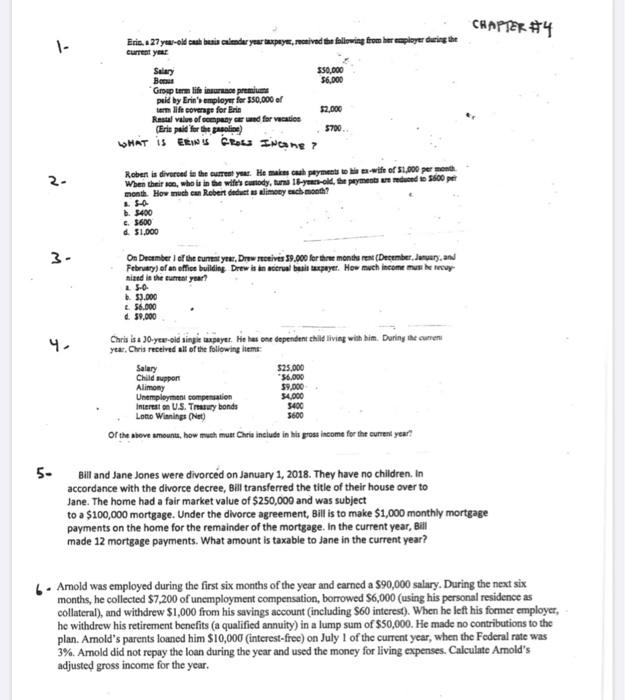

CHAPTER #4 T Eris..27you-old cash basis calendar year taxpayer, received the following from her employer during the Current year Salary 550.000 Best $6,000 Group term life insurance premiums paid by Erin'employer for 350,000 of term life coverage for Brin $2,000 Rastal value of company wed for vacation (Erin paid for the pasoline) 5700 WHAT IS EE Grots Incane ? 2. Roben is divorced to the current you. He makes cash payment to his wife of 51,000 per month When their son, who is in the wife custody, tulos old, the payments are made to 5600 per month. How much an Robert deducta alimony each month? b. 5400 6. 5600 d. 51.000 3 4. On December of the current year, Drew roeives 39.000 for three months rent (December January, and February) of an office building Drew is an accrual basis taxpayer. How much income musete nized ed is the current year? 15-0. b. 59.000 56.000 d. 59.000 Chris is a 30-yeu-old single taxpayer. He has one dependent child living with him. During the content year. Chris received all of the following items: Salary 525.000 Child support 56,000 Alimony 39.000 Unemployment compensation 54,000 Interest on U.S. Truy bonds 5400 Lotto Winning (Net) 5600 of the above amounts, how much must Chris include in his gross income for the current year? 5- Bill and Jane Jones were divorced on January 1, 2018. They have no children. In accordance with the divorce decree, Bill transferred the title of their house over to Jane. The home had a fair market value of $250,000 and was subject to a $100,000 mortgage. Under the divorce agreement, Bill is to make $1,000 monthly mortgage payments on the home for the remainder of the mortgage. In the current year, Bill made 12 mortgage payments. What amount is taxable to Jane in the current year? 6. Amold was employed during the first six months of the year and earned a $90,000 salary. During the next six months, he collected $7,200 of unemployment compensation, borrowed $6,000 (using his personal residence as collateral), and withdrew $1,000 from his savings account (including $60 interest). When he left his former employer, he withdrew his retirement benefits (a qualified annuity) in a lump sum of $50,000. He made no contributions to the plan. Amold's parents loaned him $10,000 (interest-free) on July 1 of the current year, when the Federal rate was 3%. Amold did not repay the loan during the year and used the money for living expenses. Calculate Arnold's adjusted gross income for the year