Answered step by step

Verified Expert Solution

Question

1 Approved Answer

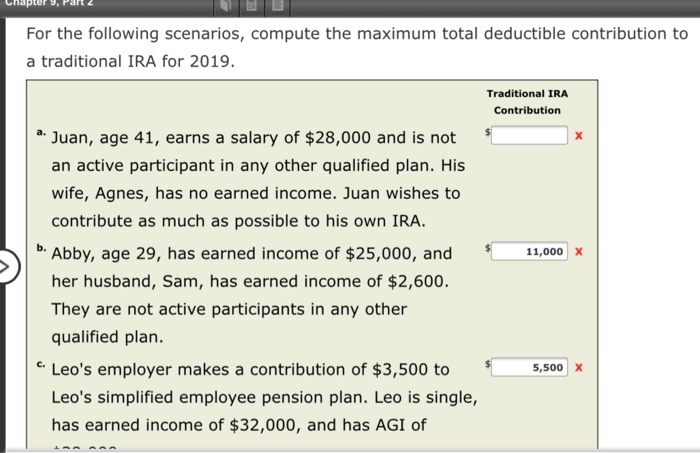

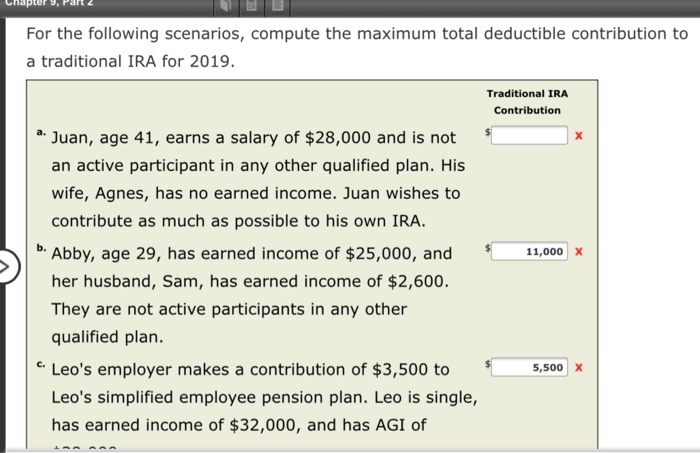

Chapter 9, Part 2 For the following scenarios, compute the maximum total deductible contribution to a traditional IRA for 2019. Traditional IRA Contribution ^ Juan,

Chapter 9, Part 2 For the following scenarios, compute the maximum total deductible contribution to a traditional IRA for 2019. Traditional IRA Contribution ^ Juan, age 41, earns a salary of $28,000 and is not an active participant in any other qualified plan. His wife, Agnes, has no earned income. Juan wishes to contribute as much as possible to his own IRA. b. Abby, age 29, has earned income of $25,000, and her husband, Sam, has earned income of $2,600. They are not active participants in any other qualified plan. - Leo's employer makes a contribution of $3,500 to Leo's simplified employee pension plan. Leo is single, has earned income of $32,000, and has AGI of 5,500

Chapter 9, Part 2 For the following scenarios, compute the maximum total deductible contribution to a traditional IRA for 2019. Traditional IRA Contribution ^ Juan, age 41, earns a salary of $28,000 and is not an active participant in any other qualified plan. His wife, Agnes, has no earned income. Juan wishes to contribute as much as possible to his own IRA. b. Abby, age 29, has earned income of $25,000, and her husband, Sam, has earned income of $2,600. They are not active participants in any other qualified plan. - Leo's employer makes a contribution of $3,500 to Leo's simplified employee pension plan. Leo is single, has earned income of $32,000, and has AGI of 5,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started