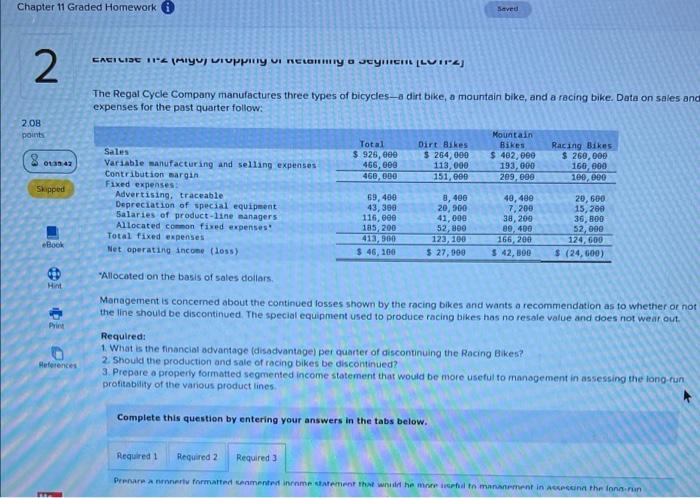

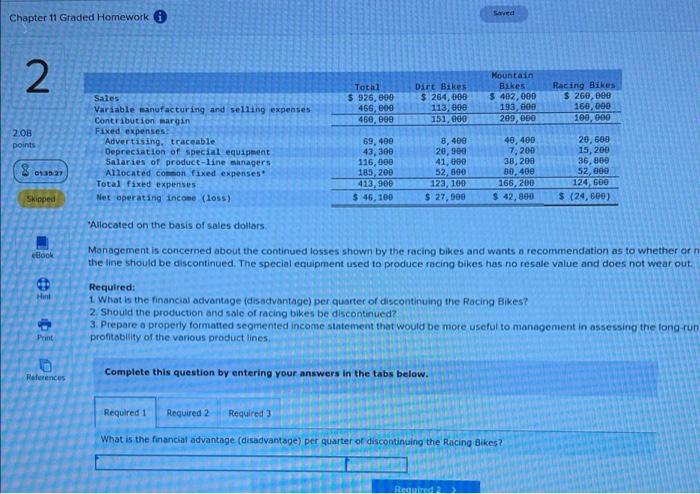

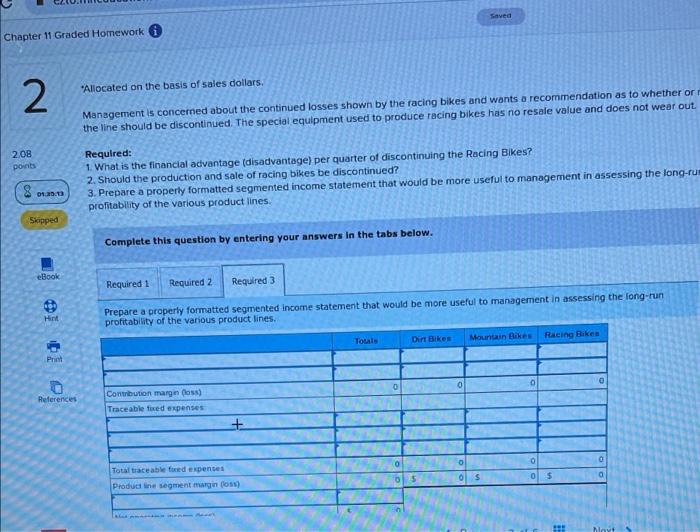

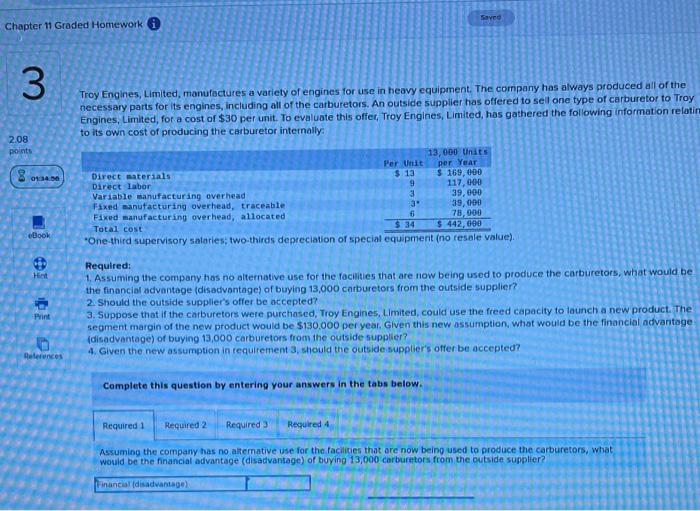

Chapter 11 Graded Homework Save 2 CACILIDE IRMyU VIUPpiny VI TELORHITy Jey (LVI The Regal Cycle Company manufactures three types of bicycles a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: 2.08 points 8 013242 Total $ 926,000 468,008 460,000 Dirt Bikes $ 264,000 113,000 151,000 Mountain Bikes $ 402, eee 193,000 209,000 Racing Bikes $ 260,000 160,000 100,000 Slapped Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses Advertising, traceable Depreciation of special equipment Salaries of product line managers Allocated common fived expenses Total fixed expenses Net operating income (less) 69, 400 43,300 116,000 185,200 413,500 $ 46, 100 8, 400 20,900 41,000 52,800 123, 100 $ 27,000 40, 480 7.200 38,200 80,400 166, 200 $ 42, 800 20,600 15, 200 36, 800 52.000 124, 600 $ (24,600) eBook "Allocated on the basis of sales dollars. Hint Print Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not weat out. Required: 1 What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a property formatted segmented income statement that would be more useful to management in assessing the long run profitability of the various product lines. Heferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prenar annerly Formattinamente in me statement that will he met mannen in Aspent the long run Sarved Chapter 11 Graded Homework 2 Total $926,800 466,000 460,000 Dart Bikes $ 264,888 113,000 151,000 Mountain Bikes $ 402,000 193,000 209,000 Racing Bikes $ 260,000 160,000 100,000 2.08 points Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses Total fixed expenses Net operating income (loss) 5 69, 409 43,380 116,000 185,200 413, 900 $ 46,100 8, 400 20,900 41,000 52.000 123, 100 $ 27,000 40,400 7,200 38,200 80,400 166,200 $ 42,800 20,609 15, 200 36,800 52,000 124,600 $ (24,600) Skipped "Allocated on the basis of sales dollars cook Monagement