Answered step by step

Verified Expert Solution

Question

1 Approved Answer

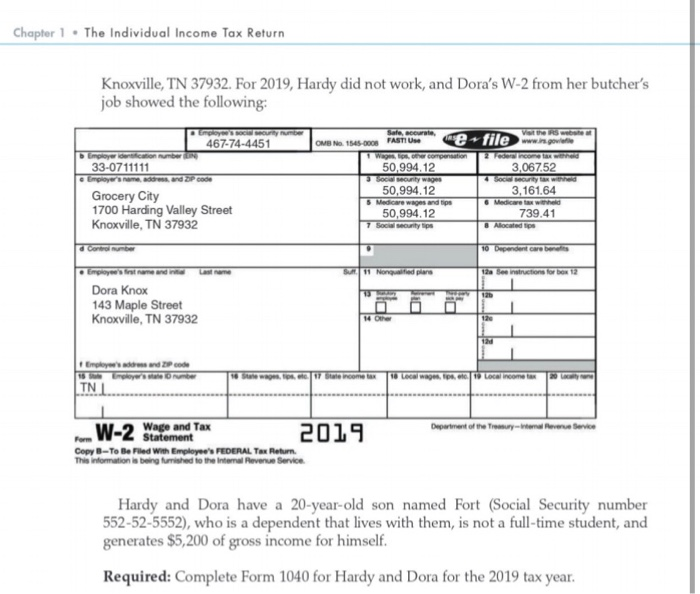

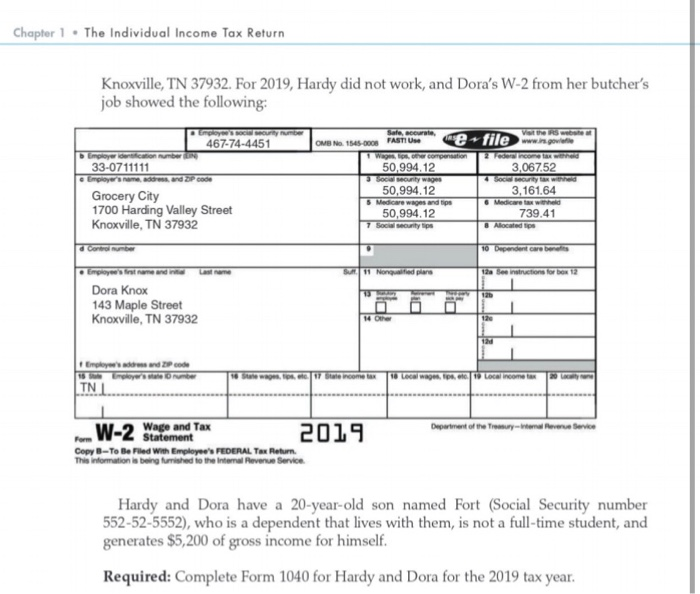

Chapter 1 . The Individual Income Tax Return Knoxville, TN 37932. For 2019, Hardy did not work, and Dora's W-2 from her butcher's job showed

