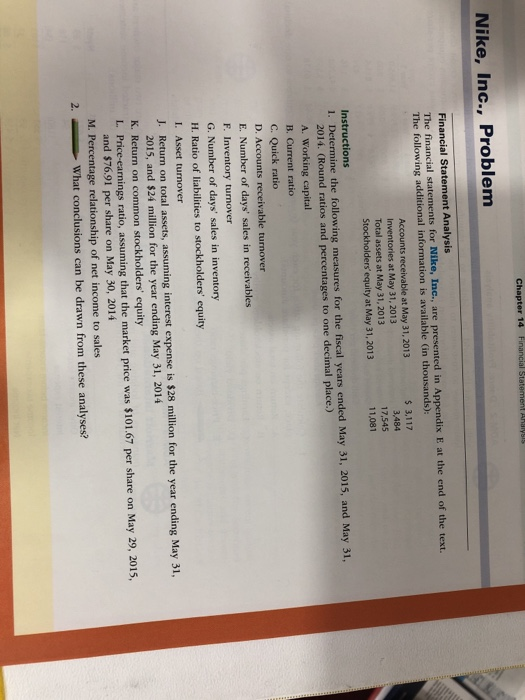

Chapter 14 Financial Statement Analys Nike, Inc., Problem Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix E at the end of the text. The following additional information is available in thousands): Accounts receivable at May 31, 2013 $ 3,117 Inventories at May 31, 2013 3,484 Total assets at May 31, 2013 17,545 Stockholders'equity at May 31, 2013 11,081 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31, 2014. (Round ratios and percentages to one decimal place.) A. Working capital B. Current ratio C. Quick ratio D. Accounts receivable turnover E. Number of days' sales in receivables F. Inventory turnover G. Number of days' sales in inventory H. Ratio of liabilities to stockholders' equity I. Asset turnover J. Return on total assets, assuming interest expense is $28 million for the year ending May 31, 2015, and $24 million for the year ending May 31, 2014 K. Return on common stockholders' equity L Price earnings ratio, assuming that the market price was $101.67 per share on May 29, 2015, and $76.91 per share on May 30, 2014 M. Percentage relationship of net income to sales What conclusions can be drawn from these analyses? Chapter 14 Financial Statement Analys Nike, Inc., Problem Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix E at the end of the text. The following additional information is available in thousands): Accounts receivable at May 31, 2013 $ 3,117 Inventories at May 31, 2013 3,484 Total assets at May 31, 2013 17,545 Stockholders'equity at May 31, 2013 11,081 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31, 2014. (Round ratios and percentages to one decimal place.) A. Working capital B. Current ratio C. Quick ratio D. Accounts receivable turnover E. Number of days' sales in receivables F. Inventory turnover G. Number of days' sales in inventory H. Ratio of liabilities to stockholders' equity I. Asset turnover J. Return on total assets, assuming interest expense is $28 million for the year ending May 31, 2015, and $24 million for the year ending May 31, 2014 K. Return on common stockholders' equity L Price earnings ratio, assuming that the market price was $101.67 per share on May 29, 2015, and $76.91 per share on May 30, 2014 M. Percentage relationship of net income to sales What conclusions can be drawn from these analyses