Question

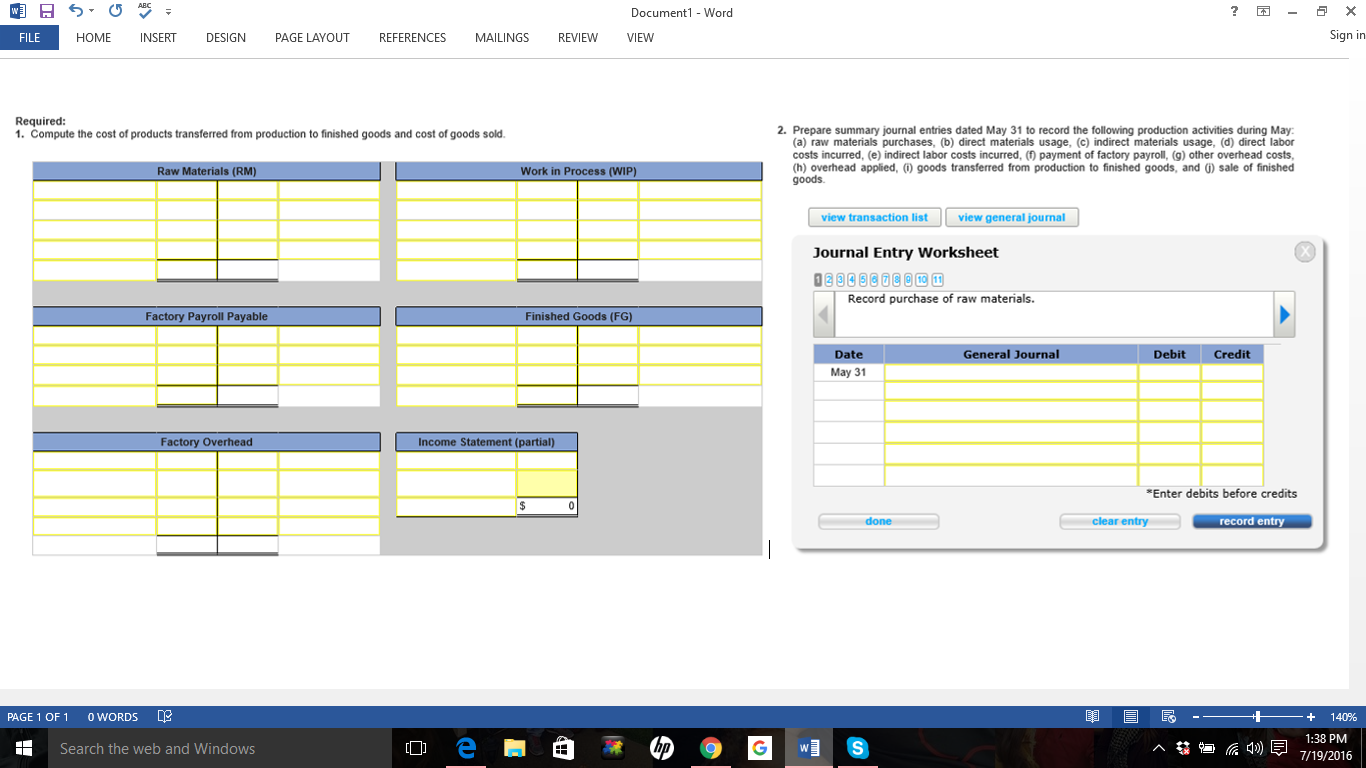

CHAPTER 16. PLEASE ANSWER 1 & 2. ******PLEASE READ THESE DIRECTIONS****** THERE ARE SPECIFIC OPTIONS FOR 1. On part 1, there are charts for Raw