is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or n the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out Hint io je Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long run profitability of the various product lines References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? Resmie22 Saved Chapter 11 Graded Homework *Allocated on the basis of sales dollars. 2 Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out 2.08 ponib Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines 8 13:00 Skipped Complete this question by entering your answers in the tabs below. eBook Required 1 Required 2 Required 3 Hint Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines. Totals Dirt Bikes Mountain Bikes Racing Bikes Print 0 0 0 References Contribution margin (los) Traceable fuced expenses + 0 o 0 Total traceabile ed expenses Producine segment margin (0) $ 0 $ a Nav Saved Chapter 11 Graded Homework 3 Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $30 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the following information relatin to its own cost of producing the carburetor internally: 2.08 points 8 134.00 13,000 Units Per Unit per Year Direct materials $.13 $ 169,000 Direct labor 9 117.000 Variable manufacturing over head 3 39,000 Fixed manufacturing overhead, traceable 3 39,000 Fixed manufacturing overhead, allocated 6 78,000 Total cost $ 34 $ 442,000 "One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value) eBook 8 Hint Required: 1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 13,000 carburetors from the outside supplier? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Limited, could use the freed capacity to launch a new product. The segment margin of the new product would be $130,000 per year. Given this new assumption, what would be the financial advantage (disadvantage) of buying 13,000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted? Print Balences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 13,000 carburetors from the outside supplier? Financial (disadvantage