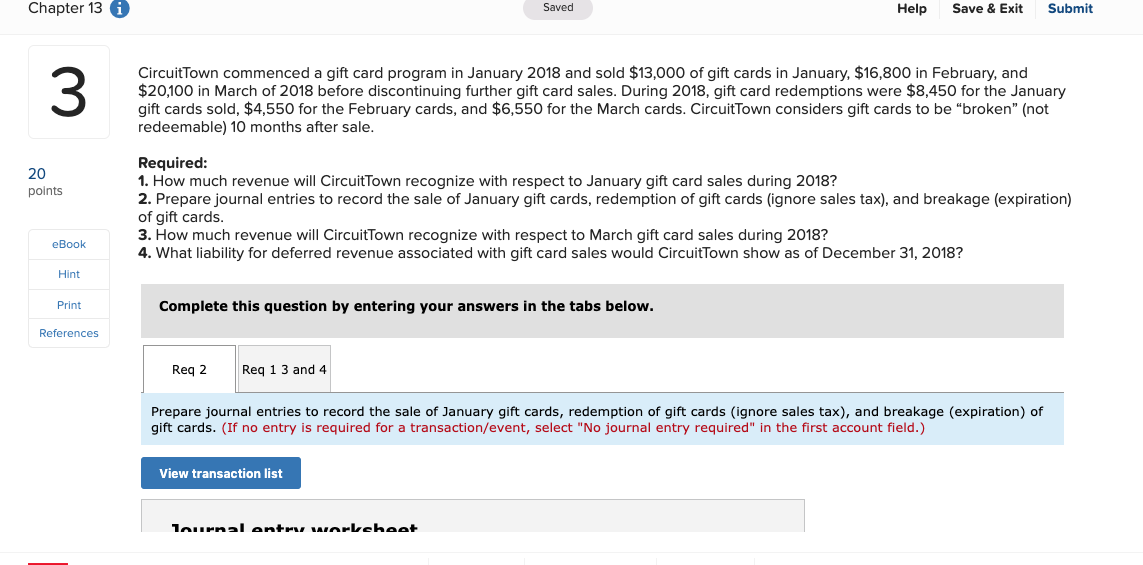

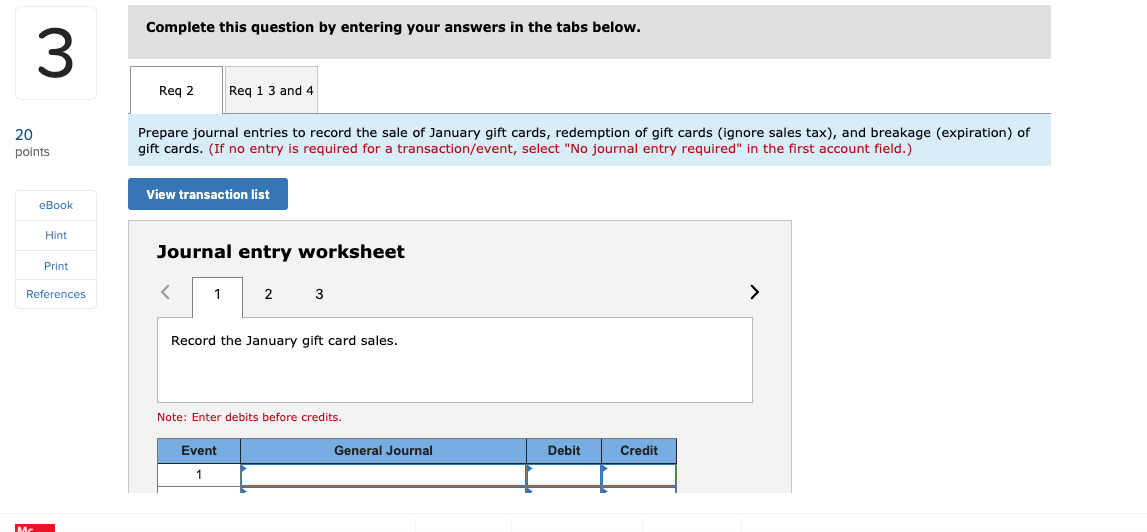

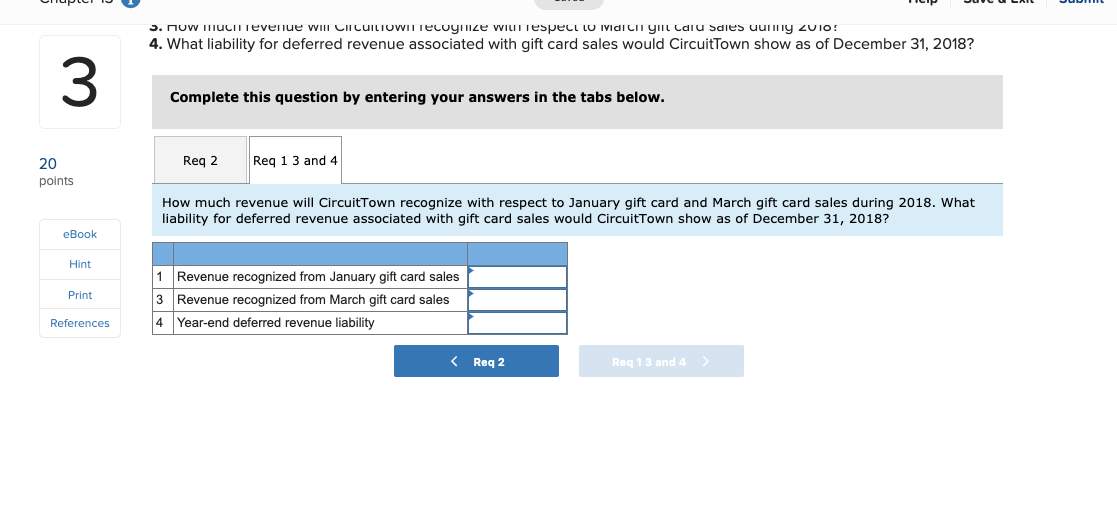

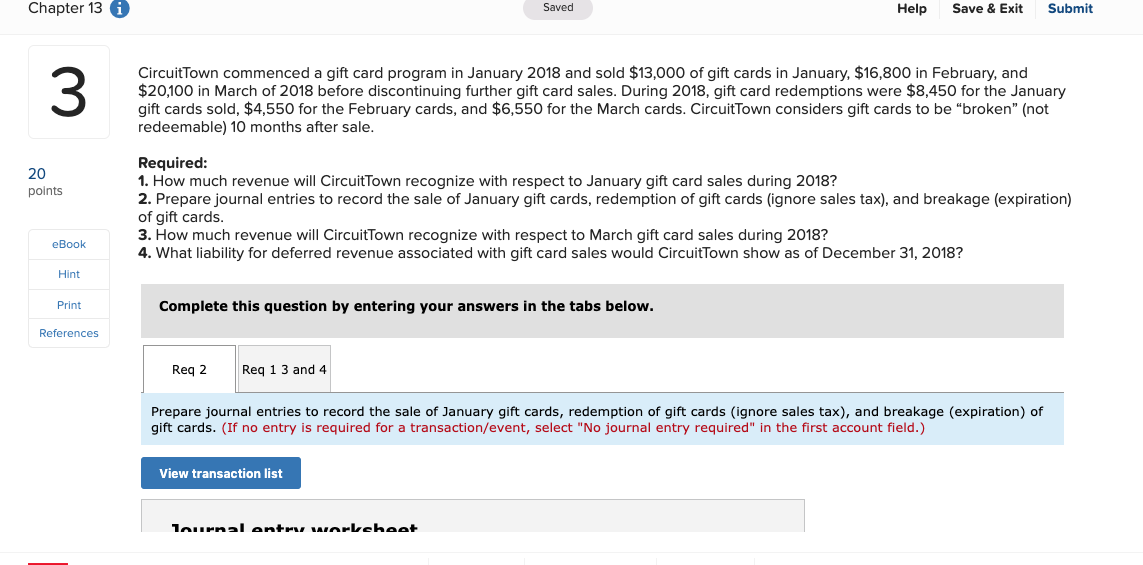

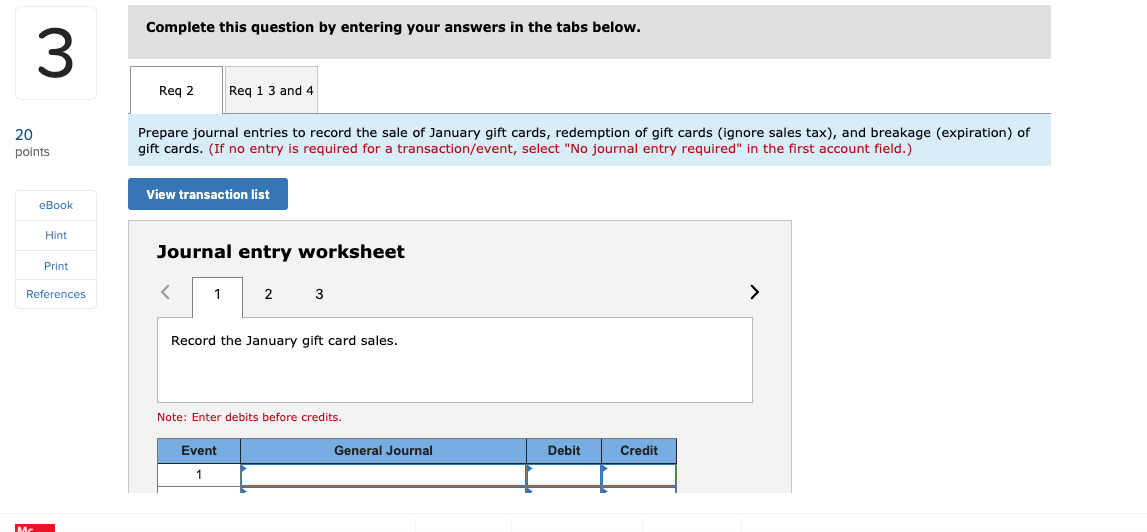

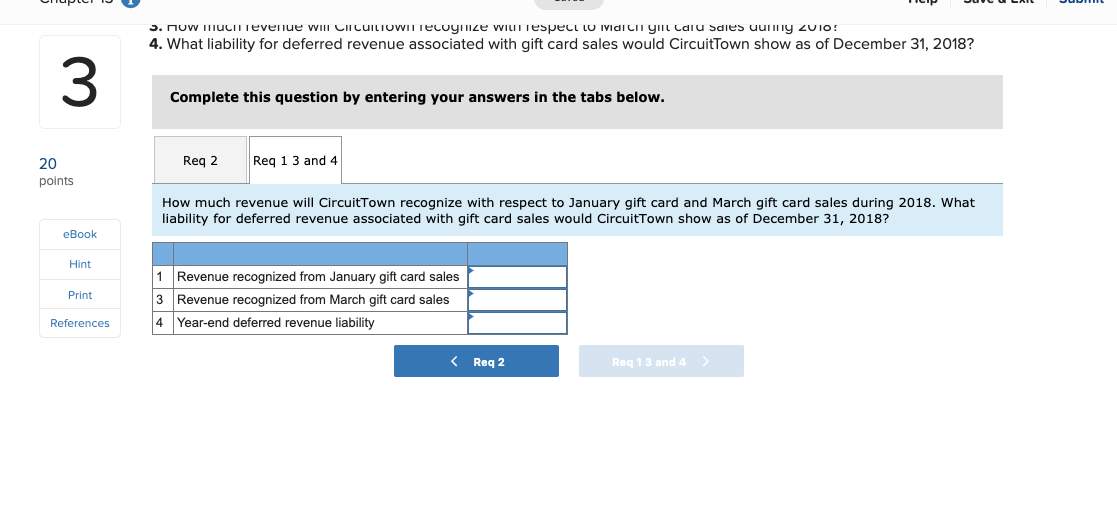

Chapter 13 i Saved Help Save & Exit Submit Circuit Town commenced a gift card program in January 2018 and sold $13,000 of gift cards in January, $16,800 in February, and $20,100 in March of 2018 before discontinuing further gift card sales. During 2018, gift card redemptions were $8,450 for the January gift cards sold, $4,550 for the February cards, and $6,550 for the March cards. Circuit Town considers gift cards to be "broken" (not redeemable) 10 months after sale. 20 points Required: 1. How much revenue will CircuitTown recognize with respect to January gift card sales during 2018? 2. Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) of gift cards. 3. How much revenue will Circuit Town recognize with respect to March gift card sales during 2018? 4. What liability for deferred revenue associated with gift card sales would CircuitTown show as of December 31, 2018? eBook Hint Print Complete this question by entering your answers in the tabs below. References Reg 2 Req 1 3 and 4 Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) of gift cards. (If no entry is required for a transaction/event, select "No ed for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Tournal entry worksheet Complete this question by entering your answers in the tabs below. Reg 2 Req 1 3 and 4 20 points Prepare journal entries to record the sale of January gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration of gift cards. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list eBook Hint Journal entry worksheet Print References 2 3 Record the January gift card sales. Note: Enter debits before credits. Event General Journal Debit Credit LUJUE USAIL 3. Now mucillevenue will LII CUILTUWIT Tecognize WILII Tespell LU IVDICIT YHL Calu Sdies uunny 2010! 4. What liability for deferred revenue associated with gift card sales would CircuitTown show as of December 31, 2018? Complete this question by entering your answers in the tabs below. Req 2 Req 1 3 and 4 20 points How much revenue will CircuitTown recognize with respect to January gift card and March gift card sales during 2018. What liability for deferred revenue associated with gift card sales would Circuit Town show as of December 31, 2018? eBook Hint Print Revenue recognized from January gift card sales 3 Revenue recognized from March gift card sales 4 Year-end deferred revenue liability References