CHAPTER 16. PLEASE ANSWER 1 & 2. ******PLEASE READ THESE DIRECTIONS******THERE ARE SPECIFIC OPTIONS FOR 1. On part 1, there are charts for Raw Materials, Work in Process, Factory Payroll Payable, Finished Goods, Factory Overhead, and Income Statement (partial). THE TWO COLUMNS IN THE MIDDLE ARE FOR NUMBERS. However, the longer columns/rows on the outsides are for meant for certain options. Please use these so there is no confusion. THE OPTIONS ARE: COSTS OF GOODS MANUF, COSTS OF GOODS SOLD, DL USED, DM USED, FG - APRIL 30, FG - MAY 31, GROSS PROFIT, INDIRECT LABOR, INDIRECT MATERIALS, OTHER OH COSTS, OVERHEAD(OH) APPLIED, RM - APRIL 30, RM MAY 31, RM PURCHASES, SALES, TOTAL FACTORY PR PAID, WIP - APRIL 30, AND FINALLY WIP - MAY 31.

******FOR PART 2, OPTIONS ARE: ACCOUNTS PAYABLE, CASH, COST OF GOODS SOLD, FACTORY OVERHEAD, FACTOY PAYROLL PAYABLE, FINISHED GOODS INVENTORY, OTHER ACCOUNTS, RAW MATERIALS INVENTORY, SALES, AND WORK IN PROCESS INVENTORY. REMEMBER THERE ARE MORE THAN ONE JOURNAL ENTRY FOR PART 2. Prepare summary journal entries dated May 31 to record the following production activities during May: (a) raw materials purchases, (b) direct materials usage, (c) indirect materials usage, (d) direct labor costs incurred, (e) indirect labor costs incurred, (f) payment of factory payroll, (g) other overhead costs, (h) overhead applied, (i) goods transferred from production to finished goods, and (j) sale of finished goods

Thanks for all the help in advance I really need to learn how to do this.

[The following information applies to the questions displayed below.]

| Sierra Company manufactures woven blankets and accounts for product costs using process costing. The company uses a single processing department. The following information is available regarding its May inventories |

| Beginning Inventory | Ending Inventory | |||||

| Raw materials inventory | $ | 51,000 | $ | 92,000 | ||

| Work in process inventory | 445,500 | 591,000 | ||||

| Finished goods inventory | 623,000 | 432,001 | ||||

| The following additional information describes the company's production activities for May. |

| Raw materials purchases (on credit) | $ | 270,000 | |

| Factory payroll cost (paid in cash) | 1,567,000 | ||

| Other overhead cost (Other Accounts credited) | 57,500 | ||

| Materials used | |||

| Direct | $ | 155,000 | |

| Indirect | 74,000 | ||

| Labor used | |||

| Direct | $ | 790,000 | |

| Indirect | 777,000 | ||

| Overhead rate as a percent of direct labor | 115 | % | |

| Sales (on credit) | $ | 2,500,000 | |

| The predetermined overhead rate was computed at the beginning of the year as 115% of direct labor cost. |

Document1- Word FILE HOME INSERT DESIGNPAGE LAYOUT REFERENCES MAILINGSREVIEW VIEW Sign in Required: 1. Compute the cost of products transferred from production to finished goods and cost of goods sold. 2. Prepare summary journal entries dated May 31 to record the following production activities during May (a) raw materials purchases, (b) direct materials usage, (c) indirect materials usage, (d) direct labor costs incurred, (e) indirect labor costs incurred (f) payment of factory payroll, (g) other overhead costs (h) overhead applied, () goods transferred from production to finished goods, and ) sale of finished goods. Raw Materials (RM) Work in Process (WIP) view transaction list view general journal Journal Entry Worksheet 33098080 Record purchase of raw materials. Factory Payroll Payable Finished Goods (FG) Date General Journal Debit Credit May 31 Factory Overhead Income Statement (partial) Enter debits before credits done clear entry record entry PAGE 1 OF1 OWORDS L + 14096 1:38 PM 0 ^4) 7/19/2016 | Search the web and Windows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started