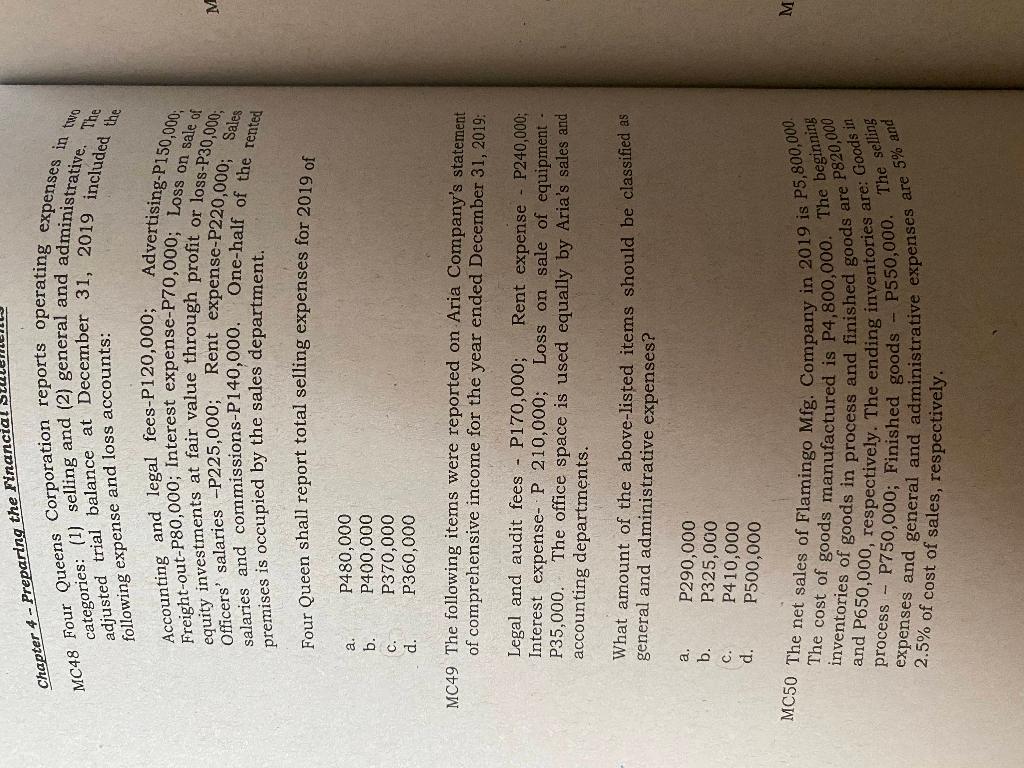

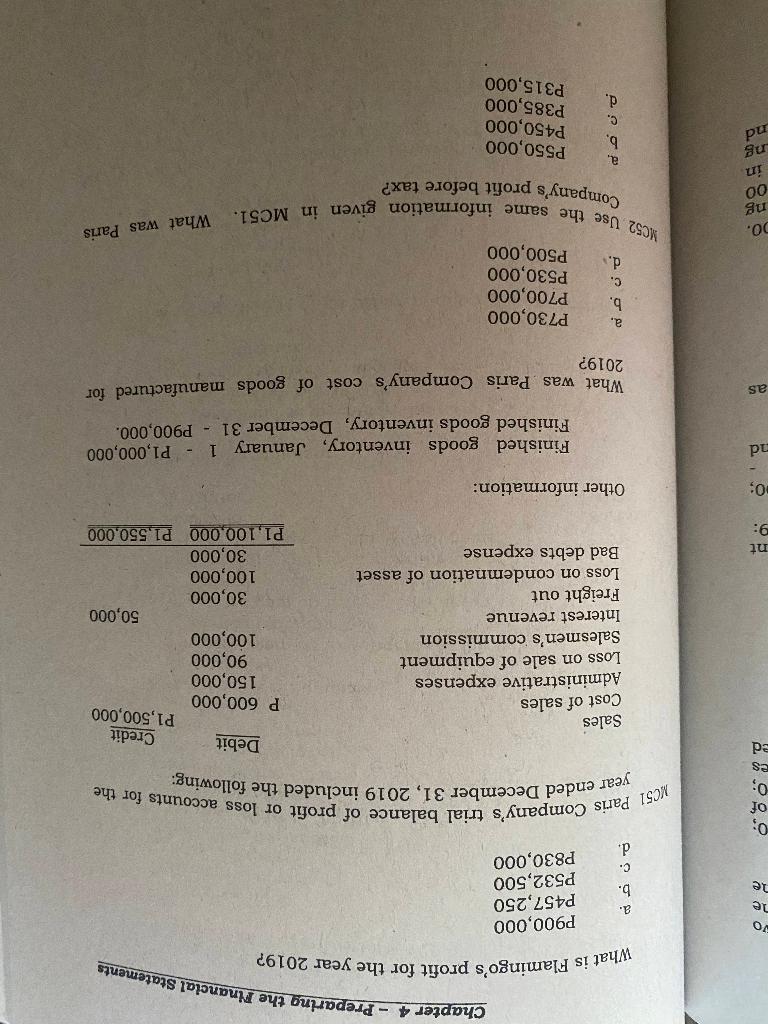

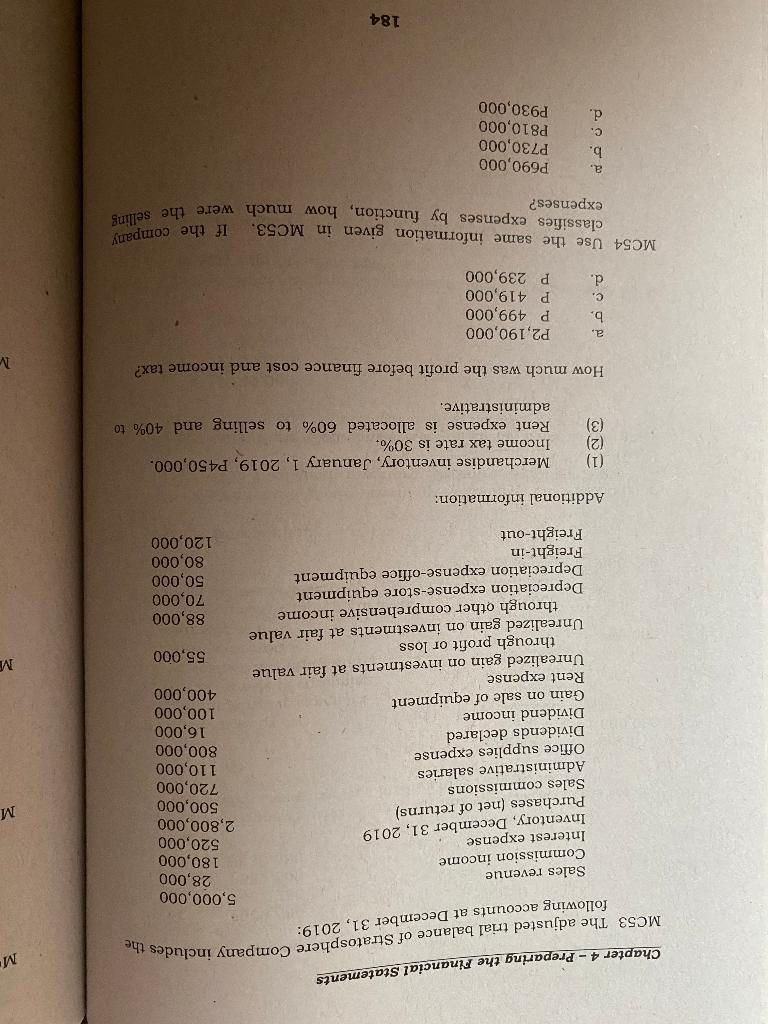

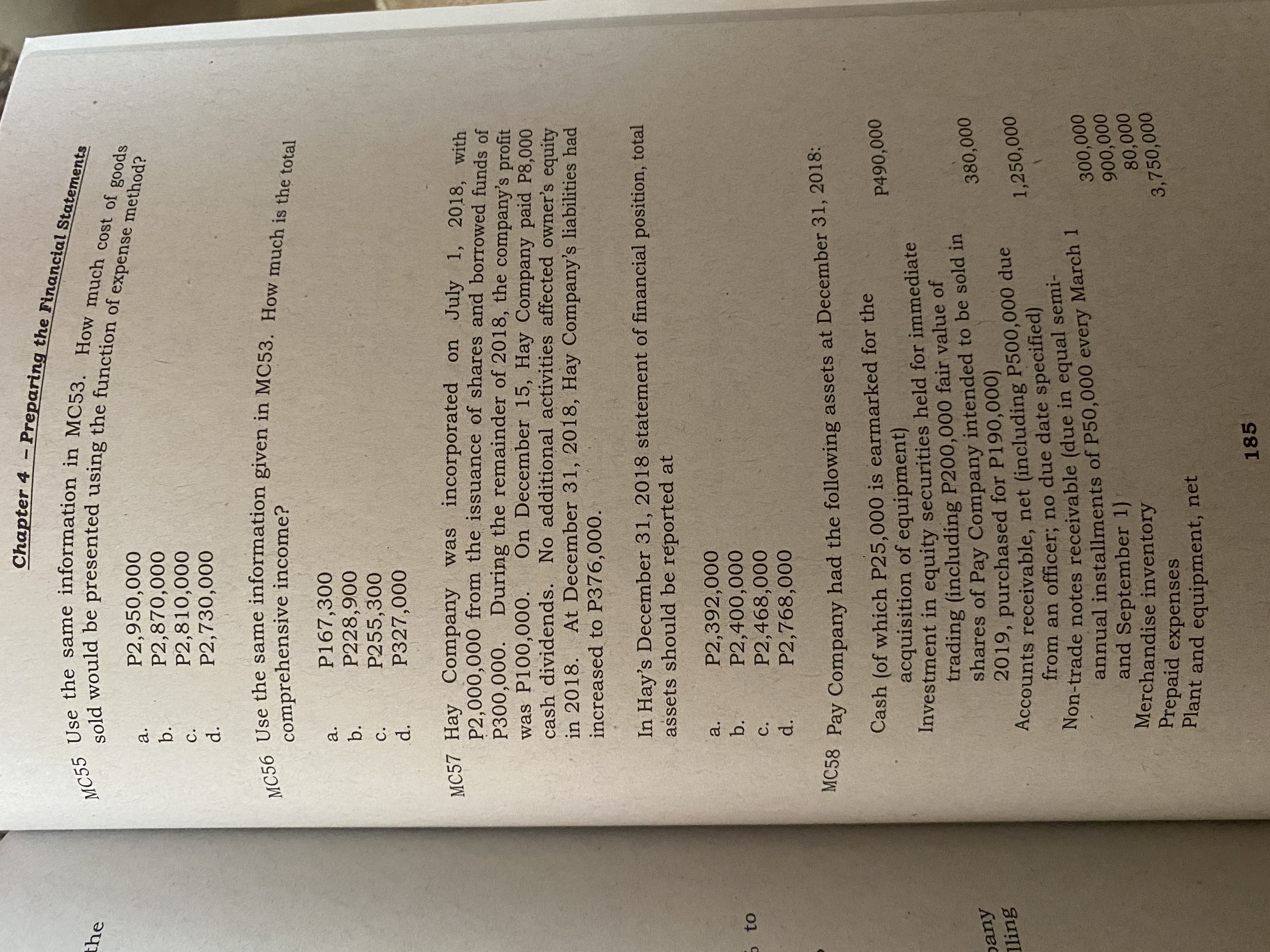

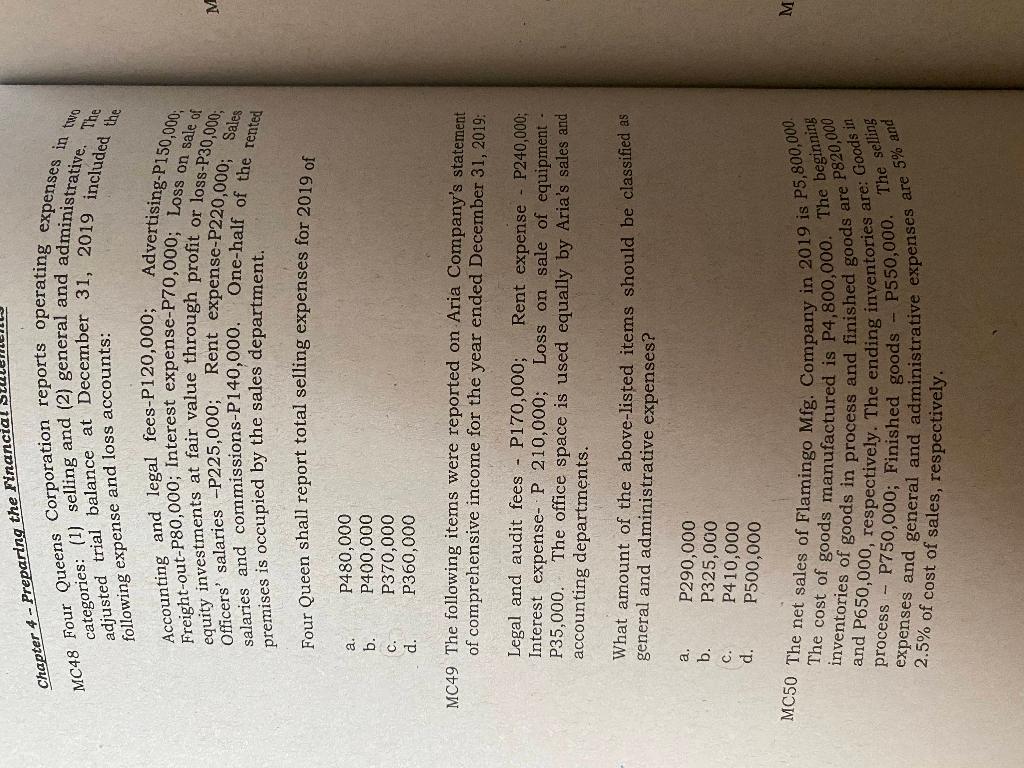

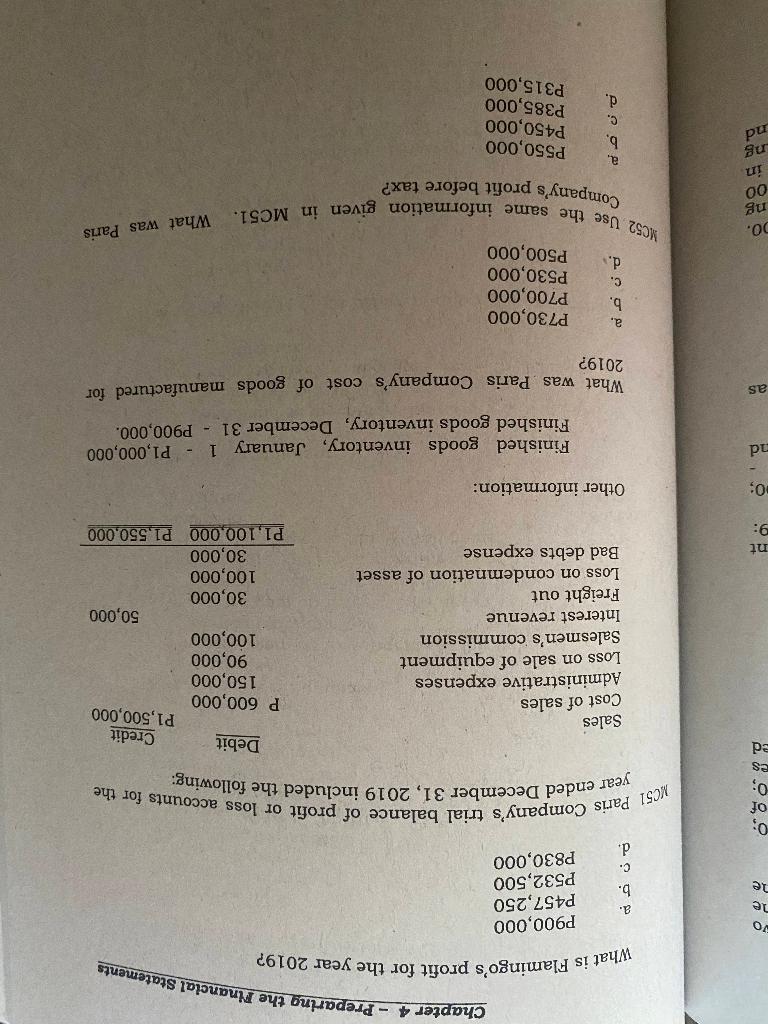

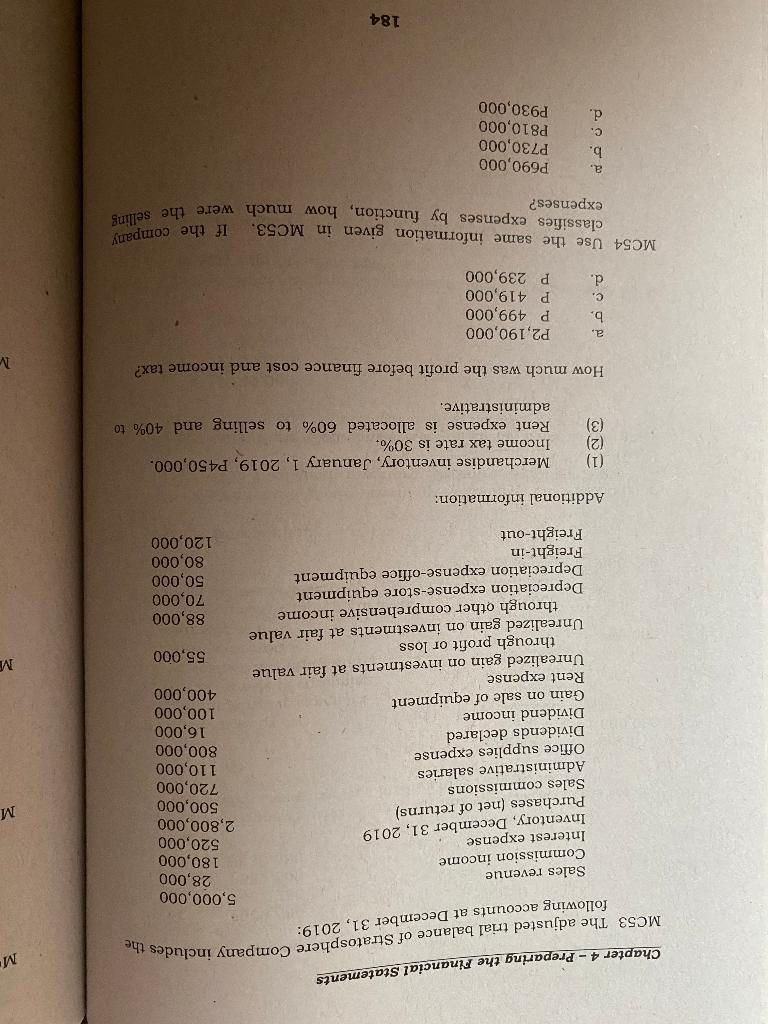

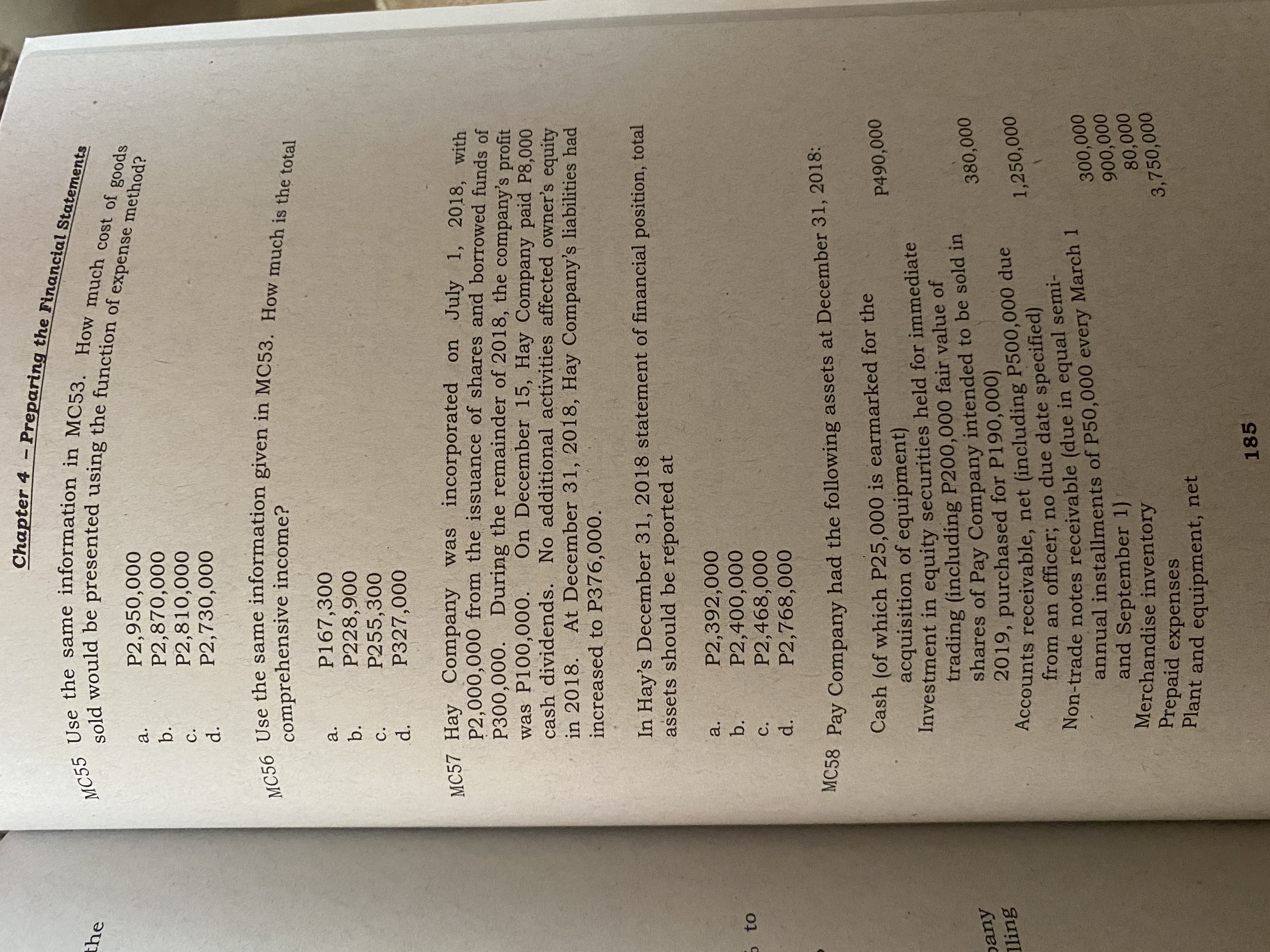

Chapter 4 - Preparing the Financial categories: (1) selling and (2) general and administrative. The MC48 Four Queens Corporation reports operating expenses in two adjusted trial balance at December 31, 2019 included the following expense and loss accounts: Accounting and legal fees-P120,000; investments at fair value Officers' salaries -P225,000; salaries and commissions-P140,000. premises is occupied by the sales department. Freight-out-P80,000; Interest