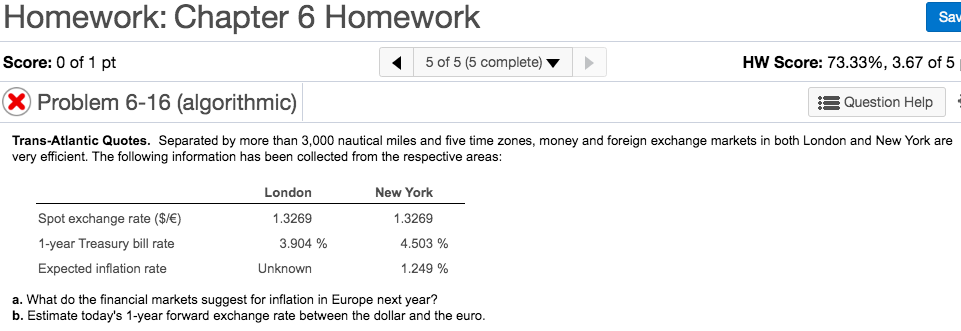

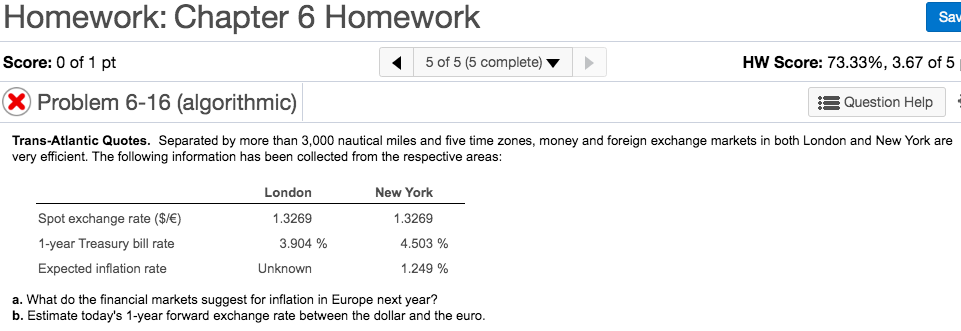

CHAPTER 6 - QUESTION 5:

