Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You believe that an investment in Ghana's real estate would be both appropriate and timely, and have decided to recommend a 20 percent position be

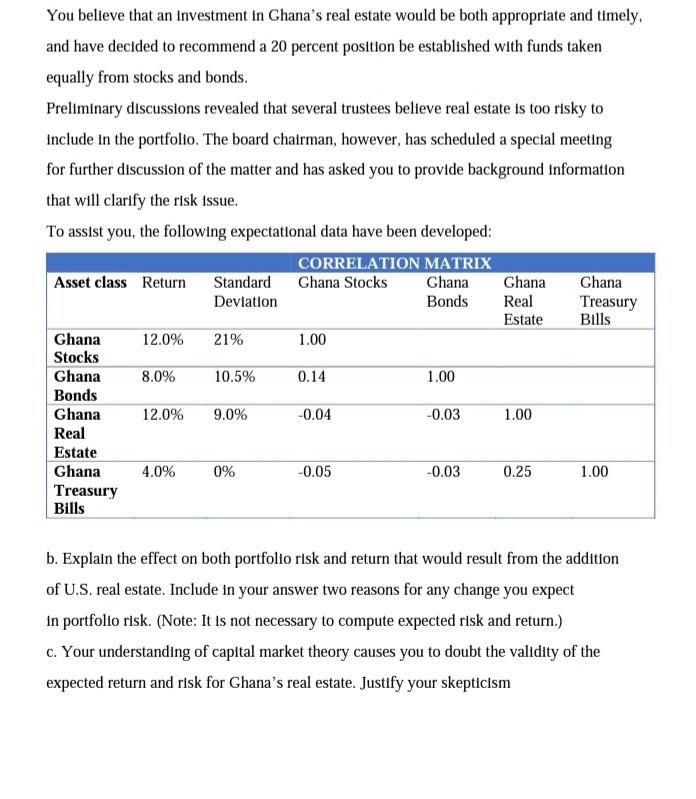

You believe that an investment in Ghana's real estate would be both appropriate and timely, and have decided to recommend a 20 percent position be established with funds taken equally from stocks and bonds. Preliminary discussions revealed that several trustees believe real estate is too risky to include in the portfolio. The board chairman, however, has scheduled a special meeting for further discussion of the matter and has asked you to provide background information that will clarify the risk issue. To assist you, the following expectational data have been developed: CORRELATION MATRIX Asset class Return Standard Ghana Stocks Ghana Ghana Ghana Deviation Bonds Real Treasury Estate Bills Ghana 12.0% 21% 1.00 Stocks Ghana 8.0% 10.5% 0.14 1.00 Bonds Ghana 12.0% 9.0% -0.04 -0.03 1.00 Real Estate Ghana 4.0% 0% -0.05 -0.03 0.25 1.00 Treasury Bills b. Explain the effect on both portfolio risk and return that would result from the addition of U.S. real estate. Include in your answer two reasons for any change you expect in portfolio risk. (Note: It is not necessary to compute expected risk and return.) c. Your understanding of capital market theory causes you to doubt the validity of the expected return and risk for Ghana's real estate. Justify your skepticism

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started