Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CHAPTER 2 Measures of Solvency and Liquidity | 5 1 Is it possible for the quick ratio to exceed the current ratio? Andrieux Industries has

CHAPTER Measures of Solvency and Liquidity

Is it possible for the quick ratio to exceed the current ratio?

Andrieux Industries has a WCR of $ million. Interpret this firm's WCR

How would you interpret a DCH of go days?

Describe ways to increase the DCH

How would you interpret a NLB of $

What might decrease the NLB

How would you interpret a of

A firm currently has a of Determine the effect of the following on assuming all else constant:

a Decreased cash holdings

b A greater portion of the credit line is used

c Decreased average daily net cash flow

d Decreased standard deviation of daily net cash flow

What would be required for to fall below

Discuss the trend in DCH

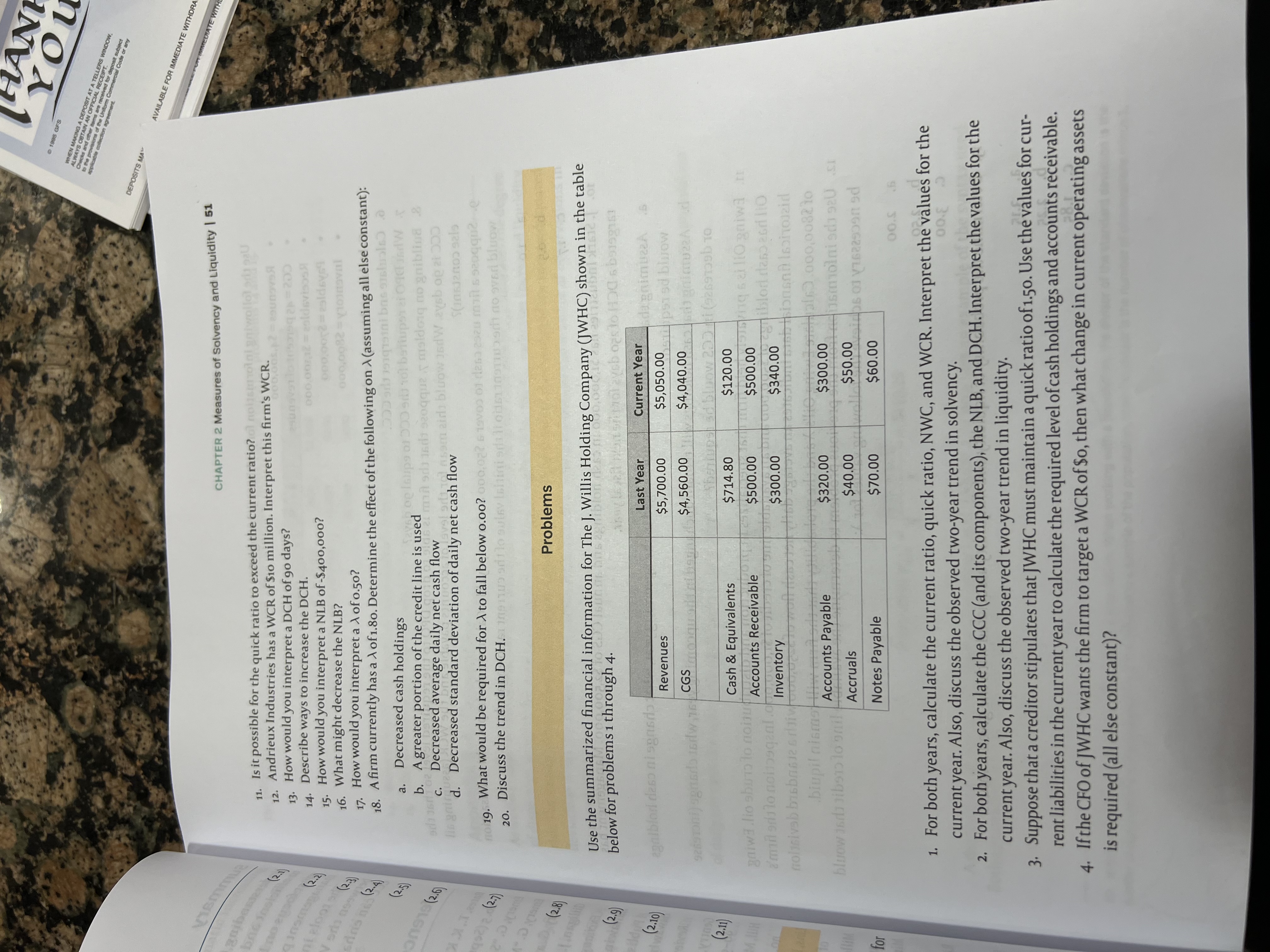

Use the summarized financial information for The J Willis Holding Company JWHC shown in the table

below for problems through

Problems

For both years, calculate the current ratio, quick ratio, NWC and WCR Interpret the values for the

current year. Also, discuss the observed twoyear trend in solvency.

For both years, calculate the CCC and its components the NLB and DCH Interpret the values for the

current year. Also, discuss the observed twoyear trend in liquidity.

Suppose that a creditor stipulates that JWHC must maintain a quick ratio of Use the values for cur

rent liabilities in the current year to calculate the required level of cash holdings and accounts receivable.

If the CFO of JWHC wants the firm to target a WCR of $o then what change in current operating assets

is required all else constant question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started