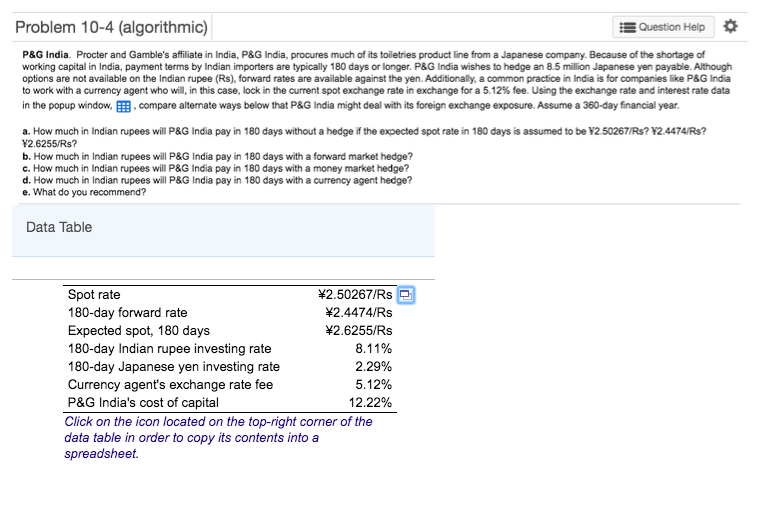

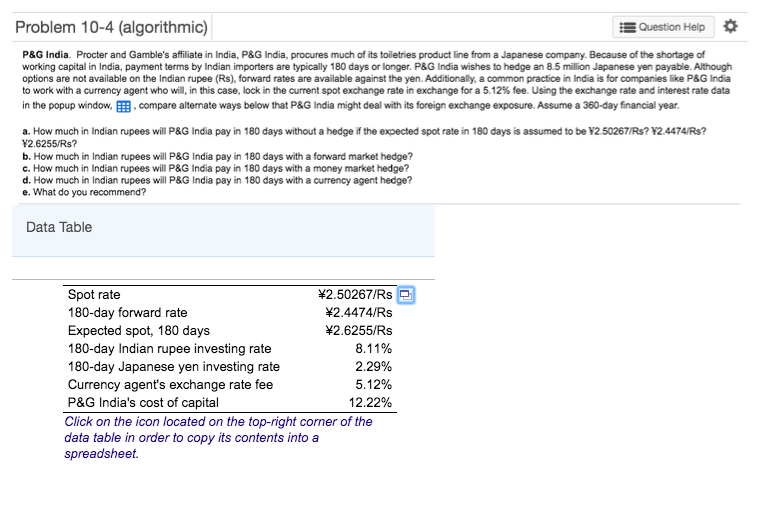

CHAPTER 10 - QUESTION 1

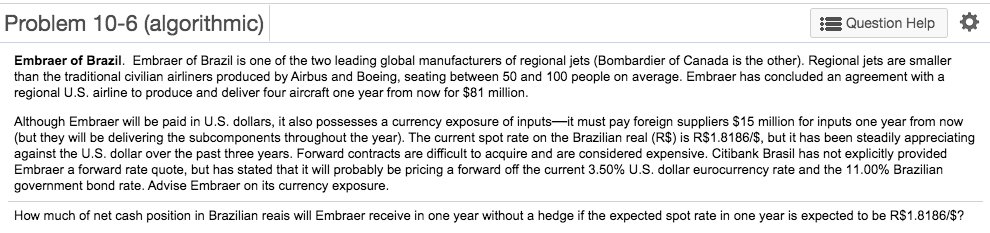

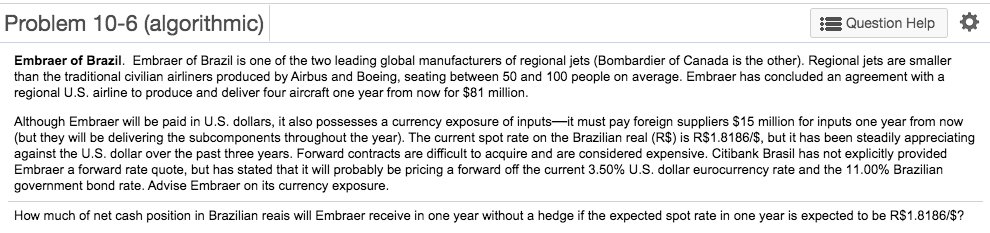

CHAPTER 10 - QUESTION 2

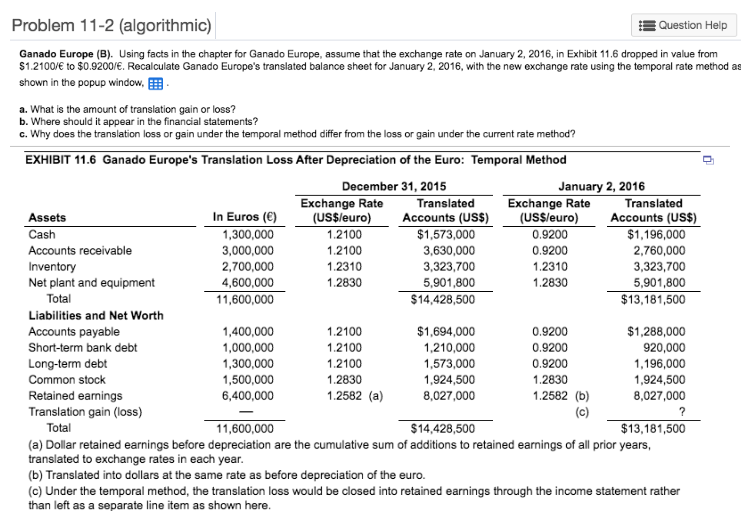

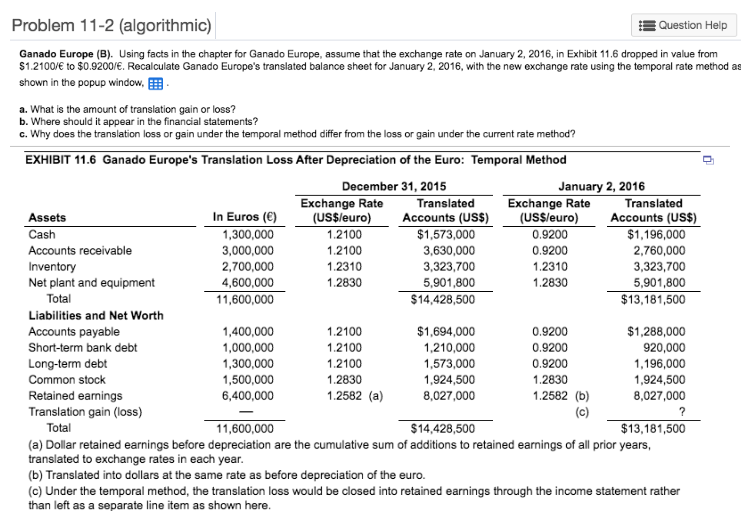

CHAPTER 11 - QUESTION 2

Homework: Chapter 6 Homework Sav Score: 0 of 1 pt 5 of 5 (5 complete) HW Score: 73.33%, 3.67 of 5 X Problem 6-16 (algorithmic) Question Help Trans-Atlantic Quotes. Separated by more than 3,000 nautical miles and five time zones, money and foreign exchange markets in both London and New York are very efficient. The following information has been collected from the respective areas: London New York 1.3269 1.3269 Spot exchange rate ($/) 1-year Treasury bill rate Expected inflation rate 3.904 % 4.503 % Unknown 1.249 % a. What do the financial markets suggest for inflation in Europe next year? b. Estimate today's 1-year forward exchange rate between the dollar and the euro. Problem 10-4 (algorithmic) E Question Help P&G India. Procter and Gamble's affiliate in India, P&G India, procures much of its toiletries product line from a Japanese company. Because of the shortage of working capital in India, payment terms by Indian importers are typically 180 days or longer. P&G India wishes to hedge an 8.5 million Japanese yen payable. Although options are not available on the Indian rupee (Rs), forward rates are available against the yen. Additionally, a common practice in India is for companies like P&G India to work with a currency agent who will in this case, lock in the current spot exchange rate in exchange for a 5.12% fee. Using the exchange rate and interest rate data in the popup window. .compare alternate ways below that P&G India might deal with its foreign exchange exposure. Assume a 360-day financial year. a. How much in Indian rupees will P&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be Y2 50267/Rs? Y2.4474/Rs? Y2.6255/Rs? b. How much in Indian rupees will P&G India pay in 180 days with a forward market hedge? c. How much in Indian rupees will P&G India pay in 180 days with a money market hedge? d. How much in Indian rupees will P&G India pay in 180 days with a currency agent hedge? e. What do you recommend? Data Table Spot rate 2.50267/Rs 180-day forward rate 2.4474/Rs Expected spot, 180 days 2.6255/Rs 180-day Indian rupee investing rate 8.11% 180-day Japanese yen investing rate 2.29% Currency agent's exchange rate fee 5.12% P&G India's cost of capital 12.22% Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet Problem 10-6 (algorithmic) Question Help Embraer of Brazil. Embraer of Brazil is one of the two leading global manufacturers of regional jets (Bombardier of Canada is the other). Regional jets are smaller than the traditional civilian airliners produced by Airbus and Boeing, seating between 50 and 100 people on average. Embraer