Answered step by step

Verified Expert Solution

Question

1 Approved Answer

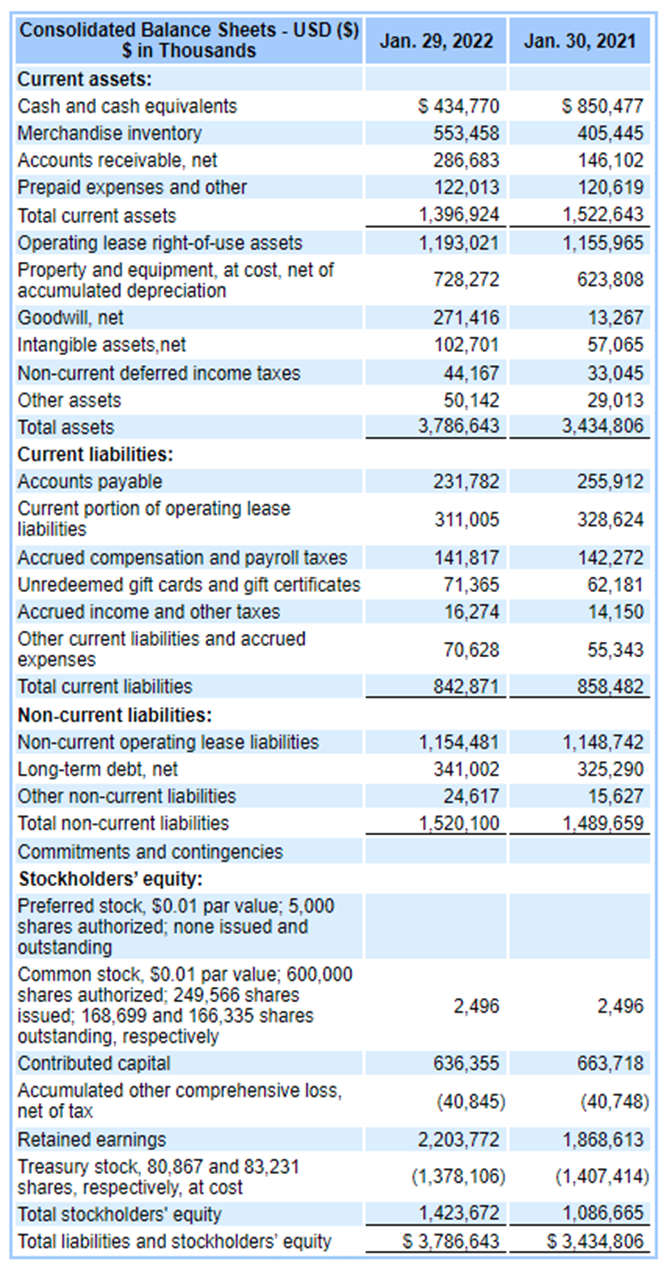

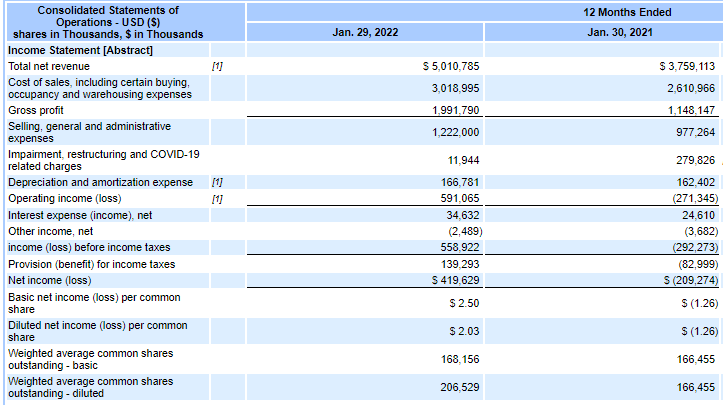

Chapter 17 Ratio Assignment-For this assignment, click into the chapter 17 module and read the instructions. You will be calculating 6 ratios for a two-year

Chapter 17 Ratio Assignment-For this assignment, click into the chapter 17 module and read the instructions. You will be calculating 6 ratios for a two-year period (total of 12 calculations). You must include the ratio, your calculation and the answer for each ratio for two years.