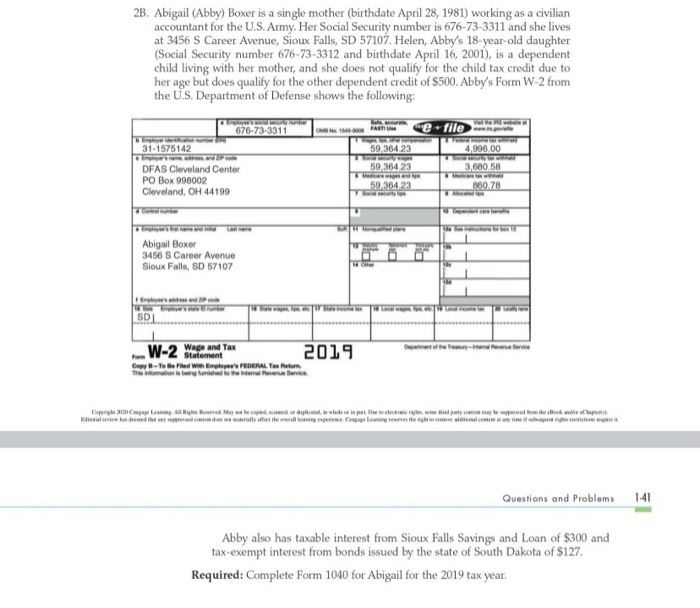

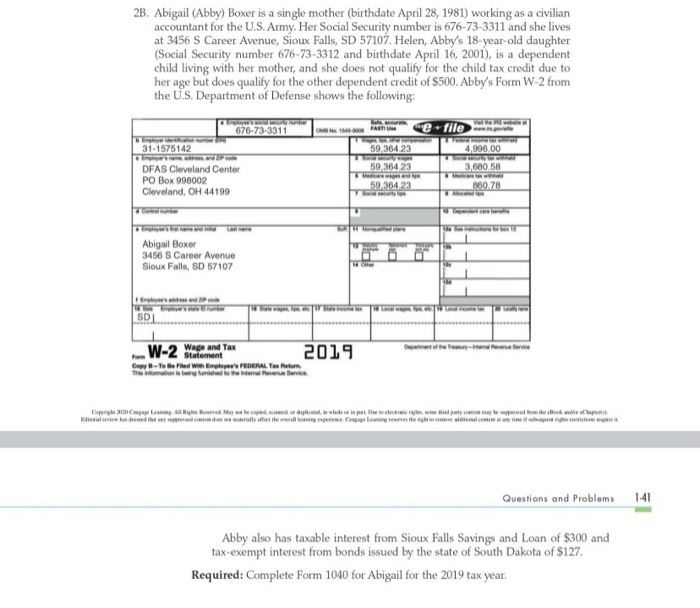

Chapter 1 . The Individual Income Tax Return Knoxville, TN 37932. For 2019, Hardy did not work, and Dora's W-2 from her butcher's job showed the following: Employees 467-74-4451 Employer cercato 33-0711111 e Employer's name, adress, and code Grocery City 1700 Harding Valley Street Knoxville, TN 37932 Sala, acouri Ver the OMB No 1545-600 FASTIU me filen portu Wagn, she compensation 50,994.12 3,067.52 County wages 4ority 50,994.12 3,161.64 5 Medicare wages and spe Medicare tax witheid 50,994.12 739.41 7 Social security located in Control umber 10 Dependent care benefits Employees 1 Nonqualified plane 12a See instructions for box 12 120 Dora Knox 143 Maple Street Knoxville, TN 37932 14 Other 12 my come to wa Local income TNT W-2 Department of the Truyterne Perene Service Wage and Tax Statement 2019 Copy B-To Be Filed Wm Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Hardy and Dora have a 20-year-old son named Fort (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full-time student, and generates $5,200 of gross income for himself. Required: Complete Form 1040 for Hardy and Dora for the 2019 tax year. 2B. Abigail (Abby) Boxer is a single mother (birthdate April 28, 1981) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby's 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2001), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby's Form W-2 from the U.S. Department of Defense shows the following: B. 676-73-3311 e file 1,996.00 31-1575142 59,364 23 59 364 23 59,364 23 DFAS Cleveland Center PO Box 998002 Cleveland, OH 44199 3,680.58 860.78 Abigail Boxer 3456 S Career Avenue Sioux Falls, SD 57107 SDI W-2 Wape and Tax 2019 Statement Cem-To Be Filed Employer's FEDERAL Textur. The tomation is being used to the Internal Revenue Service C. All werd de la pat Dewey yemekleri w review deed the way we will for the companies the right away the right Questions and Problems 141 Abby also has taxable interest from Sioux Falls Savings and Loan of $300 and tax-exempt interest from bonds issued by the state of South Dakota of $127. Required: Complete Form 1040 for Abigail for the 2019 tax year. Chapter 1 . The Individual Income Tax Return Knoxville, TN 37932. For 2019, Hardy did not work, and Dora's W-2 from her butcher's job showed the following: Employees 467-74-4451 Employer cercato 33-0711111 e Employer's name, adress, and code Grocery City 1700 Harding Valley Street Knoxville, TN 37932 Sala, acouri Ver the OMB No 1545-600 FASTIU me filen portu Wagn, she compensation 50,994.12 3,067.52 County wages 4ority 50,994.12 3,161.64 5 Medicare wages and spe Medicare tax witheid 50,994.12 739.41 7 Social security located in Control umber 10 Dependent care benefits Employees 1 Nonqualified plane 12a See instructions for box 12 120 Dora Knox 143 Maple Street Knoxville, TN 37932 14 Other 12 my come to wa Local income TNT W-2 Department of the Truyterne Perene Service Wage and Tax Statement 2019 Copy B-To Be Filed Wm Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Hardy and Dora have a 20-year-old son named Fort (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full-time student, and generates $5,200 of gross income for himself. Required: Complete Form 1040 for Hardy and Dora for the 2019 tax year. 2B. Abigail (Abby) Boxer is a single mother (birthdate April 28, 1981) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby's 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2001), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby's Form W-2 from the U.S. Department of Defense shows the following: B. 676-73-3311 e file 1,996.00 31-1575142 59,364 23 59 364 23 59,364 23 DFAS Cleveland Center PO Box 998002 Cleveland, OH 44199 3,680.58 860.78 Abigail Boxer 3456 S Career Avenue Sioux Falls, SD 57107 SDI W-2 Wape and Tax 2019 Statement Cem-To Be Filed Employer's FEDERAL Textur. The tomation is being used to the Internal Revenue Service C. All werd de la pat Dewey yemekleri w review deed the way we will for the companies the right away the right Questions and Problems 141 Abby also has taxable interest from Sioux Falls Savings and Loan of $300 and tax-exempt interest from bonds issued by the state of South Dakota of $127. Required: Complete Form 1040 for Abigail for the 2019 tax year

