Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 6 (Mathematics of Finance): MATHEMATICAL APPLICATIONS FOR THE MANAGEMENT, LIFE, AND SOCIAL SCIENCES, 12TH EDITION ======This problem is a complex financial problem that requires

Chapter 6 (Mathematics of Finance): MATHEMATICAL APPLICATIONS FOR THE MANAGEMENT, LIFE, AND SOCIAL SCIENCES, 12TH EDITION

======This problem is a complex financial problem that requires several skills, perhaps some from previous sections.=======

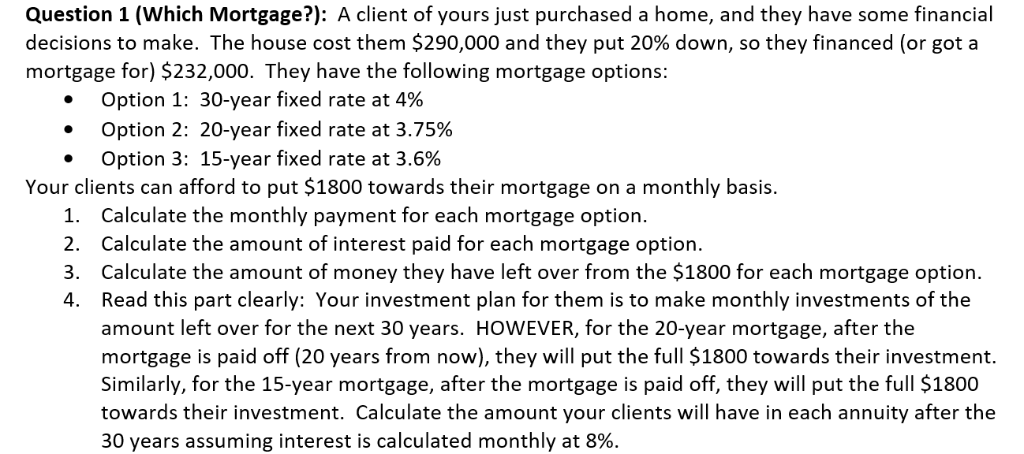

Question 1 (Which Mortgage?): A client of yours just purchased a home, and they have some financial decisions to make. The house cost them $290,000 and they put 20% down, so they financed (or got a mortgage for) $232,000. They have the following mortgage options: Option 1: 30-year fixed rate at 4% Option 2: 20-year fixed rate at 3.75% Option 3: 15-year fixed rate at 3.6% . Your clients can afford to put $1800 towards their mortgage on a monthly basis. Calculate the monthly payment for each mortgage option. Calculate the amount of interest paid for each mortgage option. Calculate the amount of money they have left over from the $1800 for each mortgage option. Read this part clearly: Your investment plan for them is to make monthly investments of the amount left over for the next 30 years. HOWEVER, for the 20-year mortgage, after the mortgage is paid off (20 years from now), they will put the full $1800 towards their investment. Similarly, for the 15-year mortgage, after the mortgage is paid off, they will put the full $1800 towards their investment. Calculate the amount your clients will have in each annuity after the 30 years assuming interest is calculated monthly at 8%. 1. 2. 3. 4. Question 1 (Which Mortgage?): A client of yours just purchased a home, and they have some financial decisions to make. The house cost them $290,000 and they put 20% down, so they financed (or got a mortgage for) $232,000. They have the following mortgage options: Option 1: 30-year fixed rate at 4% Option 2: 20-year fixed rate at 3.75% Option 3: 15-year fixed rate at 3.6% . Your clients can afford to put $1800 towards their mortgage on a monthly basis. Calculate the monthly payment for each mortgage option. Calculate the amount of interest paid for each mortgage option. Calculate the amount of money they have left over from the $1800 for each mortgage option. Read this part clearly: Your investment plan for them is to make monthly investments of the amount left over for the next 30 years. HOWEVER, for the 20-year mortgage, after the mortgage is paid off (20 years from now), they will put the full $1800 towards their investment. Similarly, for the 15-year mortgage, after the mortgage is paid off, they will put the full $1800 towards their investment. Calculate the amount your clients will have in each annuity after the 30 years assuming interest is calculated monthly at 8%. 1. 2. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started