Additional information: Total Assets as of Feb 1, 2020 $3,328,679 ($ in Thousands) Total Stockholders equity as of Feb 1, 2020 $1,247,853 ($ in Thousands)

\begin{tabular}{|c|c|c|} \hline \begin{tabular}{c} Consolidated Balance Sheets - USD (\$) \\ \$ in Thousands \end{tabular} & Jan. 29, 2022 & Jan. 30, 2021 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $434,770 & $850,477 \\ \hline Merchandise inventory & 553,458 & 405,445 \\ \hline Accounts receivable, net & 286,683 & 146,102 \\ \hline Prepaid expenses and other & 122,013 & 120,619 \\ \hline Total current assets & 1,396,924 & 1,522,643 \\ \hline Operating lease right-of-use assets & 1,193,021 & 1,155,965 \\ \hline \begin{tabular}{l} Property and equipment, at cost, net of \\ accumulated depreciation \end{tabular} & 728,272 & 623,808 \\ \hline Goodwill, net & 271,416 & 13,267 \\ \hline Intangible assets, net & 102,701 & 57,065 \\ \hline Non-current deferred income taxes & 44,167 & 33,045 \\ \hline Other assets & 50,142 & 29,013 \\ \hline Total assets & 3,786,643 & 3,434,806 \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & 231,782 & 255,912 \\ \hline \begin{tabular}{l} Current portion of operating lease \\ liabilities \end{tabular} & 311,005 & 328,624 \\ \hline Accrued compensation and payroll taxes & 141,817 & 142,272 \\ \hline Unredeemed gift cards and gift certificates & 71,365 & 62,181 \\ \hline Accrued income and other taxes & 16,274 & 14,150 \\ \hline \begin{tabular}{l} Other current liabilities and accrued \\ expenses \end{tabular} & 70,628 & 55,343 \\ \hline Total current liabilities & 842,871. & 858,482 \\ \hline \multicolumn{3}{|l|}{ Non-current liabilities: } \\ \hline Non-current operating lease liabilities & 1,154,481 & 1,148,742 \\ \hline Long-term debt, net & 341,002 & 325,290 \\ \hline Other non-current liabilities & 24,617 & 15,627 \\ \hline Total non-current liabilities & 1,520,100 & 1,489,659 \\ \hline \multicolumn{3}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Preferred stock, $0.01 par value; 5,000 \\ shares authorized; none issued and \\ outstanding \end{tabular}} \\ \hline \begin{tabular}{l} Common stock, $0.01 par value; 600,000 \\ shares authorized; 249,566 shares \\ issued; 168,699 and 166,335 shares \\ outstanding, respectively \end{tabular} & 2,496 & 2,496 \\ \hline Contributed capital & 636,355 & 663,718 \\ \hline \begin{tabular}{l} Accumulated other comprehensive loss, \\ net of tax \end{tabular} & (40,845) & (40,748) \\ \hline Retained earnings & 2,203,772 & 1,868,613 \\ \hline \begin{tabular}{l} Treasury stock, 80,867 and 83,231 \\ shares, respectively, at cost \end{tabular} & (1,378,106) & (1,407,414) \\ \hline Total stockholders' equity & 1,423,672 & 1,086,665 \\ \hline Total liabilities and stockholders' equity & $3,786,643 & $3,434,806 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{c} Consolidated Statements of \\ Operations - USD (\$) \\ shares in Thousands, \$ in Thousands \end{tabular}}} & \multicolumn{2}{|r|}{12 Months Ended } \\ \hline & & Jan. 29, 2022 & Jan. 30, 2021 \\ \hline \multicolumn{4}{|l|}{ Income Statement [Abstract] } \\ \hline Total net revenue & [1] & $5,010,785 & $3,759,113 \\ \hline \begin{tabular}{l} Cost of sales, including certain buying, \\ occupancy and warehousing expenses \end{tabular} & & 3,018,995 & 2,610,966 \\ \hline Gross profit & & 1,991,790 & 1,148,147 \\ \hline \begin{tabular}{l} Selling, general and administrative \\ expenses \end{tabular} & & 1,222,000 & 977,264 \\ \hline \begin{tabular}{l} Impairment, restructuring and COVID-19 \\ related charges \end{tabular} & & 11,944 & 279,826 \\ \hline Depreciation and amortization expense & [1] & 166,781 & 162,402 \\ \hline Operating income (loss) & [1] & 591,065 & (271,345) \\ \hline Interest expense (income), net & & 34,632 & 24,610 \\ \hline Other income, net & & (2,489) & (3,682) \\ \hline income (loss) before income taxes & & 558,922 & (292,273) \\ \hline Provision (benefit) for income taxes & & 139,293 & (82,999) \\ \hline Net income (loss) & & $419,629 & S(209,274) \\ \hline \begin{tabular}{l} Basic net income (loss) per common \\ share \end{tabular} & & $2.50 & $(1.26) \\ \hline \begin{tabular}{l} Diluted net income (loss) per common \\ share \end{tabular} & & $2.03 & $(1.26) \\ \hline \begin{tabular}{l} Weighted average common shares \\ outstanding - basic \end{tabular} & & 168,156 & 166,455 \\ \hline \begin{tabular}{l} Weighted average common shares \\ outstanding - diluted \end{tabular} & & 206,529 & 166,455 