Answered step by step

Verified Expert Solution

Question

1 Approved Answer

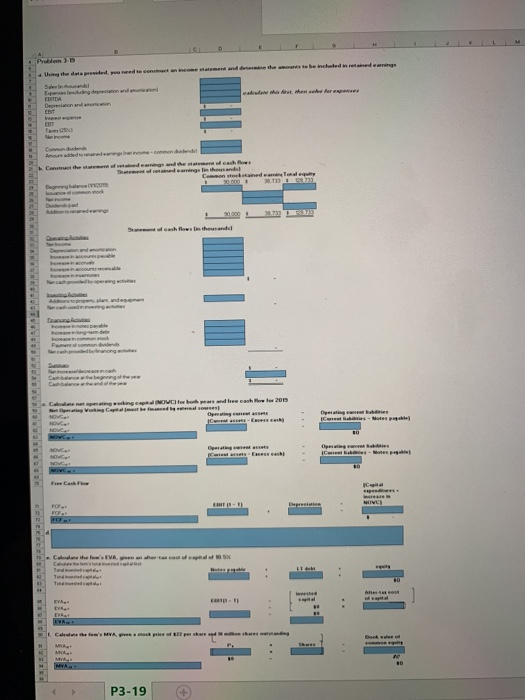

The problem is shown in the book and the answers have to be filled out in the blue sections of the excel sheet hensive/Spreadsheet Problem

The problem is shown in the book and the answers have to be filled out in the blue sections of the excel sheet

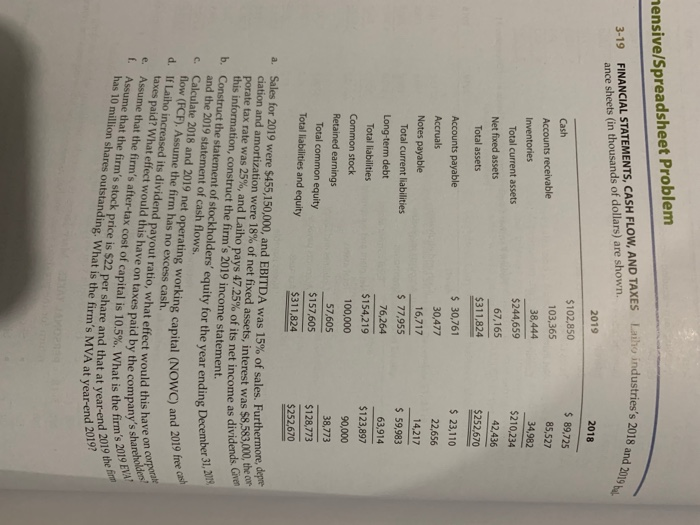

hensive/Spreadsheet Problem ries's 2018 and 2019 4 3-19 FINANCIAL STATEMENTS, CASH FLOW, AND TAXES Laiho industries's ance sheets (in thousands of dollars) are shown. 2018 $ 89,725 Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets 2019 $102,850 103,365 38,444 $244,659 67,165 $311,824 85,527 34,982 $210,234 42,436 $252,670 $ 23,110 22,656 14,217 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,761 30,477 16,717 $ 77,955 76,264 $154,219 100,000 57,605 $157,605 $311,824 $ 59,983 63,914 $123,897 90,000 38,773 $128,773 $252,670 est was $8,583,000, the com come as dividends. Given a. Sales for 2019 were $455,150,000, and EBITDA was 15% of sales. Furthermore, ciation and amortization were 18% of net fixed assets, interest was $8,00 porate tax rate was 25%, and Laiho pays 47.25% of its net income as divide this information, construct the firm's 2019 income statement. b. Construct the statement of stockholders' equity for the year ending Dee and the 2019 statement of cash flows. c. Calculate 2018 and 2019 net operating working capital (NOWC) an flow (FCF). Assume the firm has no excess cash. d. Laiho increased its dividend payout ratio, what effect would this taxes paid? What effect would this have on taxes paid by the company c. Assume that the firm's after-tax cost of capital is 10.5%. What is the Assume that the firm's stock price is $22 per share and that at year has 10 million shares outstanding. What is the firm's MVA at year nding December 31, 2019 WC) and 2019 free cash this have on corporuke ompany's shareholders is the firm's 2019 EVA Year-end 2019 the first "Year-end 2019? M e ings and the EDOTOVO P3-19 hensive/Spreadsheet Problem ries's 2018 and 2019 4 3-19 FINANCIAL STATEMENTS, CASH FLOW, AND TAXES Laiho industries's ance sheets (in thousands of dollars) are shown. 2018 $ 89,725 Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets 2019 $102,850 103,365 38,444 $244,659 67,165 $311,824 85,527 34,982 $210,234 42,436 $252,670 $ 23,110 22,656 14,217 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,761 30,477 16,717 $ 77,955 76,264 $154,219 100,000 57,605 $157,605 $311,824 $ 59,983 63,914 $123,897 90,000 38,773 $128,773 $252,670 est was $8,583,000, the com come as dividends. Given a. Sales for 2019 were $455,150,000, and EBITDA was 15% of sales. Furthermore, ciation and amortization were 18% of net fixed assets, interest was $8,00 porate tax rate was 25%, and Laiho pays 47.25% of its net income as divide this information, construct the firm's 2019 income statement. b. Construct the statement of stockholders' equity for the year ending Dee and the 2019 statement of cash flows. c. Calculate 2018 and 2019 net operating working capital (NOWC) an flow (FCF). Assume the firm has no excess cash. d. Laiho increased its dividend payout ratio, what effect would this taxes paid? What effect would this have on taxes paid by the company c. Assume that the firm's after-tax cost of capital is 10.5%. What is the Assume that the firm's stock price is $22 per share and that at year has 10 million shares outstanding. What is the firm's MVA at year nding December 31, 2019 WC) and 2019 free cash this have on corporuke ompany's shareholders is the firm's 2019 EVA Year-end 2019 the first "Year-end 2019? M e ings and the EDOTOVO P3-19 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started