2,665 Interest expense 164 Pretax income $2,501 es 625 Current: $559 Deferred: $66 Net income $1,876 $ 688 Dividends Retained earnings $1,188 Prepare the financial statement of cash flowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started