expense-P70,000; Loss on sale of Advertising-P150,000; or loss-P30,000; M Rent expense-P220,000; Sales One-half of the rented Four Queen shall report total selling expenses for 2019 of a. b. P480,000 P400,000 P370,000 P360,000 c. d. MC49 The following items were reported on Aria Company's statement of comprehensive income for the year ended December 31, 2019: Legal and audit fees - P170,000; Rent expense - P240,000; Interest expense- P 210,000; Loss on sale of equipment - P35,000. The office space is used equally by Aria's sales and accounting departments. What amount of the above-listed items should be classified as general and administrative expenses? a. b. P290,000 P325,000 P410,000 P500,000 C. d. M MC50 The net sales of Flamingo Mfg. Company in 2019 is P5,800,000 and P650,000, respectively. The ending inventories are: Goods in inventories of goods in process and finished goods are P820,000 The cost of goods manufactured is P4,800,000. The beginning expenses and general and administrative expenses are 5% and The selling process - P750,000; Finished goods - P550,000 2.5% of cost of sales, respectively. What is Flamingo's profit for the year 2019? Chapter 4 - Preparing the Financial Statements o le P900,000 P457,250 P532,500 P830,000 a. b. c. d. 0; of 0; es ed MC51 Paris Company's trial balance of profit or loss accounts for the year ended December 31, 2019 included the following: Sales Cost of sales Administrative expenses Loss on sale of equipment Salesmen's commission Interest revenue Freight out Loss on condemnation of asset Bad debts expense Debit Credit P1,500,000 P 600,000 150,000 