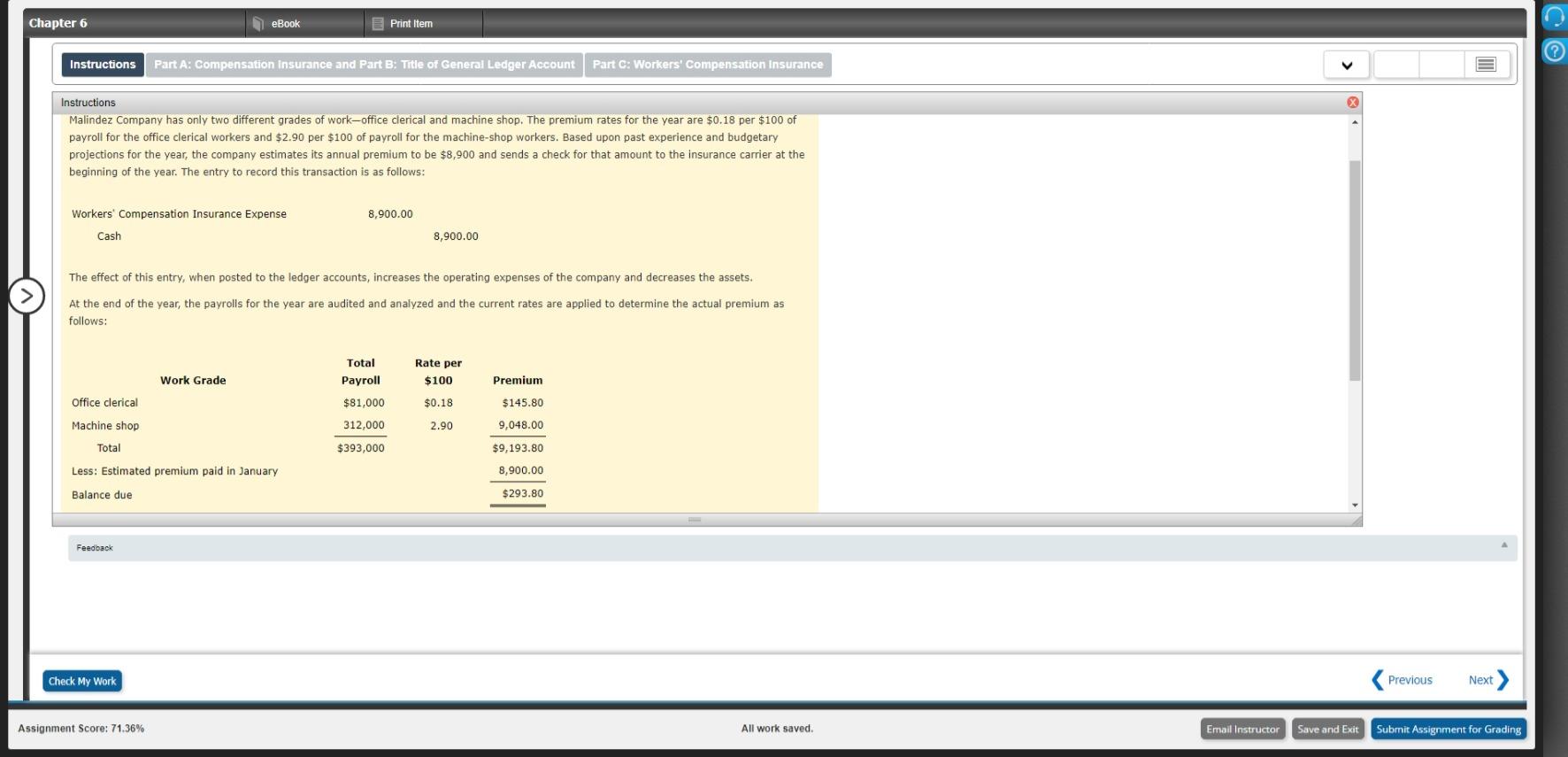

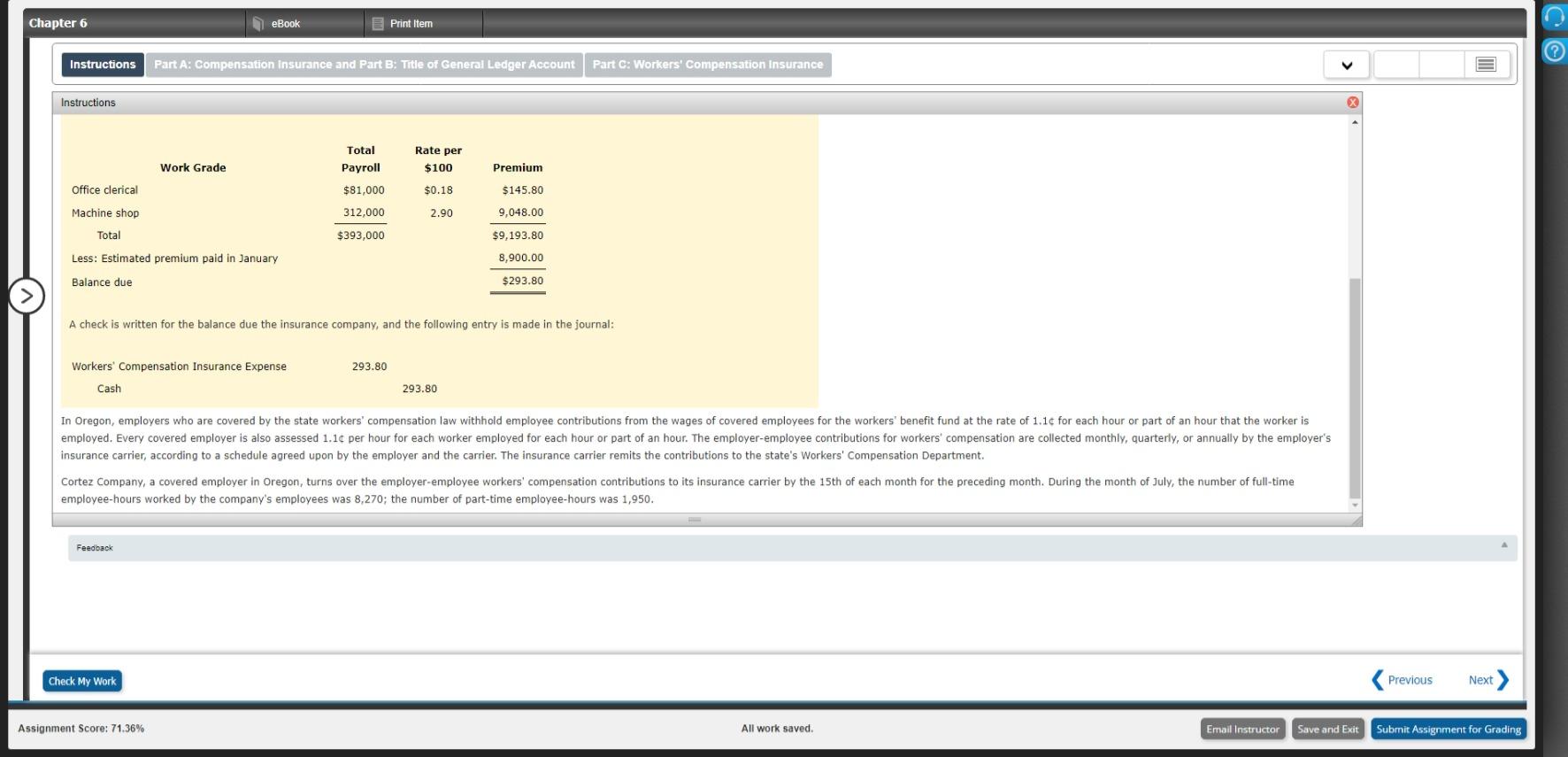

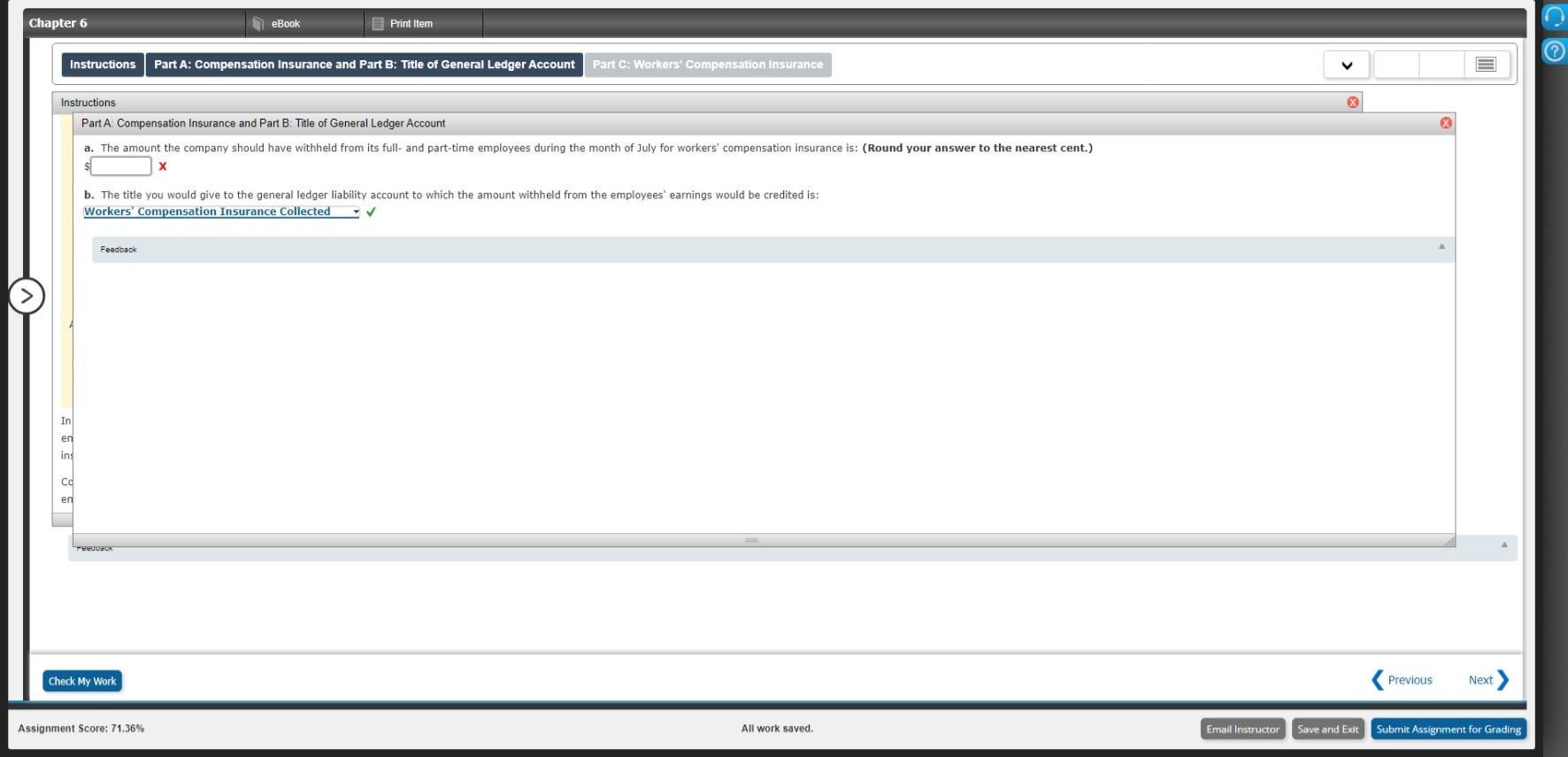

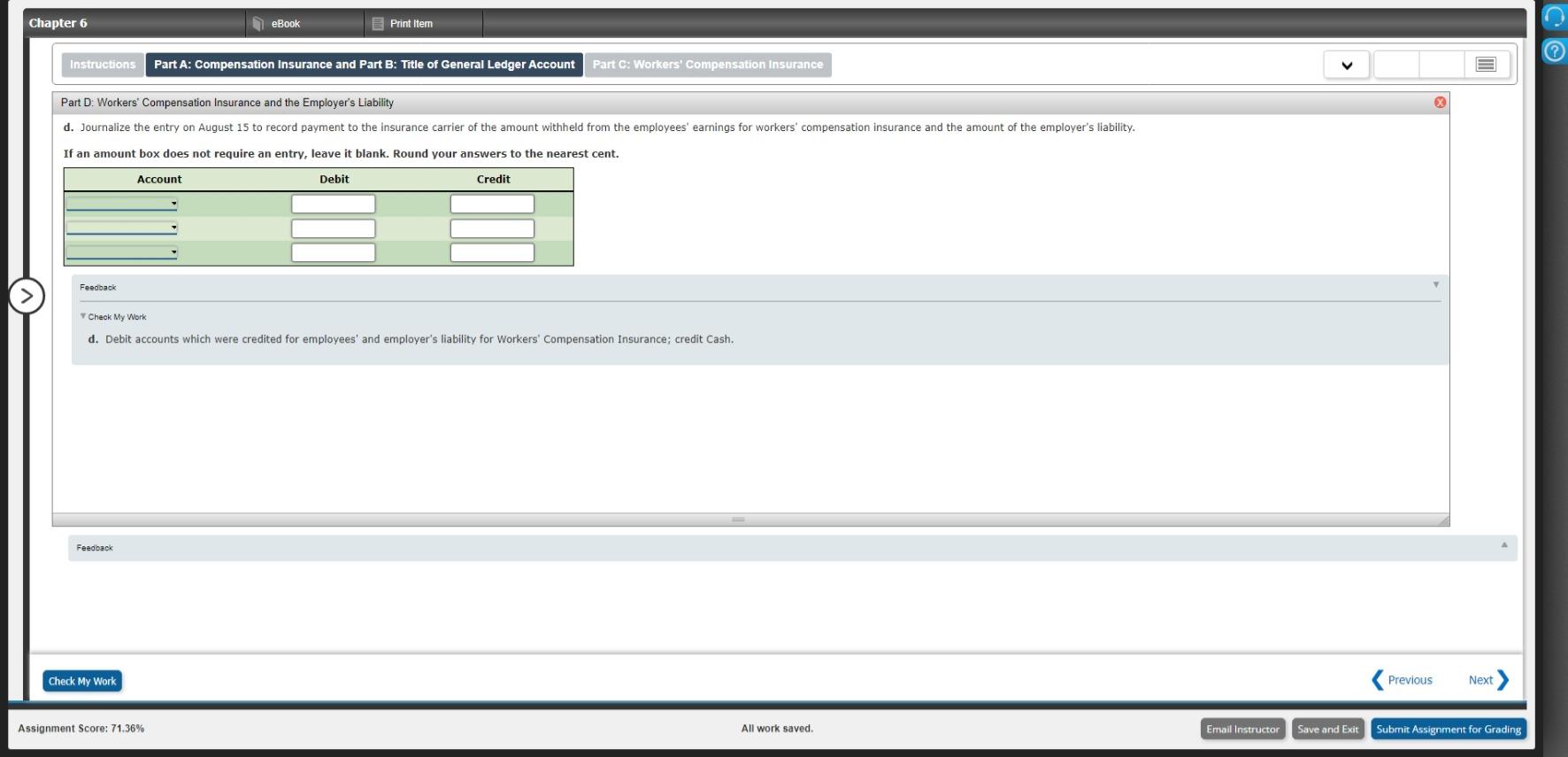

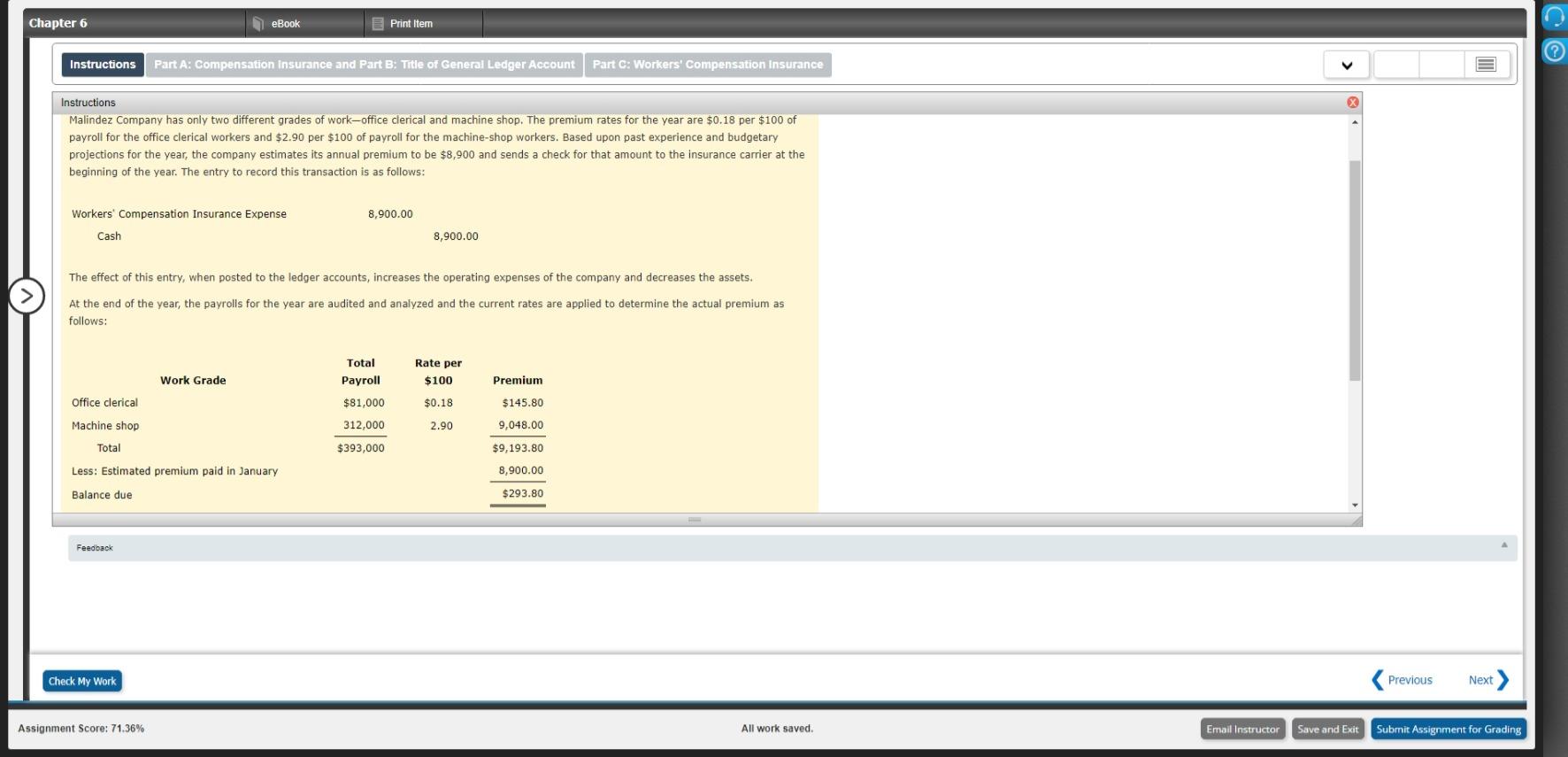

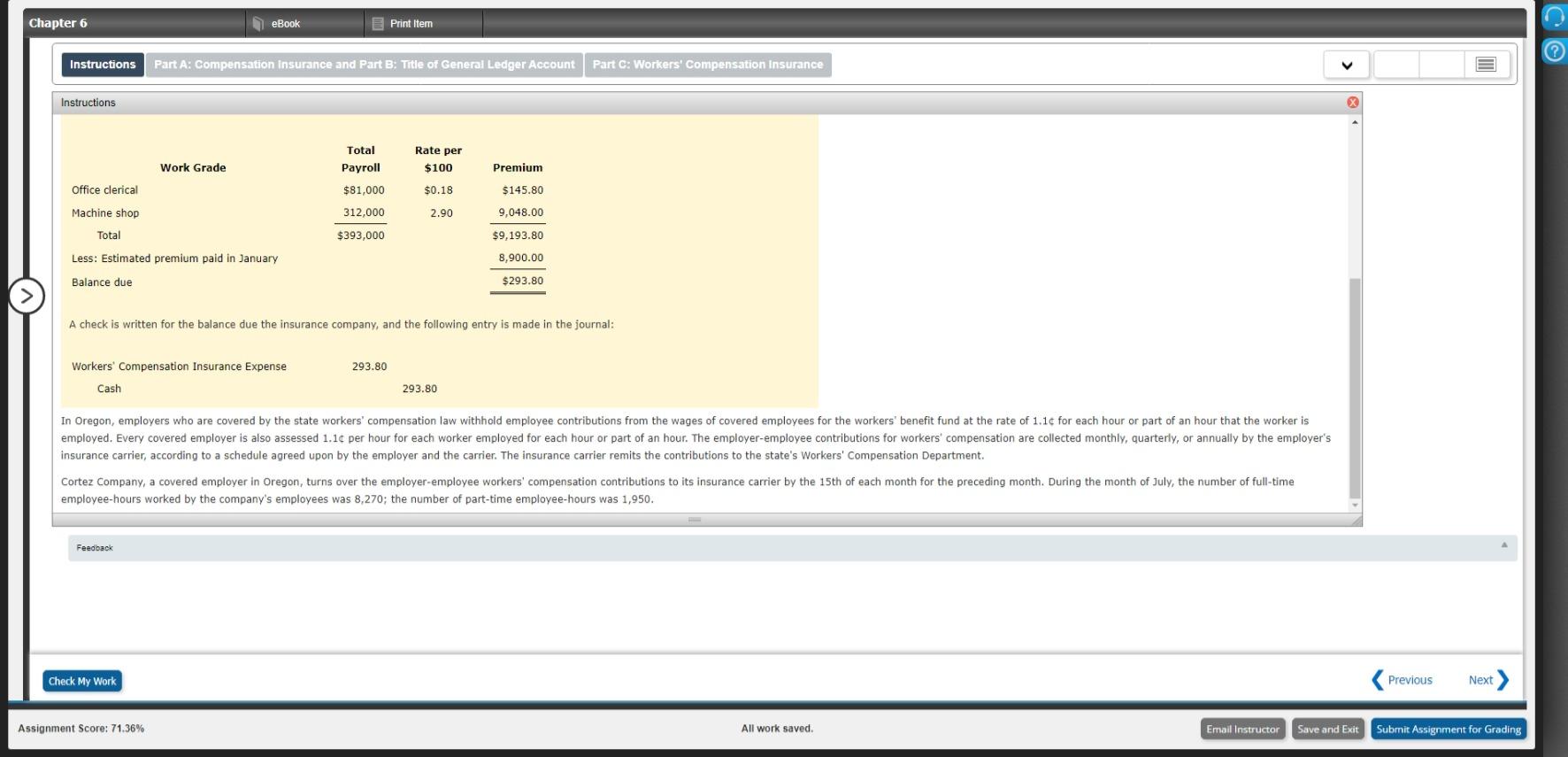

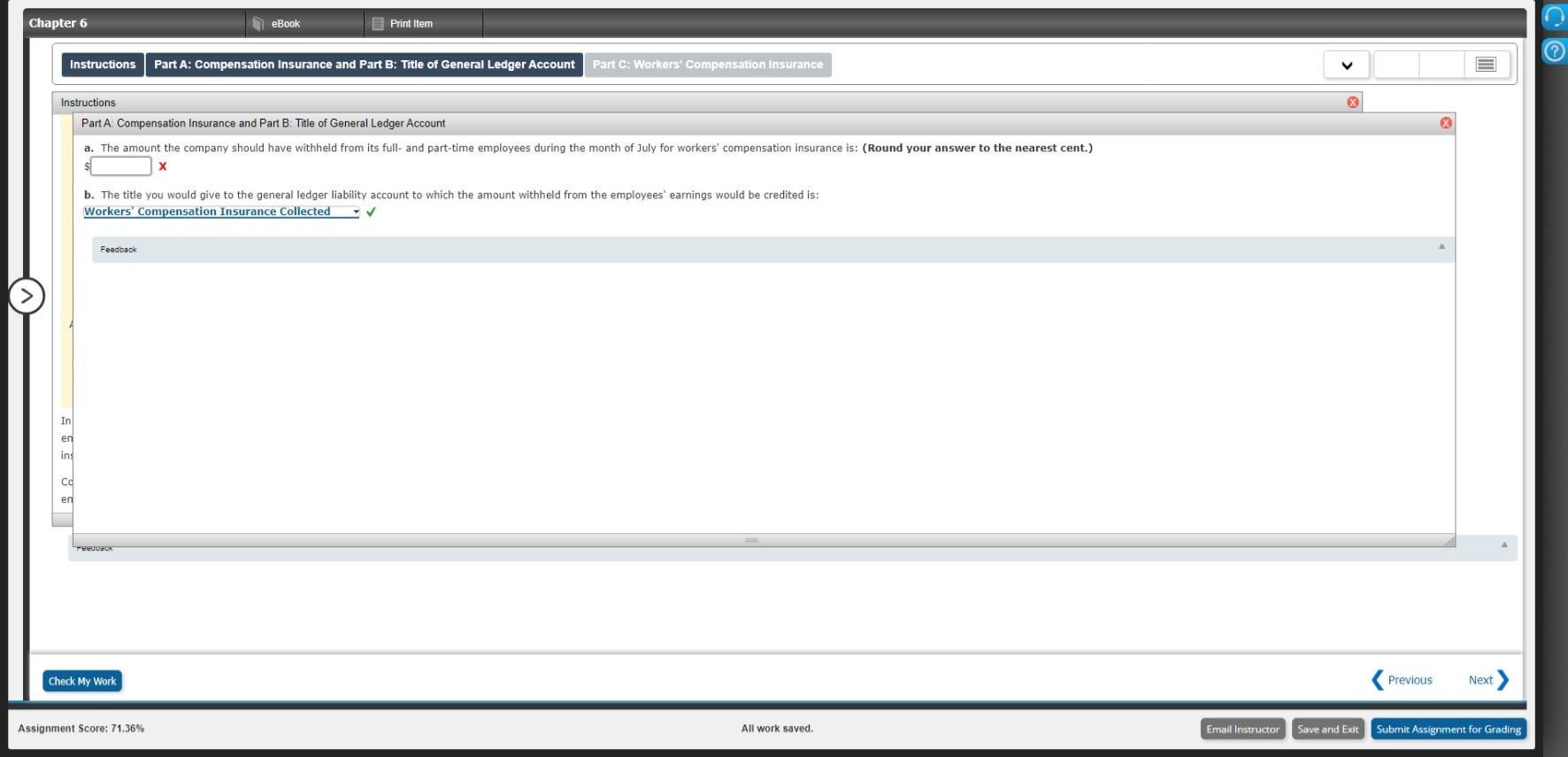

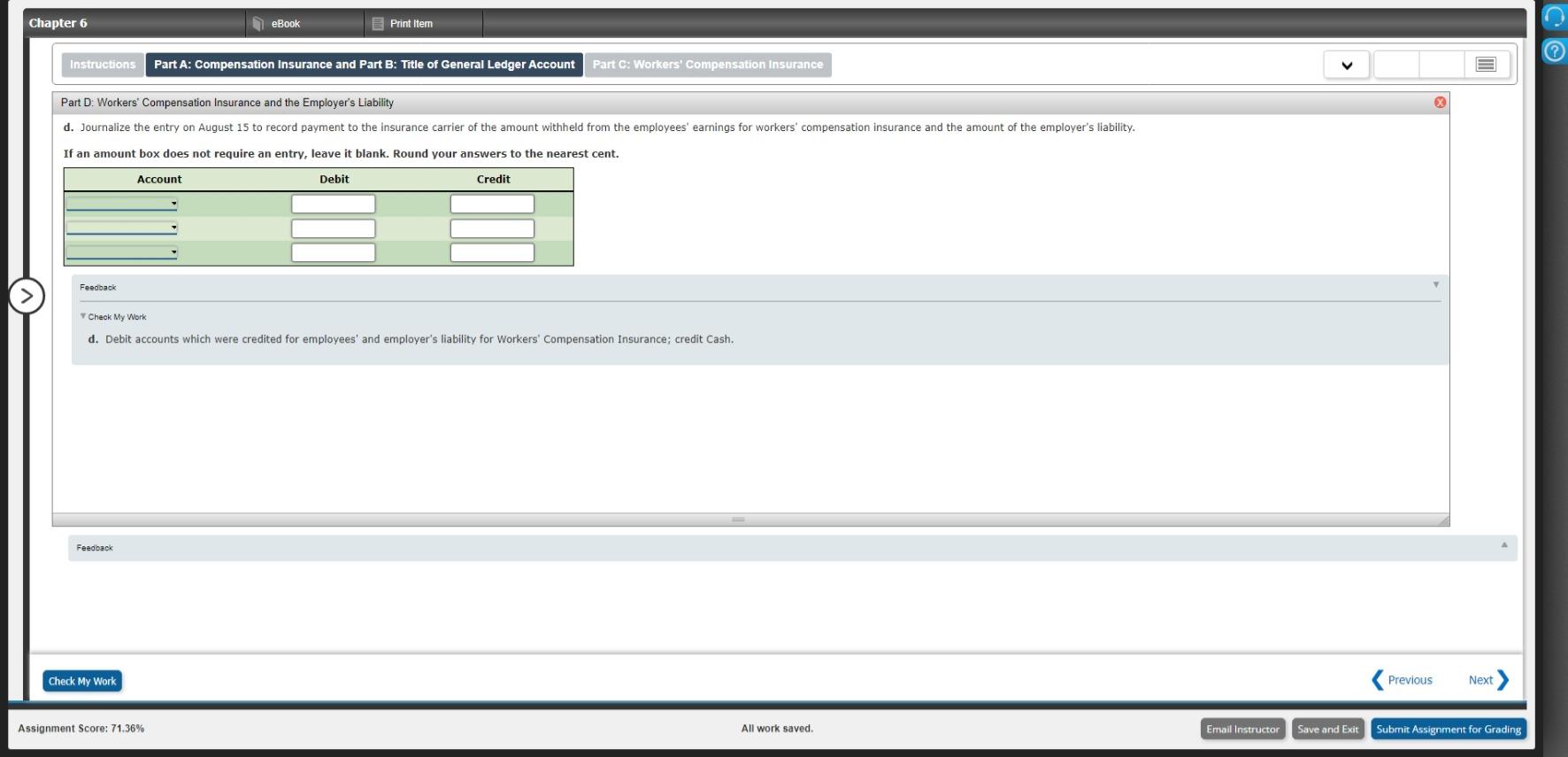

Chapter 6 eBook Print Item ? Instructions Part A: Compensation insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation insurance Instructions Malindez Company has only two different grades of work-office clerical and machine shop. The premium rates for the year are $0.18 per $100 of payroll for the office clerical workers and $2.90 per $100 of payroll for the machine-shop workers. Based upon past experience and budgetary projections for the year, the company estimates its annual premium to be $8,900 and sends a check for that amount to the insurance carrier at the beginning of the year. The entry to record this transaction is as follows: Workers' Compensation Insurance Expense 8,900.00 Cash 8,900.00 The effect