Answered step by step

Verified Expert Solution

Question

1 Approved Answer

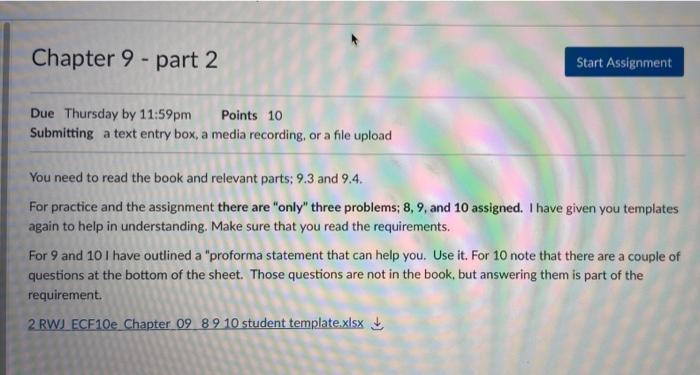

Chapter 9 part 2 Chapter 9 - part 2 - Start Assignment Due Thursday by 11:59pm Points 10 Submitting a text entry box, a media

Chapter 9 part 2

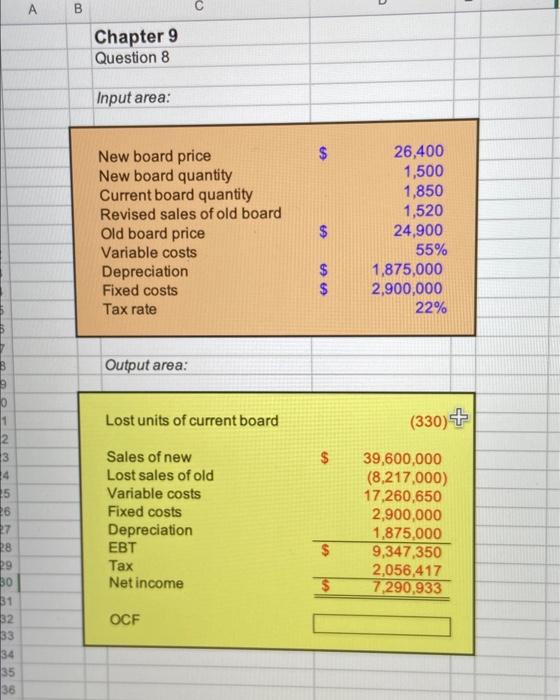

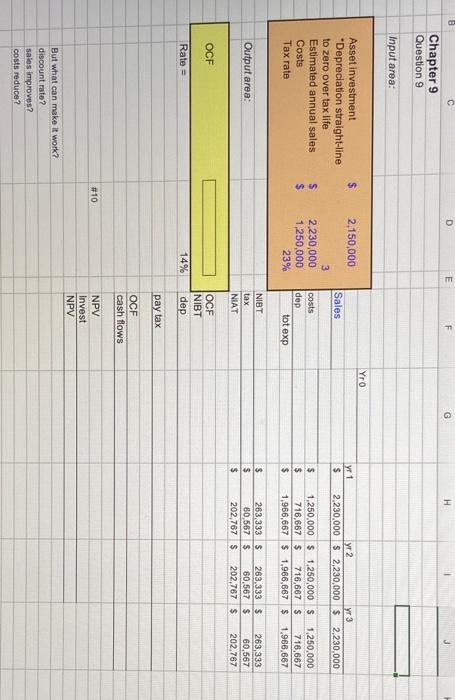

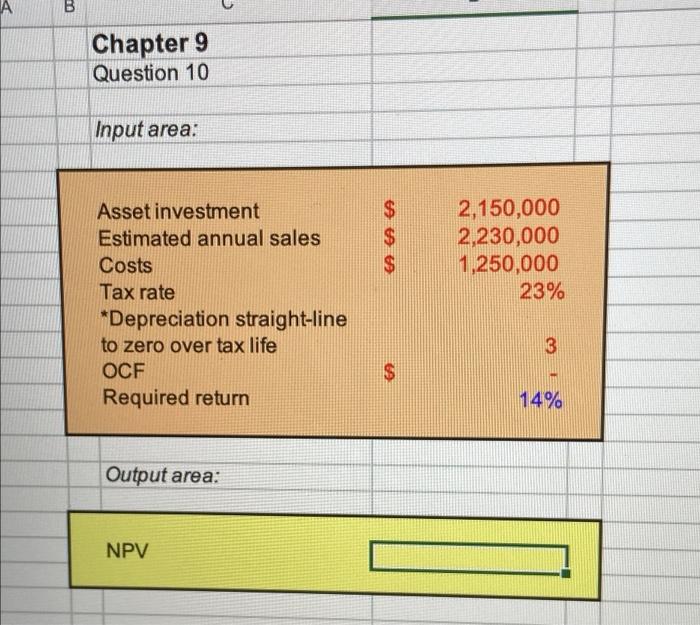

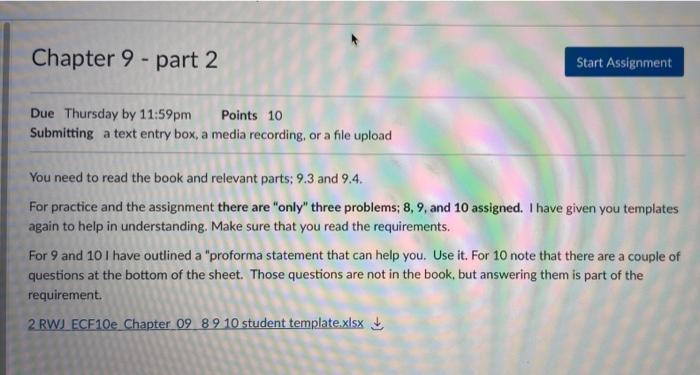

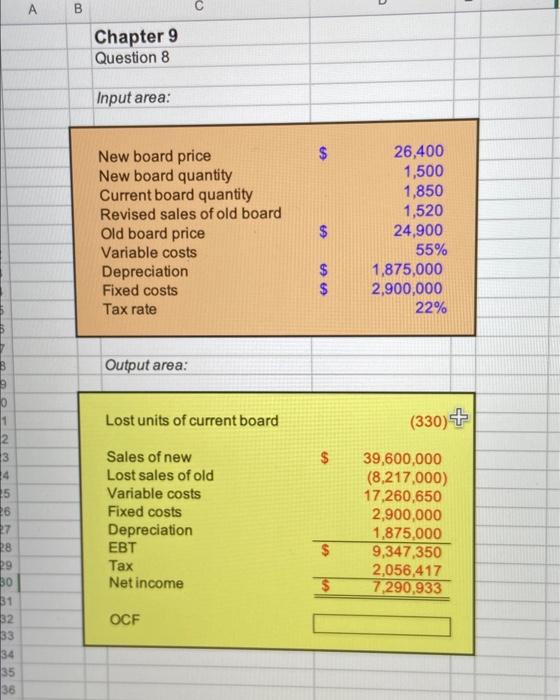

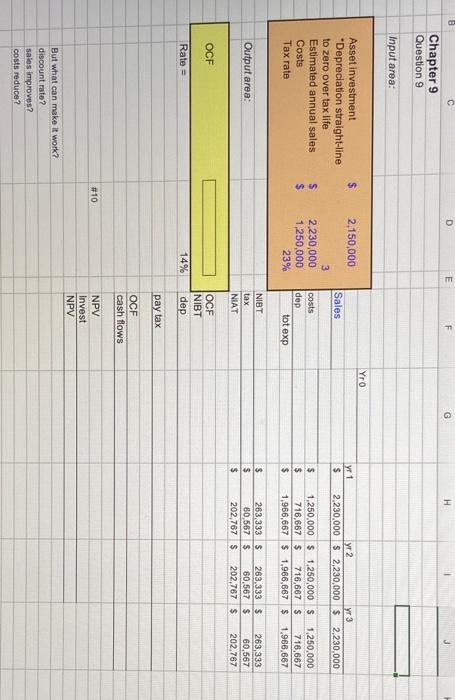

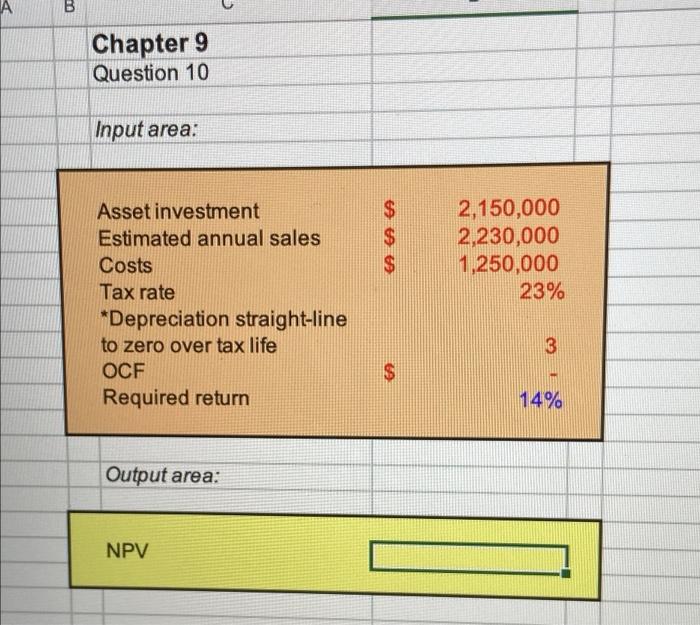

Chapter 9 - part 2 - Start Assignment Due Thursday by 11:59pm Points 10 Submitting a text entry box, a media recording, or a file upload You need to read the book and relevant parts: 9.3 and 9.4. For practice and the assignment there are "only" three problems; 8, 9, and 10 assigned. I have given you templates again to help in understanding. Make sure that you read the requirements. For 9 and 10 I have outlined a "proforma statement that can help you. Use it. For 10 note that there are a couple of questions at the bottom of the sheet. Those questions are not in the book, but answering them is part of the requirement. 2 RW) ECF 10e Chapter 09 89 10 student template.xlsx U A B Chapter 9 Question 8 Input area: $ New board price New board quantity Current board quantity Revised sales of old board Old board price Variable costs Depreciation Fixed costs Tax rate $ 26,400 1,500 1,850 1,520 24,900 55% 1,875,000 2,900,000 22% $ $ Output area: Lost units of current board (330)+ 2 3 $ Sales of new Lost sales of old