90,000 100,000 50,000 30,000 100,000 30,000 P1,100,000 P1,550,000 nt 9: 0; Other information: nd Finished goods inventory, January 1 - P1,000,000 Finished goods inventory, December 31 - P900,000. What was Paris Company's cost of goods manufactured for as 2019? a. b. C. d. P730,000 P700,000 P530,000 P500,000 What was Paris 20. ng 00 MC52 Use the same information given in MC51. Company's profit before tax? a. b. nd c. d. P550,000 P450,000 P385,000 P315,000 Chapter 4 - Preparing the Financial Statements MC53 The adjusted trial balance of Stratosphere Company includes the M following accounts at December 31, 2019: M Sales revenue Commission income Interest expense Inventory, December 31, 2019 Purchases (net of returns) Sales commissions Administrative salaries Office supplies expense Dividends declared Dividend income Gain on sale of equipment Rent expense Unrealized gain on investments at fair value through profit or loss Unrealized gain on investments at fair value through other comprehensive income Depreciation expense-store equipment Depreciation expense-office equipment Freight-in Freight-out 5,000,000 28,000 180,000 520,000 2,800,000 500,000 720,000 110,000 800,000 16,000 100,000 400,000 M 55,000 88,000 70,000 50,000 80,000 120,000 Additional information: (1) (2) (3) Merchandise inventory, January 1, 2019, P450,000. Income tax rate is 30%. Rent expense is allocated 60% to selling and 40% to administrative. How much was the profit before finance cost and income tax? M a. b. c. d. P2,190,000 P 499,000 P 419,000 P 239,000 MC54 If the company classifies expenses by function, how much were