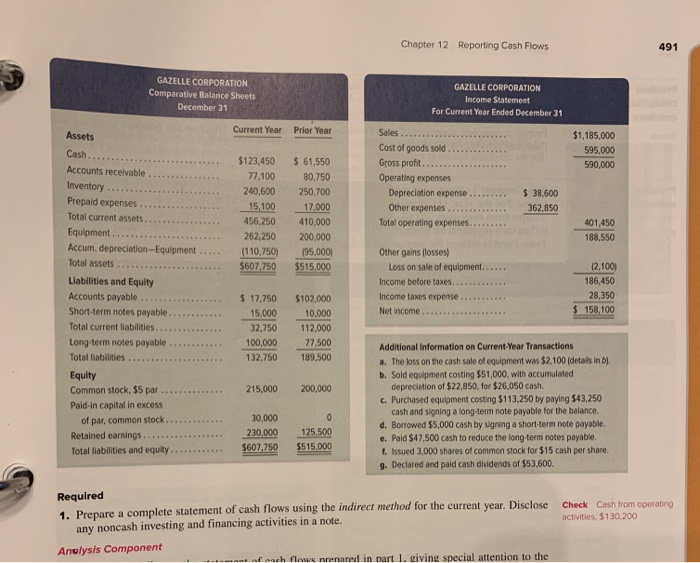

Chapter 12 Reporting Cash Flows 491 GAZELLE CORPORATION Comparative Balance Sheets December 31 GAZELLE CORPORATION Income Statement For Current Year Ended December 31 Prior Year Sales $1,185,000 595.000 590,000 Cost of goods sold ...... Gross profit.... Operating expenses Depreciation expense ......... Other expenses.............. Total operating expenses..... $ 61,550 80.750 250,700 17.000 410,000 200.000 (95,000) $515,000 $ 38,600 362,850 401.450 188,550 Current Year Assets Cash.... $123,450 Accounts receivable 77.100 Inventory .... . . 240,600 Prepaid expenses .......... 15,100 Total current assets..... 456,250 Equipment ........... 262,250 Accum. depreciation Equipment ... (110,750) Total assets $607,750 Liabilities and Equity Accounts payable.. $ 17.750 Short-term notes payable.... 15,000 Total current liabilities....... 32,750 Long-term notes payable ....... 100,000 Total liabilities ..... 132,750 Equity Common stock, $5 par.. 215,000 Paid-in capital in excess of par, common stock... 30,000 230,000 Retained earnings... Total liabilities and equity............ $607,750 Other gains (losses Loss on sale of equipment...... Income before taxes.... Income taxes expense.......... Net income 12,100) 186,450 28,350 $ 158,100 $102,000 10,000 112,000 77.500 189,500 200,000 Additional Information on Current-Year Transactions a. The loss on the cash sale of equipment was $2,100 (details in b). b. Sold equipment costing $51,000, with accumulated depreciation of $22,850, for $26,050 cash. c. Purchased equipment costing $113,250 by paying $43.250 cash and signing a long-term note payable for the balance. d. Borrowed $5,000 cash by signing a short-term note payable. e. Paid $47,500 cash to reduce the long-term notes payable. 1. Issued 3,000 shares of common stock for $15 cash per share. 9. Declared and paid cash dividends of $53,600. 125,500 $515.000 Check Cash from operating activities. $130.200 Required 4. Prepare a complete statement of cash flows using the indirect method for the current year. Disclose any noncash investing and financing activities in a note. Anulysis Component t asch fle neared in nart I. giving special attention to the