Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 7 Assignment Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are

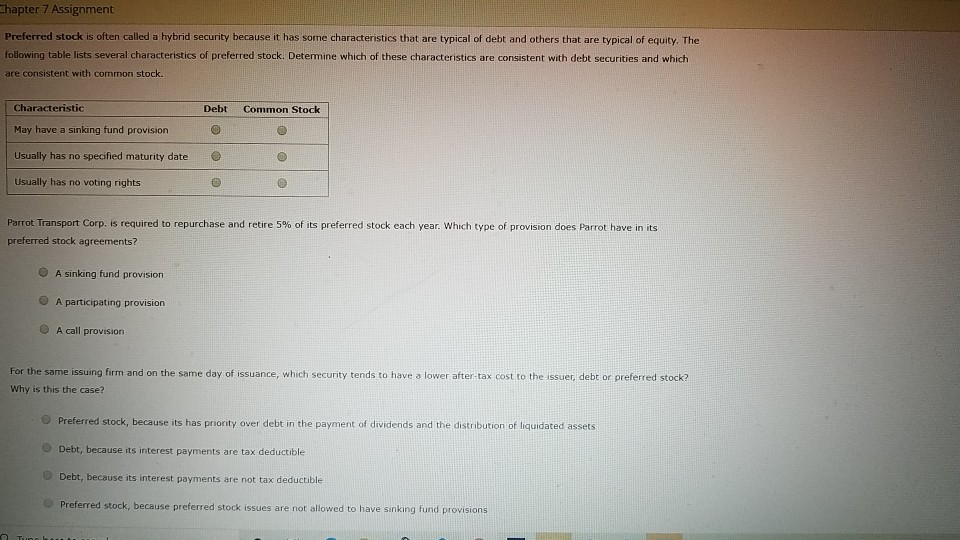

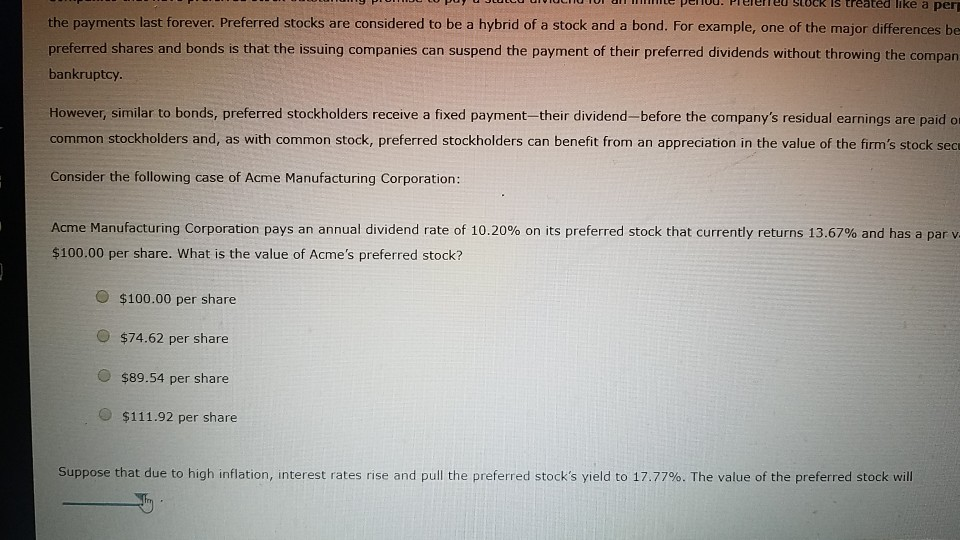

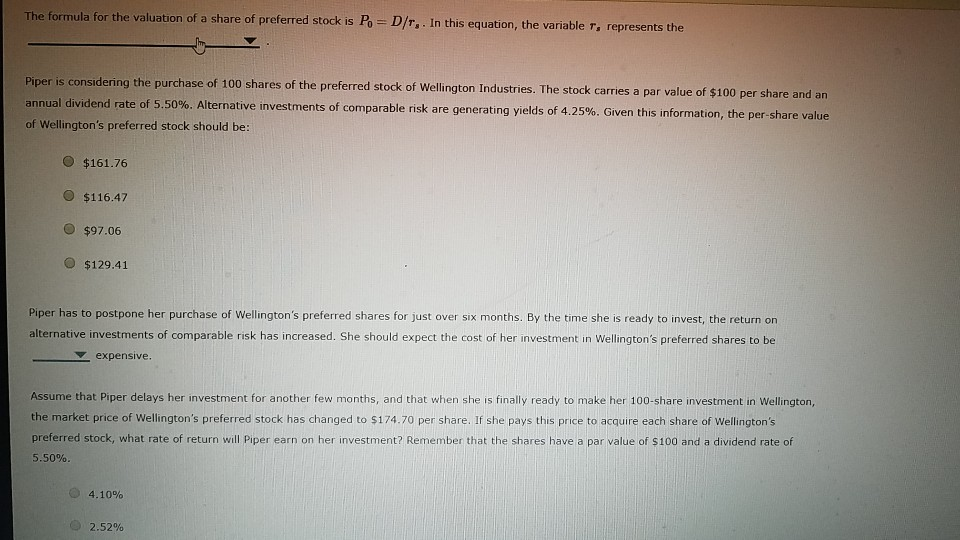

Chapter 7 Assignment Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of equity. The following table lists several characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock. Characteristic Debt Common Stock May have a sinking fund provision Usually has no specified maturity date Usually has no voting rights Parrot Transport Corp. is required to repurchase and retire 5% of its preferred stock each year. Which type of provision does Parrot have in its preferred stock agreements? A sinking fund provision A participating provision O A call provision For the same issuing firm and on the same day of issuance, which security tends to have a lower after-tax cost to the issuer, debt or preferred stock? Why is this the case? Preferred stock, because its has priority over debt in the payment of dividends and the distribution of liquidated assets Debt, because its interest payments are tax deductible Debt, because its interest payments are not tax deductible Preferred stock, because preferred stock issues are not allowed to have sinking fund provisions JLULLU UVIULIU TUI UM Penuu.HCICILU SLUCA 15 Ledu Rea Pel the payments last forever. Preferred stocks are considered to be a hybrid of a stock and a bond. For example, one of the major differences be preferred shares and bonds is that the issuing companies can suspend the payment of their preferred dividends without throwing the compan bankruptcy. However, similar to bonds, preferred stockholders receive a fixed payment-their dividend-before the company's residual earnings are paid o common stockholders and, as with common stock, preferred