the selling expenses? a. b. C. d. P690,000 P730,000 P810,000 P930,000 184 the Chapter 4 - Preparing the Financial Statements sold would be presented using the function of expense method? MC55 Use the same information in MC53. How much cost of goods a. b. P2,950,000 P2,870,000 P2,810,000 P2,730,000 C. d. comprehensive ? MC56 Use the same information given in MC53. How much is the total a. b. P167,300 P228,900 P255,300 P327,000 C. d. MC57 Hay Company was incorporated on July 1, 2018, with P2,000,000 from the issuance of shares and borrowed funds of P300,000. During the remainder of 2018, the company's profit was P100,000. On December 15, Hay Company paid P8,000 cash dividends. No additional activities affected owner's equity in 2018. At December 31, 2018, Hay Company's liabilities had increased to P376,000. In Hay's December 31, 2018 statement of financial position, total assets should be reported at a. b. to P2,392,000 P2,400,000 P2,468,000 P2,768,000 C. d MC58 Pay Company had the following assets at December 31, 2018: P490,000 Cash (of which P25,000 is earmarked for the acquisition of equipment) Investment in equity securities held for immediate trading (including P200,000 fair value of shares of Pay Company intended to be sold in 2019, purchased for P190,000) 380,000 pany lling Accounts receivable, net (including P500,000 due 1,250,000 from an officer; no due date specified) Non-trade notes receivable (due in equal semi- annual installments of P50,000 every March 1 300,000 900,000 80,000 3,750,000 and September 1) Merchandise inventory Prepaid expenses Plant and equipment, net 185