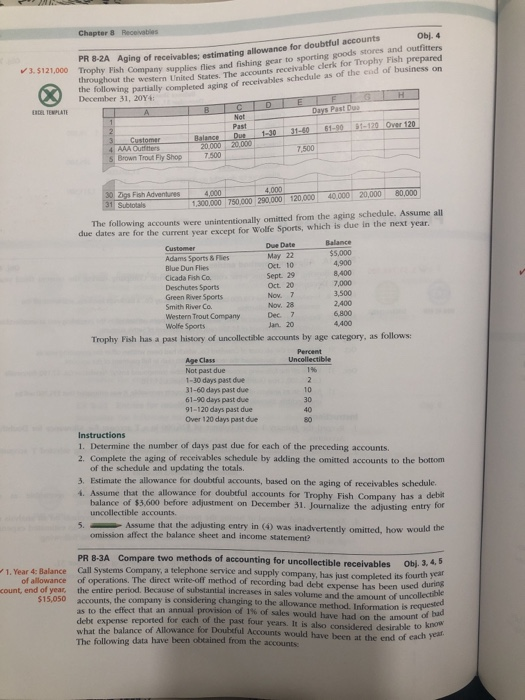

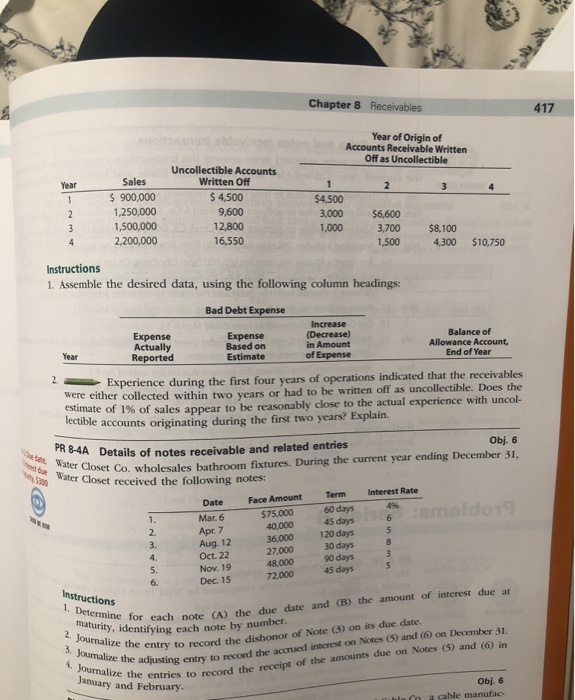

Chapter 8 Receivables Obj. 4 3. $121,000 FR 8-2A Aging of receivables estimating allowance for doubtful accounts wrophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United Suates. The accounts receivable clerk for Trophy Fish prepared me following partially completed aging of receivables schedule as of the end of business on December 31, 20Y4: EHTE PLATE Days Past Du Not Past 51-170 Over 120 1-30 Due 20100 Customer AAA Outfitters S Brown Trout Fly Shop Balance 201000 7.500 31-6061-0 7.500 30 Zig Fish Adventures 4000 40.000 120.000 20,000 80,000 31 Subtotals 1.300.000 750.000 290,000 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year. Customer Due Date Balance Adams Sports & Flies May 22 $5,000 Blue Dun Flies Oct. 10 4.900 Cicada Fish Co. Sept. 29 8.400 Deschutes Sports Oct. 20 7,000 Green River Sports Noy. 7 3,500 Smith River Co. Nov, 28 2.400 Western Trout Company Dec. 7 6.900 Wolfe Sports jan. 20 4400 Trophy Fish has a past history of uncollectible accounts by age category, as follows: Percent Age Class Uncollectible Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-120 days past due Over 120 days past due Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31. Journalize the adjusting entry for uncollectible accounts 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement 1. Year 4: Balance of allowance count, end of year, $15.050 PR 8-3A Compare two methods of accounting for uncollectible recelyables Obj. 3. 4,5 Call Systems Company, a telephone service and supply company has just completed its fourth year of operations. The direct write-off method of recording bad debe expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollect accounts, the company is considering changing to the allowance method Information is request as to the effect that an annual provision of 1% of sales would have had on the amount of de expense reported for each of the past four years. It is also considered desirable to know what the balance of Allowance for Doubtful Accounts would have been at the end of each ye The following data have been obtained from the accounts Chapter 8 Receivables Year of Origin of Accounts Receivable Written Off as Uncollectible Year 3 Sales $ 900,000 1,250,000 1,500,000 2,200,000 Uncollectible Accounts Written Off $ 4,500 9,600 12,800 16,550 $4,500 3,000 1,000 $6,600 3,700 1,500 $8,100 4,300 $10,750 Instructions 1. Assemble the desired data, using the following column headings: Bad Debt Expense Expense Actually Reported Expense Based on Estimate Increase (Decrease) in Amount of Expense Balance of Allowance Account End of Year - Experience during the first four years of operations indicated that the receivables were either collected within two years or had to be written off as uncollectible. Does the estimate of 1% of sales appear to be reasonably close to the actual experience with uncol lectible accounts originating during the first two years? Explain. ou Want Water Closet Co. w 8-4A Details of notes receivable and related entries Obj. 6 Closet Co. wholesales bathroom fixtures. During the current year ending December 31. Water Closet received the following notes: Date Face Amount Term Interest Rate Mar. 6 $75,000 60 days 45 days 40,000 Apr. 7 36,000 120 days Aug. 12 30 days Oct. 22 27,000 90 days Nov. 19 48.000 45 days Dec. 15 72.000 Instructions 1. Determine for maturity, identifying 2. Journalize the entry 5. Joumalize the adjust le for each note (A) the due date and (B) the amount of interest due at urity, identifying each note by number e entry to record the dishonor of Note (3) on its due date. e adjusting entry to record the accrued interest on Notes (5) and (6) on December 31 alize the entries to record the receipt of the receipt of the amounts due on Notes (5) and (b) in 4. Journalize th January and February. Obj. 6 la coa cable manufac