stockholders can benefit from an appreciation in the value of the firm's stock sec Consider the following case of Acme Manufacturing Corporation: Acme Manufacturing Corporation pays an annual dividend rate of 10.20% on its preferred stock that currently returns 13.67% and has a parv $100.00 per share. What is the value of Acme's preferred stock? $100.00 per share $74.62 per share $89.54 per share $111.92 per share Suppose that due to high inflation, interest rates rise and pull the preferred stock's yield to 17.77%. The value of the preferred stock will The formula for the valuation of a share of preferred stock is P = D/T,. In this equation, the variable , represents the Piper is considering the purchase of 100 shares of the preferred stock of Wellington Industries. The stock carries a par value of $100 per share and an annual dividend rate of 5.50%. Alternative investments of comparable risk are generating yields of 4.25%. Given this information, the per-share value of Wellington's preferred stock should be: $161.76 $116.47 $97.06 $129.41 Piper has to postpone her purchase of Wellington's preferred shares for just over six months. By the time she is ready to invest, the return on alternative investments of comparable risk has increased. She should expect the cost of her investment in Wellington's preferred shares to be expensive. Assume that Piper delays her investment for another few months, and that when she is finally ready to make her 100-share investment in Wellington, the market price of Wellington's preferred stock has changed to $174.70 per share. If she pays this price to acquire each share of Wellington's preferred stock, what rate of return will Piper earn on her investment? Remember that the shares have a par value of $100 and a dividend rate of 5.50%. 4.10% 2.52%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started