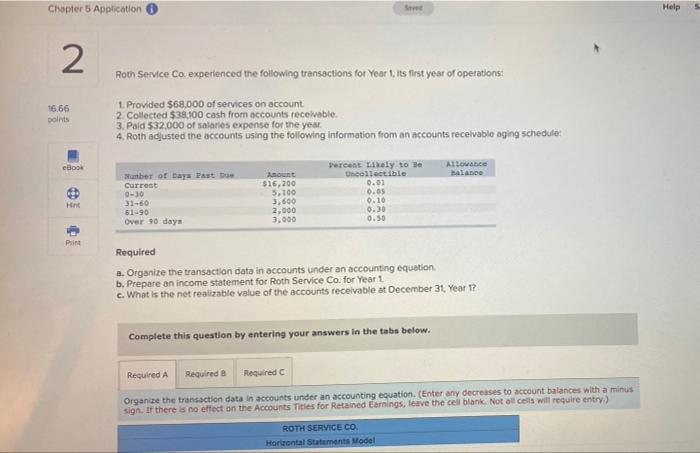

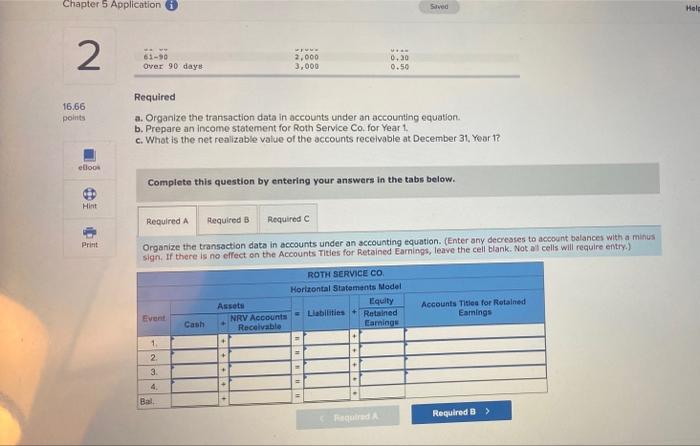

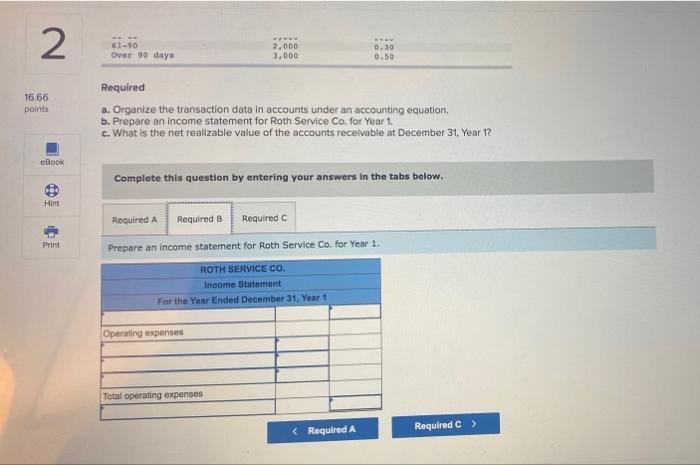

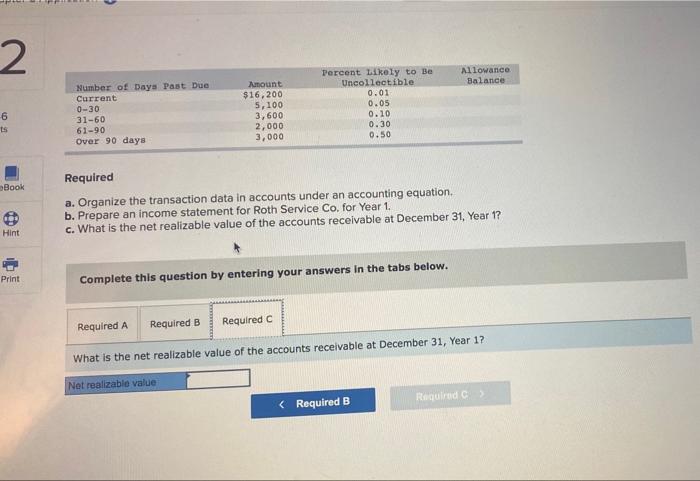

Chapter 5 Application Help 2 Rom Service Co experienced the following transactions for Year 1, its first year of operations: 16.66 DOS 1. Provided $68,000 of services on account 2. Collected $38 100 cash from accounts receivable 3. Paid 532.000 of salaries expense for the year 4. Roth adjusted the accounts using the following information from an accounts receivable aging schedule: eBoo Allowance balance Number of Days Paste Currest 0-30 31-60 51-90 Over 30 days Amount $16,200 5.100 3.600 2,000 3,000 Percent rely to Be collectible 0.01 0.05 0.10 0.30 0.50 Hint Point Required a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement for Roth Service Co. for Year 1 c. What is the net realizable value of the accounts receivable at December 31, Year 1? Complete this question by entering your answers in the tabs below. Required A Required Required Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry) ROTH SERVICE CO. Horizontal Statements Model Chapter 5 Application Saved Hels 2 63-90 Over 90 days 2,000 3,000 0.30 0.50 16.66 points Required a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement for Roth Service Co. for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 12 ellos Complete this question by entering your answers in the tabs below. Hint Required A Required B Required Print Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not al cells will require entry.) ROTH SERVICE CO Horizontal Statements Model Assets Equity Accounts Titles for Retained Event NRV Accounts Liabilities Retained Earnings Cash Receivable Earnings 1 + 2 + 3 4 Bal Required Required B > 2 51-50 Over 90 days 2,000 3.000 0.30 0.50 16,66 points Required a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement for Roth Service Co. for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 12 eBook Complete this question by entering your answers in the tabs below. Hint Required A Required B Required Print Prepare an income statement for Roth Service Co. for Year 1. ROTH SERVICE CO. Income Statement For the Year Ended December 31, Year 1 Operating expenses Total operating expenses 2 Allowance Balance mount $16,200 5,100 3,600 2,000 3,000 Number of Days Past Due Current 0-30 31-60 61-90 Over 90 days Dercent likely to Be Uncollectible 0.01 0.05 0.10 0.30 0.50 6 ts Book Required a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement for Roth Service Co. for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 1? Hint Print Complete this question by entering your answers in the tabs below. Required A Required B Required What is the net realizable value of the accounts receivable at December 31, Year 1? Not realizablo value Required