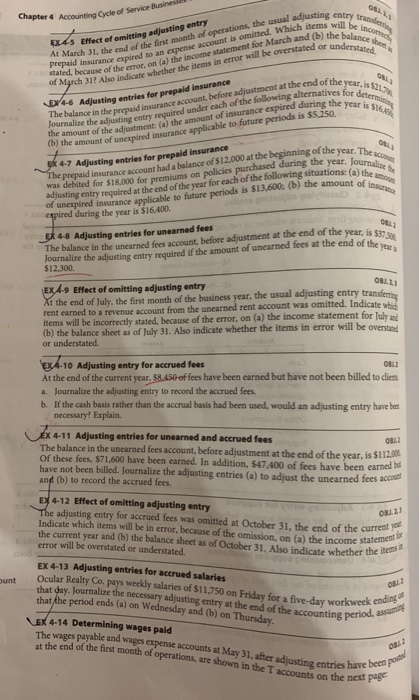

Chapter 4 Accounting Cycle of Service Business ed. Which will be in balance she ed or understated EX45 Effect of multing adjusting entry March 31, the end of the first month of operations, the usual adjusting en Prepaid insurance expired to an opense account is omitted. Which items will ated, because of the error on (a) the income statement for March and (b) the bal March 31 ? Also indicate whether the items in error will be ovenstated or under ear the year is $16.43 16 Adjusting entries for prepaid Insurance The balance in the end insurance account, before adjustment at the end of the Journalize the adjusting entry required under each of the following alternatives for $25 the amount of the adiustment (a) the amount of insurance expired during the for deter e b) the amount of unexpired insurance applicable to future periods is $5.250 he year. Journalize (a) the nt of inte EX 4-7 Adjusting entries for prepaid insurance The prepaid insurance account had a balance of $12.000 at the beginning of the year was debited for SIR000 for premiums on policies purchased during the year. Ion adjusting entry required at the end of the year for each of the following situations of unexpired Insurance applicable to future periods is $13.600 (b) the amount of expired during the year is $16,400. of the year, is $37.50 the end of the years LUX 4-8 Adjusting entries for unearned fees The balance in the unearned fees account, before adjustment at the end of the year is so Journalize the adjusting entry required if the amount of uncerned ces at the end of the $12,300. OL EX 4-9 Effect of omitting adjusting entry At the end of July, the first month of the business year, the usual adjusting entry transfer rent earned to a revenue account from the unearned rent account was omitted. Indicate items will be incorrectly stated, because of the error, on (a) the income statement for July (b) the balance sheet as of July 31. Also indicate whether the items in error will be overstar or understated. EX 4-10 Adjusting entry for accrued fees OB2 At the end of the current year, 58.450 of fees have been earned but have not been billed to die a. Journalize the adjusting entry to record the accrued fees. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry have bet necessary? Explain. x 4-11 Adjusting entries for unearned and accrued fees 0811 The balance in the unearned fees account, before adjustment at the end of the year.is SI of these fees, $71,600 have been earned. In addition, $47.400 of fees have been carned have not been billed. Journalize the adjusting entries (a) to adjust the unearned fees ac and (b) to record the accrued fees. OBL. 21 E 4-12 Effect of omitting adjusting entry The adjusting entry for accrued fees was omitted at October 31, the end of the current Indicate which items will be in error, because of the mission a l the income stateme the current year and (b) the balance sheet as of October 31. Also indicate whether the crror will be overstated or understated Watement ate whether the items punt EX 4-13 Adjusting entries for accrued salaries Ocular Realty Co, pays weekly salaries of $11.750 on Friday for a five-day workweek en that day. Journalize the necessary adjusting entry at the end of the accounting period, that the period ends (a) on Wednesday and (b) on Thursday. on Wednesday ng entry at the end for a five-day workweek ending or ng period, assum EX 4-14 Determining wages paid The wages payable and wages expense accounts at May 31, after a dusting entries have the end of the first month of operations are shown in the counts on the next pe Thuthe end of the first moments.com OR tries have been post