Chapter 1 . The Individual Income Tax Return Knoxville, TN 37932. For 2019, Hardy did not work, and Dora's W-2 from her butcher's job showed the following: Employees 467-74-4451 Employer cercato 33-0711111 e Employer's name, adress, and code Grocery City 1700 Harding Valley Street Knoxville, TN 37932 Sala, acouri Ver the OMB No 1545-600 FASTIU me filen portu Wagn, she compensation 50,994.12 3,067.52 County wages 4ority 50,994.12 3,161.64 5 Medicare wages and spe Medicare tax witheid 50,994.12 739.41 7 Social security located in Control umber 10 Dependent care benefits Employees 1 Nonqualified plane 12a See instructions for box 12 120 Dora Knox 143 Maple Street Knoxville, TN 37932 14 Other 12 my come to wa Local income TNT W-2 Department of the Truyterne Perene Service Wage and Tax Statement 2019 Copy B-To Be Filed Wm Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Hardy and Dora have a 20-year-old son named Fort (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full-time student, and generates $5,200 of gross income for himself. Required: Complete Form 1040 for Hardy and Dora for the 2019 tax year. 2B. Abigail (Abby) Boxer is a single mother (birthdate April 28, 1981) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby's 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2001), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby's Form W-2 from the U.S. Department of Defense shows the following: B. 676-73-3311 e file 1,996.00 31-1575142 59,364 23 59 364 23 59,364 23 DFAS Cleveland Center PO Box 998002 Cleveland, OH 44199 3,680.58 860.78 Abigail Boxer 3456 S Career Avenue Sioux Falls, SD 57107 SDI W-2 Wape and Tax 2019 Statement Cem-To Be Filed Employer's FEDERAL Textur. The tomation is being used to the Internal Revenue Service C. All werd de la pat Dewey yemekleri w review deed the way we will for the companies the right away the right Questions and Problems 141 Abby also has taxable interest from Sioux Falls Savings and Loan of $300 and tax-exempt interest from bonds issued by the state of South Dakota of $127. Required: Complete Form 1040 for Abigail for the 2019 tax year. Chapter 1 . The Individual Income Tax Return Knoxville, TN 37932. For 2019, Hardy did not work, and Dora's W-2 from her butcher's job showed the following: Employees 467-74-4451 Employer cercato 33-0711111 e Employer's name, adress, and code Grocery City 1700 Harding Valley Street Knoxville, TN 37932 Sala, acouri Ver the OMB No 1545-600 FASTIU me filen portu Wagn, she compensation 50,994.12 3,067.52 County wages 4ority 50,994.12 3,161.64 5 Medicare wages and spe Medicare tax witheid 50,994.12 739.41 7 Social security located in Control umber 10 Dependent care benefits Employees 1 Nonqualified plane 12a See instructions for box 12 120 Dora Knox 143 Maple Street Knoxville, TN 37932 14 Other 12 my come to wa Local income TNT W-2 Department of the Truyterne Perene Service Wage and Tax Statement 2019 Copy B-To Be Filed Wm Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Hardy and Dora have a 20-year-old son named Fort (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full-time student, and generates $5,200 of gross income for himself. Required: Complete Form 1040 for Hardy and Dora for the 2019 tax year. 2B. Abigail (Abby) Boxer is a single mother (birthdate April 28, 1981) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby's 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2001), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby's Form W-2 from the U.S. Department of Defense shows the following: B. 676-73-3311 e file 1,996.00 31-1575142 59,364 23 59 364 23 59,364 23 DFAS Cleveland Center PO Box 998002 Cleveland, OH 44199 3,680.58 860.78 Abigail Boxer 3456 S Career Avenue Sioux Falls, SD 57107 SDI W-2 Wape and Tax 2019 Statement Cem-To Be Filed Employer's FEDERAL Textur. The tomation is being used to the Internal Revenue Service C. All werd de la pat Dewey yemekleri w review deed the way we will for the companies the right away the right Questions and Problems 141 Abby also has taxable interest from Sioux Falls Savings and Loan of $300 and tax-exempt interest from bonds issued by the state of South Dakota of $127. Required: Complete Form 1040 for Abigail for the 2019 tax year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started