has concluded an agreement with a regional U.S. airline to produce and deliver four aircraft one year from now for $81 million. Although Embraer will be paid in U.S. dollars, it also possesses a currency exposure of inputs-it must pay foreign suppliers $ 15 million for inputs one year from now (but they will be delivering the subcomponents throughout the year). The current spot rate on the Brazilian real (R$) is R$1.8186/$, but it has been steadily appreciating against the U.S. dollar over the past three years. Forward contracts are difficult to acquire and are considered expensive. Citibank Brasil has not explicitly provided Embraer a forward rate quote, but has stated that it will probably be pricing a forward off the current 3.50% U.S. dollar eurocurrency rate and the 11.00% Brazilian government bond rate. Advise Embraer on its currency exposure. How much of net cash position in Brazilian reais will Embraer receive in one year without a hedge if the expected spot rate in one year is expected to be R$1.8186/$? Problem 11-2 (algorithmic) Question Help Ganado Europe (B). Using facts in the chapter for Ganado Europe, assume that the exchange rate on January 2, 2016, in Exhibit 11.6 dropped in value from $1.2100/ to $0.9200/. Recalculate Ganado Europe's translated balance sheet for January 2, 2016, with the new exchange rate using the temporal rate method as shown in the popup window, a. What is the amount of translation gain or loss? b. Where should it appear in the financial statements? c. Why does the translation loss or gain under the temporal method differ from the loss or gain under the current rate method? EXHIBIT 11.6 Ganado Europe's Translation Loss After Depreciation of the Euro: Temporal Method December 31, 2015 January 2, 2016 Exchange Rate Translated Exchange Rate Translated Assets In Euros (E) (US$/euro) Accounts (US$) (US$/euro) Accounts (USS) Cash 1,300,000 1.2100 $1,573,000 0.9200 $1,196,000 Accounts receivable 3,000,000 1.2100 3,630,000 0.9200 2,760,000 Inventory 2,700,000 1.2310 3,323,700 1.2310 3,323,700 Net plant and equipment 4,600,000 1.2830 5,901,800 1.2830 5,901,800 Total 11,600,000 $14,428,500 $13,181,500 Liabilities and Net Worth Accounts payable 1,400,000 1.2100 $1,694,000 0.9200 $1,288,000 Short-term bank debt 1,000,000 1.2100 1,210,000 0.9200 920,000 Long-term debt 1,300,000 1.2100 1,573,000 0.9200 1,196,000 Common stock 1,500,000 1.2830 1,924,500 1.2830 1,924,500 Retained earnings 6,400,000 1.2582 (a) 8,027,000 1.2582 (b) 8,027,000 Translation gain (loss) Total 11,600,000 $14,428,500 $13,181,500 (a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated to exchange rates in each year. (b) Translated into dollars at the same rate as before depreciation of the euro. (c) Under the temporal method, the translation loss would be closed into retained earnings through the income statement rather than left as a separate line item as shown here. (c)