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \begin{tabular}{c} Consolidated Balance Sheets - USD (\$) \\ \$ in Thousands \end{tabular} & Jan. 29, 2022 & Jan. 30, 2021 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $434,770 & $850,477 \\ \hline Merchandise inventory & 553,458 & 405,445 \\ \hline Accounts receivable, net & 286,683 & 146,102 \\ \hline Prepaid expenses and other & 122,013 & 120,619 \\ \hline Total current assets & 1,396,924 & 1,522,643 \\ \hline Operating lease right-of-use assets & 1,193,021 & 1,155,965 \\ \hline \begin{tabular}{l} Property and equipment, at cost, net of \\ accumulated depreciation \end{tabular} & 728,272 & 623,808 \\ \hline Goodwill, net & 271,416 & 13,267 \\ \hline Intangible assets, net & 102,701 & 57,065 \\ \hline Non-current deferred income taxes & 44,167 & 33,045 \\ \hline Other assets & 50,142 & 29,013 \\ \hline Total assets & 3,786,643 & 3,434,806 \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & 231,782 & 255,912 \\ \hline \begin{tabular}{l} Current portion of operating lease \\ liabilities \end{tabular} & 311,005 & 328,624 \\ \hline Accrued compensation and payroll taxes & 141,817 & 142,272 \\ \hline Unredeemed gift cards and gift certificates & 71,365 & 62,181 \\ \hline Accrued income and other taxes & 16,274 & 14,150 \\ \hline \begin{tabular}{l} Other current liabilities and accrued \\ expenses \end{tabular} & 70,628 & 55,343 \\ \hline Total current liabilities & 842,871. & 858,482 \\ \hline \multicolumn{3}{|l|}{ Non-current liabilities: } \\ \hline Non-current operating lease liabilities & 1,154,481 & 1,148,742 \\ \hline Long-term debt, net & 341,002 & 325,290 \\ \hline Other non-current liabilities & 24,617 & 15,627 \\ \hline Total non-current liabilities & 1,520,100 & 1,489,659 \\ \hline \multicolumn{3}{|l|}{ Commitments and contingencies } \\ \hline \multicolumn{3}{|l|}{ Stockholders' equity: } \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Preferred stock, $0.01 par value; 5,000 \\ shares authorized; none issued and \\ outstanding \end{tabular}} \\ \hline \begin{tabular}{l} Common stock, $0.01 par value; 600,000 \\ shares authorized; 249,566 shares \\ issued; 168,699 and 166,335 shares \\ outstanding, respectively \end{tabular} & 2,496 & 2,496 \\ \hline Contributed capital & 636,355 & 663,718 \\ \hline \begin{tabular}{l} Accumulated other comprehensive loss, \\ net of tax \end{tabular} & (40,845) & (40,748) \\ \hline Retained earnings & 2,203,772 & 1,868,613 \\ \hline \begin{tabular}{l} Treasury stock, 80,867 and 83,231 \\ shares, respectively, at cost \end{tabular} & (1,378,106) & (1,407,414) \\ \hline Total stockholders' equity & 1,423,672 & 1,086,665 \\ \hline Total liabilities and stockholders' equity & $3,786,643 & $3,434,806 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{c} Consolidated Statements of \\ Operations - USD (\$) \\ shares in Thousands, \$ in Thousands \end{tabular}}} & \multicolumn{2}{|r|}{12 Months Ended } \\ \hline & & Jan. 29, 2022 & Jan. 30, 2021 \\ \hline \multicolumn{4}{|l|}{ Income Statement [Abstract] } \\ \hline Total net revenue & [1] & $5,010,785 & $3,759,113 \\ \hline \begin{tabular}{l} Cost of sales, including certain buying, \\ occupancy and warehousing expenses \end{tabular} & & 3,018,995 & 2,610,966 \\ \hline Gross profit & & 1,991,790 & 1,148,147 \\ \hline \begin{tabular}{l} Selling, general and administrative \\ expenses \end{tabular} & & 1,222,000 & 977,264 \\ \hline \begin{tabular}{l} Impairment, restructuring and COVID-19 \\ related charges \end{tabular} & & 11,944 & 279,826 \\ \hline Depreciation and amortization expense & [1] & 166,781 & 162,402 \\ \hline Operating income (loss) & [1] & 591,065 & (271,345) \\ \hline Interest expense (income), net & & 34,632 & 24,610 \\ \hline Other income, net & & (2,489) & (3,682) \\ \hline income (loss) before income taxes & & 558,922 & (292,273) \\ \hline Provision (benefit) for income taxes & & 139,293 & (82,999) \\ \hline Net income (loss) & & $419,629 & S(209,274) \\ \hline \begin{tabular}{l} Basic net income (loss) per common \\ share \end{tabular} & & $2.50 & $(1.26) \\ \hline \begin{tabular}{l} Diluted net income (loss) per common \\ share \end{tabular} & & $2.03 & $(1.26) \\ \hline \begin{tabular}{l} Weighted average common shares \\ outstanding - basic \end{tabular} & & 168,156 & 166,455 \\ \hline \begin{tabular}{l} Weighted average common shares \\ outstanding - diluted \end{tabular} & & 206,529 & 166,455 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started