of this entry, when posted to the ledger accounts, increases the operating expenses of the company and decreases the assets. At the end of the year, the payrolls for the year are audited and analyzed and the current rates are applied to determine the actual premium as follows: Rate per Total Payroll Work Grade $100 Premium Office clerical $81,000 $0.18 $145.80 Machine shop 312,000 2.90 9,048.00 Total $393,000 $9,193.80 Less: Estimated premium paid in January 8,900.00 Balance due $293.80 Feedback Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation Insurance Instructions Total Payroll $81,000 Rate per $100 Work Grade Premium Office clerical $0.18 $145.80 Machine shop 312,000 2.90 9,048.00 Total $393,000 $9,193.80 Less: Estimated premium paid in January 8,900.00 Balance due $293.80 A check is written for the balance due the insurance company, and the following entry is made in the journal: 293.80 Workers Compensation Insurance Expense Cash 293.80 In Oregon, employers who are covered by the state workers' compensation law withhold employee contributions from the wages of covered employees for the workers' benefit fund at the rate of 1.1 for each hour or part of an hour that the worker is employed. Every covered employer is also assessed 1.10 per hour for each worker employed for each hour or part of an hour. The employer-employee contributions for workers' compensation are collected monthly, quarterly, or annually by the employer's insurance carrier, according to a schedule agreed upon by the employer and the carrier. The insurance carrier remits the contributions to the state's Workers' Compensation Department. Cortez Company, a covered employer in Oregon, turns over the employer-employee workers' compensation contributions to its insurance carrier by the 15th of each month for the preceding month. During the month of July, the number of full-time employee-hours worked by the company's employees was 8,270; the number of part-time employee-hours was 1,950. Feedback Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation Insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation Insurance X X Instructions Part A Compensation Insurance and Part B. Title of General Ledger Account a. The amount the company should have withheld from its full- and part-time employees during the month of July for workers' compensation insurance is: (Round your answer to the nearest cent.) sl b. The title you would give to the general ledger liability account to which the amount withheld from the employees' earnings would be credited is: Workers' Compensation Insurance Collected Feedback In en ins cd en re Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation Insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation Insurance Part D. Workers' Compensation Insurance and the Employer's Liability d. Journalize the entry on August 15 to record payment to the insurance carrier of the amount withheld from the employees' earnings for workers' compensation insurance and the amount of the employer's liability. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Account Debit Credit Feedback Check My Work d. Debit accounts which were credited for employees' and employer's liability for Workers Compensation Insurance; credit cash. Feedback Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation insurance Instructions Malindez Company has only two different grades of work-office clerical and machine shop. The premium rates for the year are $0.18 per $100 of payroll for the office clerical workers and $2.90 per $100 of payroll for the machine-shop workers. Based upon past experience and budgetary projections for the year, the company estimates its annual premium to be $8,900 and sends a check for that amount to the insurance carrier at the beginning of the year. The entry to record this transaction is as follows: Workers' Compensation Insurance Expense 8,900.00 Cash 8,900.00 The effect of this entry, when posted to the ledger accounts, increases the operating expenses of the company and decreases the assets. At the end of the year, the payrolls for the year are audited and analyzed and the current rates are applied to determine the actual premium as follows: Rate per Total Payroll Work