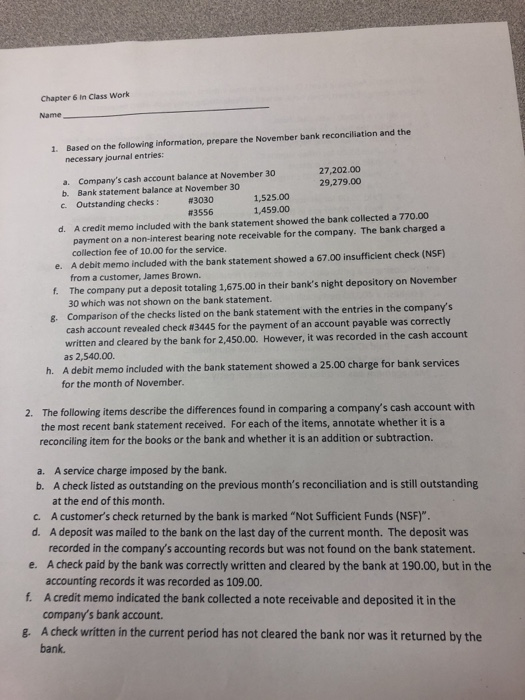

Chapter 6 In Class Work Name 1. Based on the following information, prepare the November bank reconciliation and the necessary journal entries: 27,202.00 a. Company's cash account balance at November 30 29,279.00 b. Bank statement balance at November 30 c. Outstanding checks: 3030 1,525.00 #3556 1,459.00 d. A credit memo included with the bank statement showed the bank collected a 770.00 payment on a non-interest bearing note receivable for the company. The bank charged a collection fee of 10.00 for the service. e. A debit memo included with the bank statement showed a 67.00 insufficient check (NSF) from a customer, James Brown. f. The company put a deposit totaling 1,675.00 in their bank's night depository on November 30 which was not shown on the bank statement. 8. Comparison of the checks listed on the bank statement with the entries in the company's cash account revealed check #3445 for the payment of an account payable was correctly written and cleared by the bank for 2,450.00. However, it was recorded in the cash account as 2,540.00. h. A debit memo included with the bank statement showed a 25.00 charge for bank services for the month of November. 2. The following items describe the differences found in comparing a company's cash account with the most recent bank statement received. For each of the items, annotate whether it is a reconciling item for the books or the bank and whether it is an addition or subtraction. a. A service charge imposed by the bank. b. A check listed as outstanding on the previous month's reconciliation and is still outstanding at the end of this month. C. A customer's check returned by the bank is marked "Not Sufficient Funds (NSF)". d. A deposit was mailed to the bank on the last day of the current month. The deposit was recorded in the company's accounting records but was not found on the bank statement. e. A check paid by the bank was correctly written and cleared by the bank at 190.00, but in the accounting records it was recorded as 109.00. f. A credit memo indicated the bank collected a note receivable and deposited it in the company's bank account. 8. A check written in the current period has not cleared the bank nor was it returned by the bank