Variable costs Fixed costs Depreciation EBT Tax Net income 4 15 26 27 28 29 30 31 32 33 34 35 36 39,600,000 (8,217,000) 17,260,650 2,900,000 1,875,000 9,347,350 2,056,417 7,290,933 $ $ OCF B D E F G H Chapter 9 Question 9 Input area: Yr 0 $ 2,150,000 Sales yr 1 $ yr 2 yr 3 2.230,000 $2,230,000 $2,230,000 Asset investment *Depreciation straight-line to zero over tax life Estimated annual sales Costs Tax rate s $ costs 3 2,230,000 1,250,000 23% dep tot exp $ $ $ 1,250,000 $1,250,000 $ 1,250,000 716,667 $ 716,667 S 716,667 1,966,667 $ 1,966,667 $ 1,966,667 Output area: NIBT tax NIAT $ $ $ 263,333 $ 80,567 $ 202,767 $ 263,333 S 60,567 $ 202,767 $ 263,333 60,567 202,767 OCF OCF NIBT dep Rate = 14% pay tax OCF cash flows #10 NPV Invest NPV But what can make it work? discount rato? sales improves? costs reduce? B Chapter 9 Question 10 Input area: $ $ 2,150,000 2,230,000 1,250,000 23% Asset investment Estimated annual sales Costs Tax rate *Depreciation straight-line to zero over tax life OCF Required return 3 $ 14% Output area: NPV Chapter 9 - part 2 - Start Assignment Due Thursday by 11:59pm Points 10 Submitting a text entry box, a media recording, or a file upload You need to read the book and relevant parts: 9.3 and 9.4. For practice and the assignment there are "only" three problems; 8, 9, and 10 assigned. I have given you templates again to help in understanding. Make sure that you read the requirements. For 9 and 10 I have outlined a "proforma statement that can help you. Use it. For 10 note that there are a couple of questions at the bottom of the sheet. Those questions are not in the book, but answering them is part of the requirement. 