Question

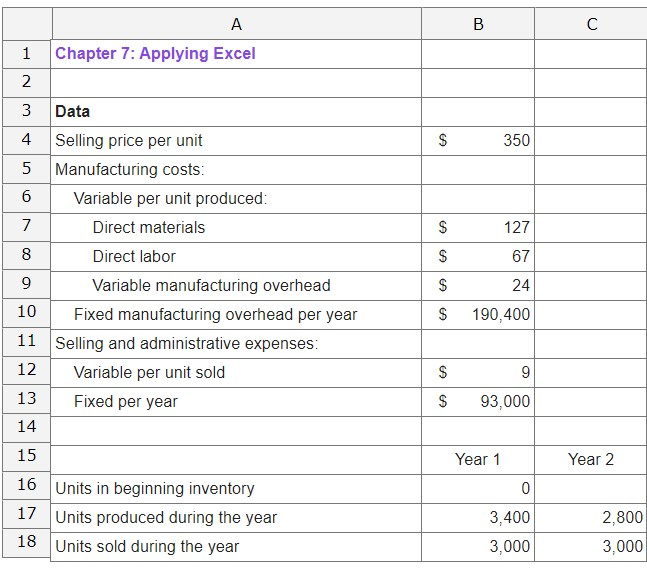

Chapter 7: Applying Excel: Exercise (a) What is the net operating income (loss) in Year 1 under absorption costing? (b) What is the net operating

Chapter 7: Applying Excel: Exercise

(a) What is the net operating income (loss) in Year 1 under absorption costing?

(b) What is the net operating income (loss) in Year 2 under absorption costing?

(c) What is the net operating income (loss) in Year 1 under variable costing?

(d) What is the net operating income (loss) in Year 2 under variable costing?

(e) The net operating income (loss) under absorption costing is less than the net operating income (loss) under variable costing in Year 2 because: (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply

- Units were left over from the previous year.unanswered

- The cost of goods sold is always less under variable costing than under absorption costing.unanswered

- Sales exceeded production so some of the fixed manufacturing overhead of the period was released from inventories under absorption costing.unanswered

3.

Make a note of the absorption costing net operating income (loss) in Year 2.

At the end of Year 1, the companys board of directors set a target for Year 2 of net operating income of $170,000 under absorption costing. If this target is met, a hefty bonus would be paid to the CEO of the company. Keeping everything else the same from part (2) above, change the units produced in Year 2 to 5,600 units.

(a) Would this change result in a bonus being paid to the CEO?

multiple choice 1

-

Yes

-

No

(b) What is the net operating income (loss) in Year 2 under absorption costing?

(c) Would this doubling of production in Year 2 be in the best interests of the company if sales are expected to continue to be 3,000 units per year?

multiple choice 2

-

Yes

-

No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started