Grade $100 Premium Office clerical $81,000 $0.18 $145.80 Machine shop 312,000 2.90 9,048.00 Total $393,000 $9,193.80 Less: Estimated premium paid in January 8,900.00 Balance due $293.80 Feedback Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation Insurance Instructions Total Payroll $81,000 Rate per $100 Work Grade Premium Office clerical $0.18 $145.80 Machine shop 312,000 2.90 9,048.00 Total $393,000 $9,193.80 Less: Estimated premium paid in January 8,900.00 Balance due $293.80 A check is written for the balance due the insurance company, and the following entry is made in the journal: 293.80 Workers Compensation Insurance Expense Cash 293.80 In Oregon, employers who are covered by the state workers' compensation law withhold employee contributions from the wages of covered employees for the workers' benefit fund at the rate of 1.1 for each hour or part of an hour that the worker is employed. Every covered employer is also assessed 1.10 per hour for each worker employed for each hour or part of an hour. The employer-employee contributions for workers' compensation are collected monthly, quarterly, or annually by the employer's insurance carrier, according to a schedule agreed upon by the employer and the carrier. The insurance carrier remits the contributions to the state's Workers' Compensation Department. Cortez Company, a covered employer in Oregon, turns over the employer-employee workers' compensation contributions to its insurance carrier by the 15th of each month for the preceding month. During the month of July, the number of full-time employee-hours worked by the company's employees was 8,270; the number of part-time employee-hours was 1,950. Feedback Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation Insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation Insurance X X Instructions Part A Compensation Insurance and Part B. Title of General Ledger Account a. The amount the company should have withheld from its full- and part-time employees during the month of July for workers' compensation insurance is: (Round your answer to the nearest cent.) sl b. The title you would give to the general ledger liability account to which the amount withheld from the employees' earnings would be credited is: Workers' Compensation Insurance Collected Feedback In en ins cd en re Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading Chapter 6 eBook Print Item ? Instructions Part A: Compensation Insurance and Part B: Title of General Ledger Account Part C: Workers' Compensation Insurance Part D. Workers' Compensation Insurance and the Employer's Liability d. Journalize the entry on August 15 to record payment to the insurance carrier of the amount withheld from the employees' earnings for workers' compensation insurance and the amount of the employer's liability. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Account Debit Credit Feedback Check My Work d. Debit accounts which were credited for employees' and employer's liability for Workers Compensation Insurance; credit cash. Feedback Check My Work Previous Next > Assignment Score: 71.36% All work saved Email Instructor Save and Exit Submit Assignment for Grading