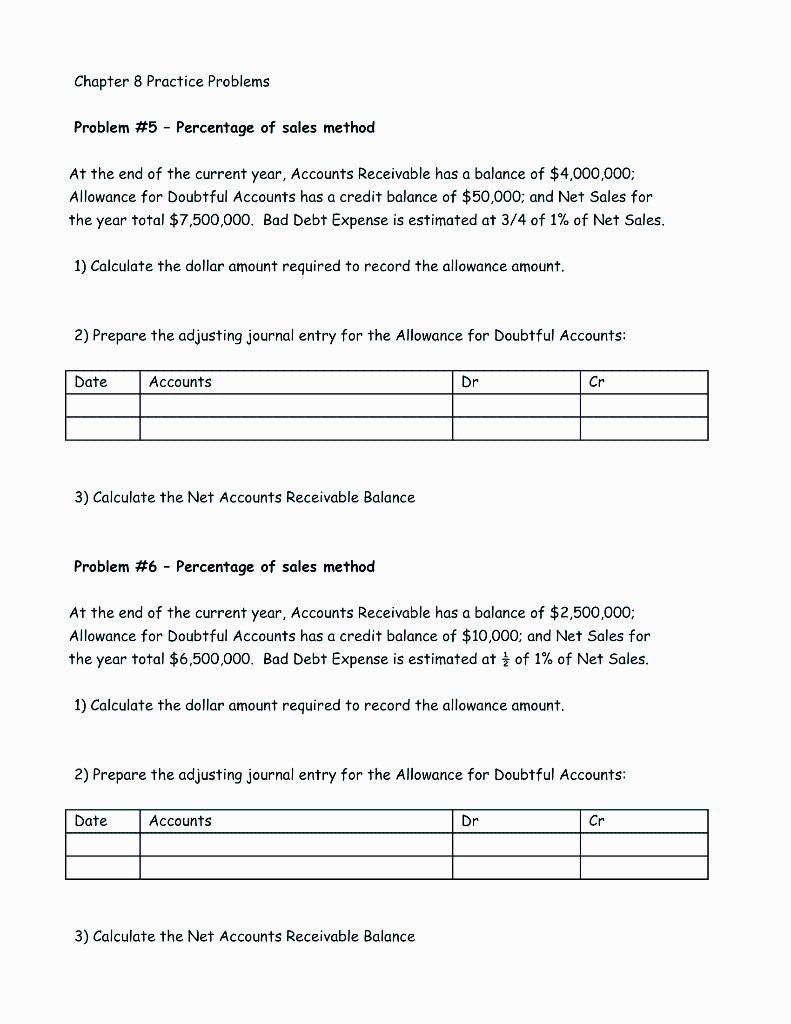

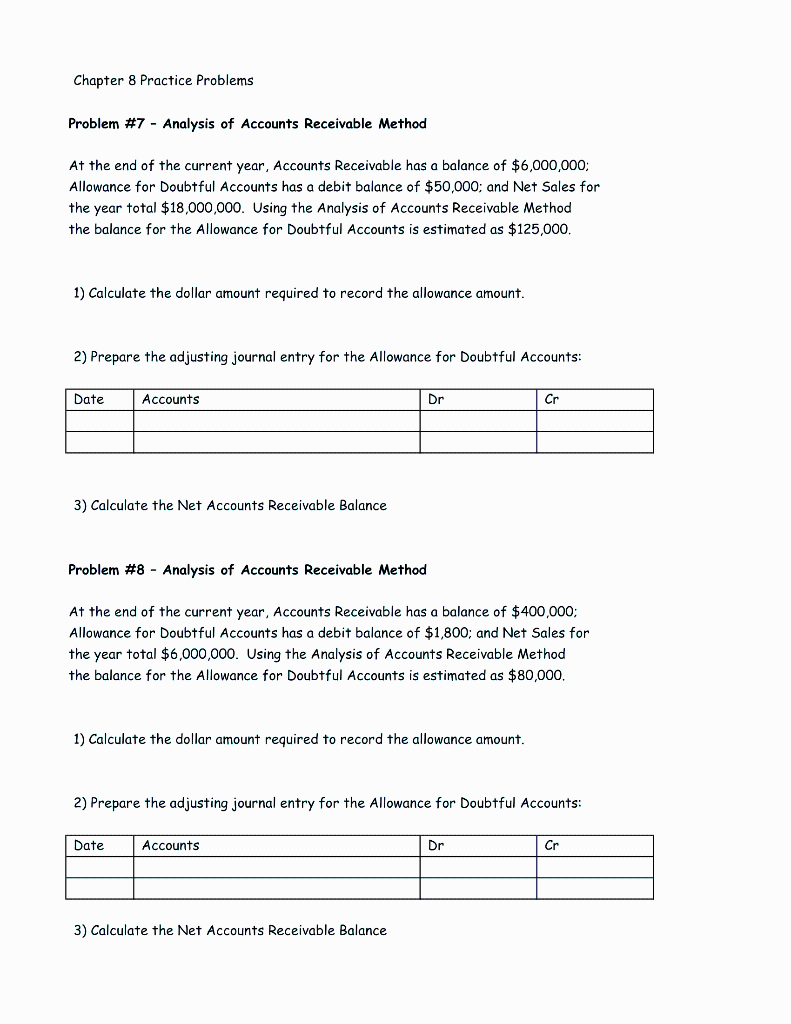

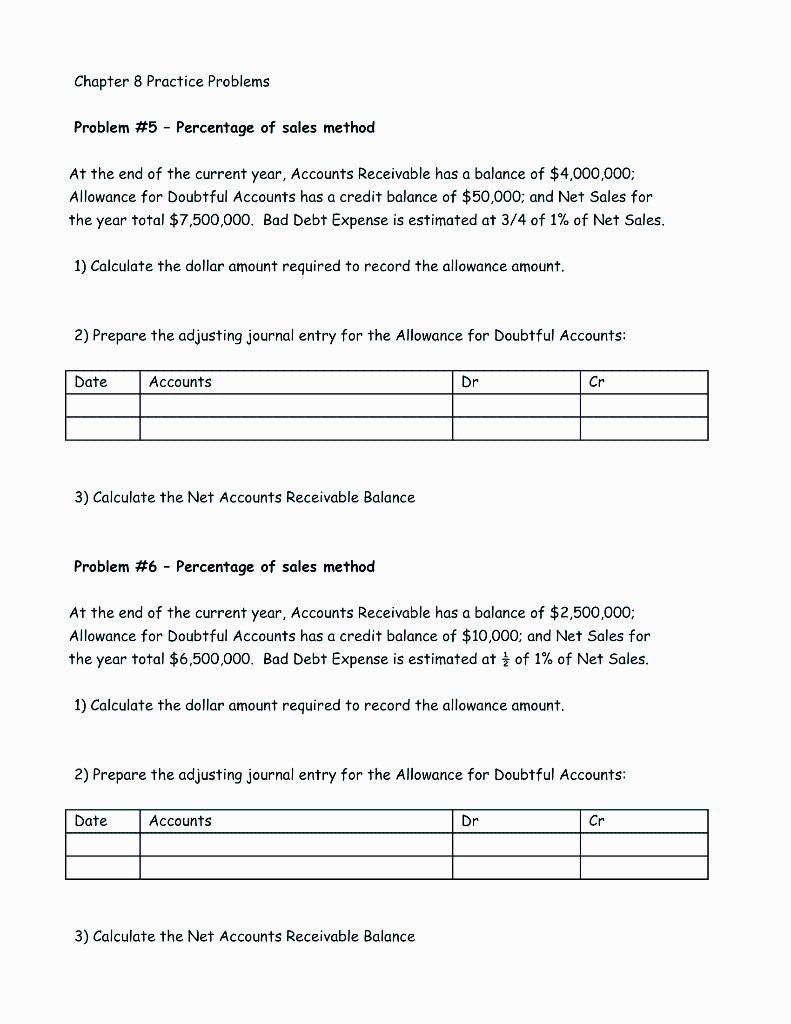

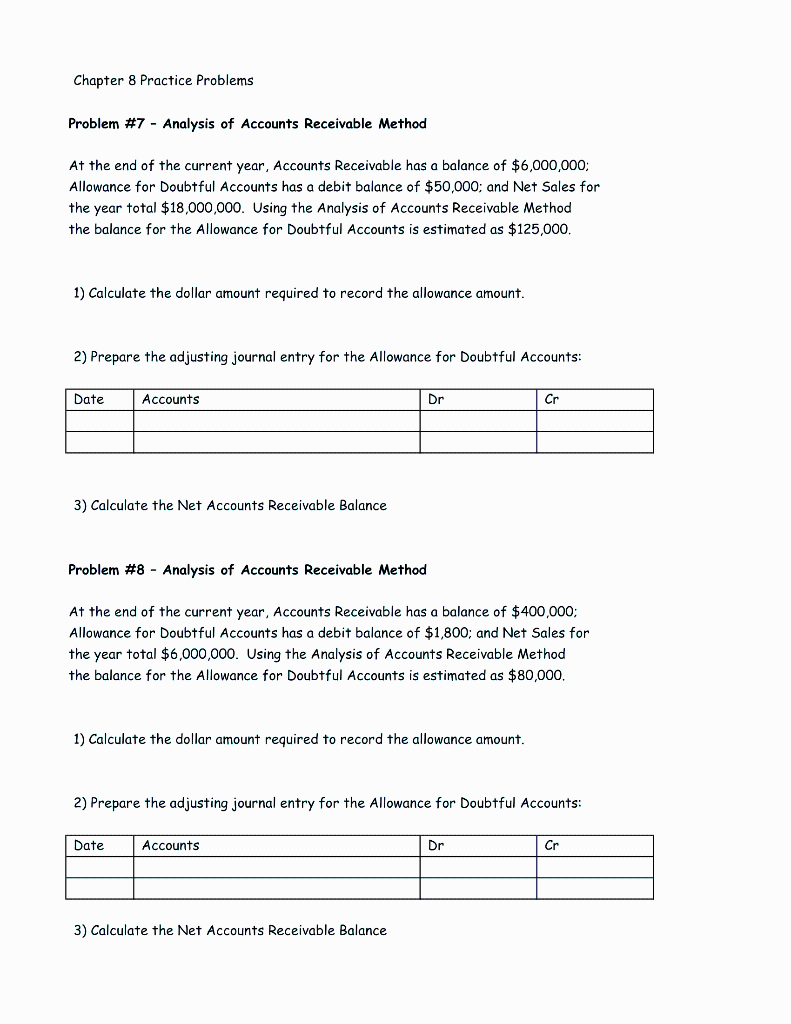

Chapter 8 Practice Problems Problem #5 - Percentage of sales method At the end of the current year, Accounts Receivable has a balance of $4,000,000; Allowance for Doubtful Accounts has a credit balance of $50,000; and Net Sales for the year total $7,500,000, Bad Debt Expense is estimated at 3/4 of 1% of Net Sales. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: Date Accounts Dr Cr 3) Calculate the Net Accounts Receivable Balance Problem #6 - Percentage of sales method At the end of the current year, Accounts Receivable has a balance of $2,500,000; Allowance for Doubtful Accounts has a credit balance of $10,000; and Net Sales for the year total $6,500,000. Bad Debt Expense is estimated at 1 of 1% of Net Sales. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: Date Accounts Dr Cr 3) Calculate the Net Accounts Receivable Balance Chapter 8 Practice Problems Problem #7 - Analysis of Accounts Receivable Method At the end of the current year, Accounts Receivable has a balance of $6,000,000: Allowance for Doubtful Accounts has a debit balance of $50,000; and Net Sales for the year total $18,000,000. Using the Analysis of Accounts Receivable Method the balance for the Allowance for Doubtful Accounts is estimated as $125,000. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: Date Accounts Dr Cr 3) Calculate the Net Accounts Receivable Balance Problem #8 - Analysis of Accounts Receivable Method At the end of the current year, Accounts Receivable has a balance of $400,000: Allowance for Doubtful Accounts has a debit balance of $1,800; and Net Sales for the year total $6,000,000. Using the Analysis of Accounts Receivable Method the balance for the Allowance for Doubtful Accounts is estimated as $80,000, 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: Date Accounts Dr Cr 3) Calculate the Net Accounts Receivable Balance