2 RW) ECF 10e Chapter 09 89 10 student template.xlsx U A B Chapter 9 Question 8 Input area: $ New board price New board quantity Current board quantity Revised sales of old board Old board price Variable costs Depreciation Fixed costs Tax rate $ 26,400 1,500 1,850 1,520 24,900 55% 1,875,000 2,900,000 22% $ $ Output area: Lost units of current board (330)+ 2 3 $ Sales of new Lost sales of old Variable costs Fixed costs Depreciation EBT Tax Net income 4 15 26 27 28 29 30 31 32 33 34 35 36 39,600,000 (8,217,000) 17,260,650 2,900,000 1,875,000 9,347,350 2,056,417 7,290,933 $ $ OCF B D E F G H Chapter 9 Question 9 Input area: Yr 0 $ 2,150,000 Sales yr 1 $ yr 2 yr 3 2.230,000 $2,230,000 $2,230,000 Asset investment *Depreciation straight-line to zero over tax life Estimated annual sales Costs Tax rate s $ costs 3 2,230,000 1,250,000 23% dep tot exp $ $ $ 1,250,000 $1,250,000 $ 1,250,000 716,667 $ 716,667 S 716,667 1,966,667 $ 1,966,667 $ 1,966,667 Output area: NIBT tax NIAT $ $ $ 263,333 $ 80,567 $ 202,767 $ 263,333 S 60,567 $ 202,767 $ 263,333 60,567 202,767 OCF OCF NIBT dep Rate = 14% pay tax OCF cash flows #10 NPV Invest NPV But what can make it work? discount rato? sales improves? costs reduce? B Chapter 9 Question 10 Input area: $ $ 2,150,000 2,230,000 1,250,000 23% Asset investment Estimated annual sales Costs Tax rate *Depreciation straight-line to zero over tax life OCF Required return 3 $ 14% Output area: NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started