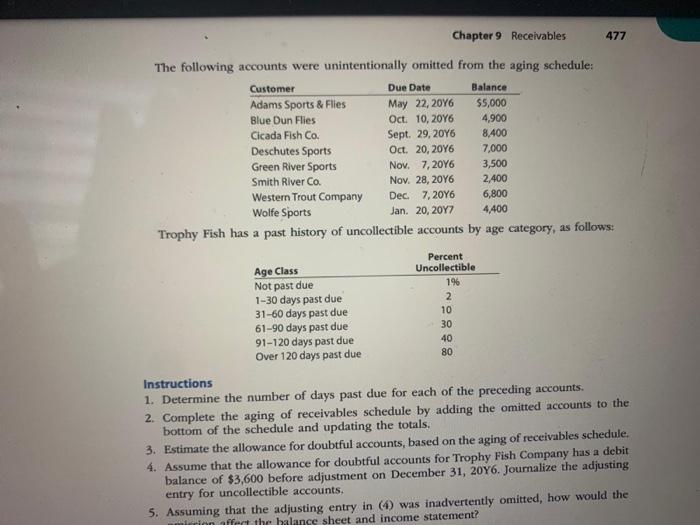

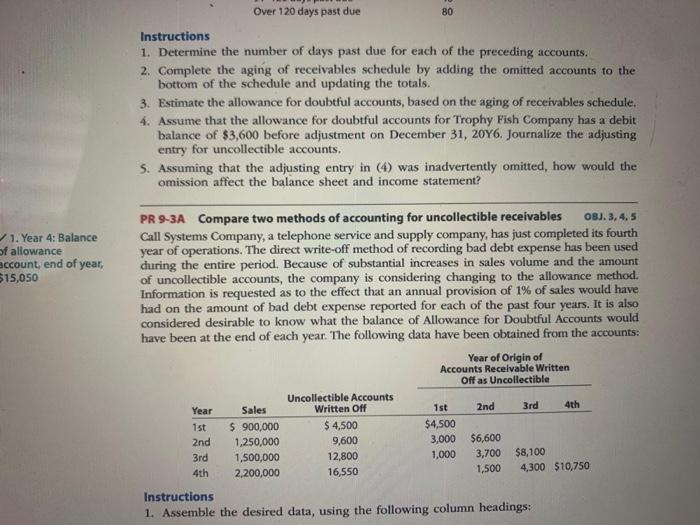

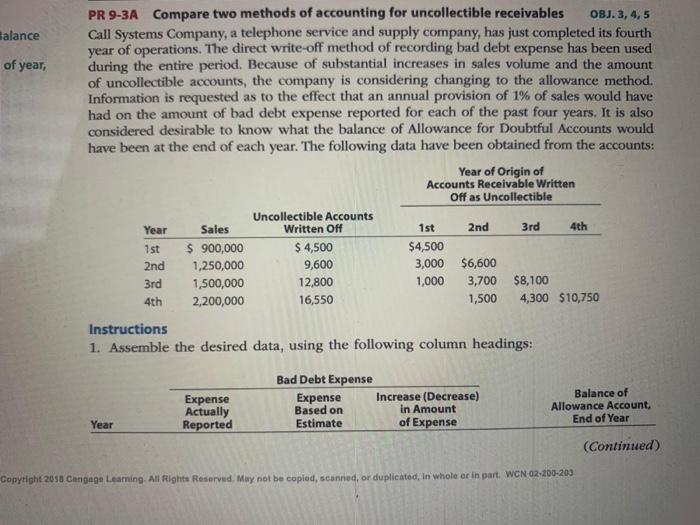

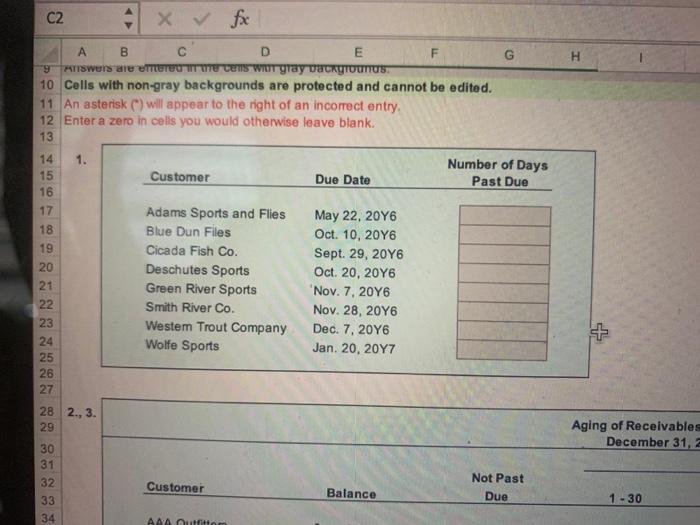

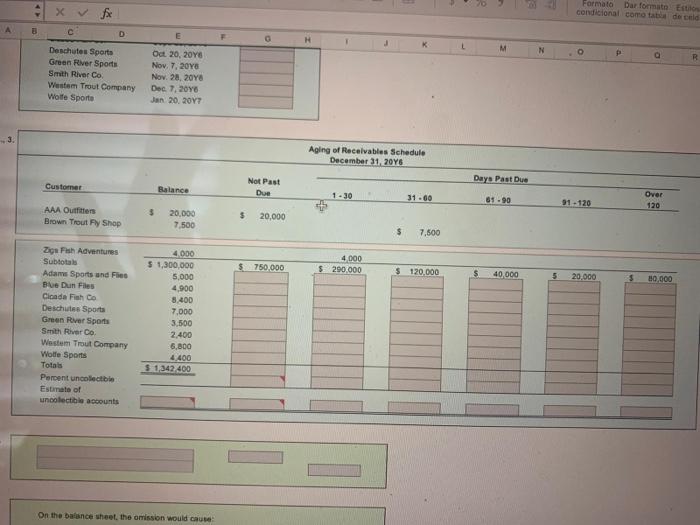

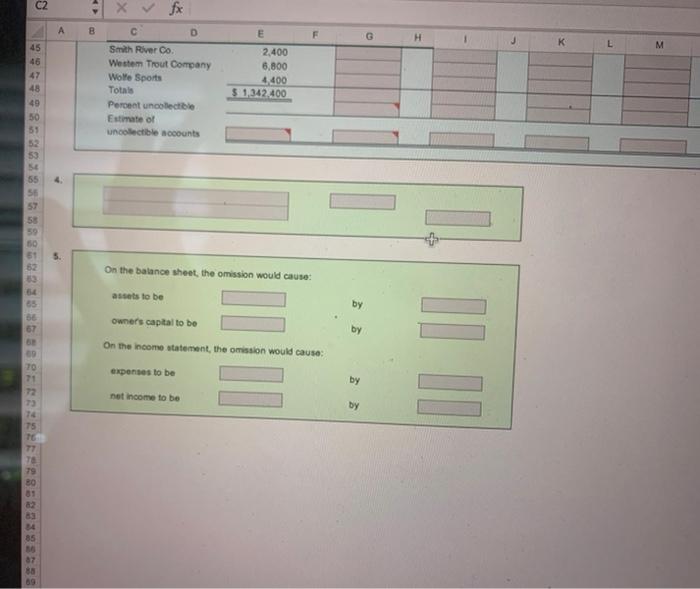

Chapter 9 Receivables 477 The following accounts were unintentionally omitted from the aging schedule: Customer Due Date Balance Adams Sports & Flies May 22, 2016 55,000 Blue Dun Flies Oct 10, 2016 4,900 Cicada Fish Co. Sept. 29, 2016 8,400 Deschutes Sports Oct. 20, 2016 7,000 Green River Sports Nov. 7, 2016 3,500 Smith River Co. Nov. 28, 2016 2,400 Western Trout Company Dec. 7, 2016 6,800 Wolfe Sports Jan. 20, 2017 4,400 Trophy Fish has a past history of uncollectible accounts by age category, as follows: Percent Age Class Uncollectible Not past due 196 1-30 days past due 2 31-60 days past due 10 61-90 days past due 30 91-120 days past due 40 Over 120 days past due 80 Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31, 20Y6. Journalize the adjusting entry for uncollectible accounts 5. Assuming that the adjusting entry in () was inadvertently omitted, how would the mirrinn affect the balance sheet and income statement? Over 120 days past due 80 Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31, 20Y6. Journalize the adjusting entry for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? 1. Year 4: Balance of allowance account, end of year, $15,050 PR 9-3A Compare two methods of accounting for uncollectible receivables OBJ. 3, 4, 5 Call Systems Company, a telephone service and supply company, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 1% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to know what the balance of Allowance for Doubtful Accounts would have been at the end of each year. The following data have been obtained from the accounts: Year of Origin of Accounts Receivable Written Off as Uncollectible Uncollectible Accounts Year Sales Written Off 1st 2nd 3rd 4th 1st $ 900,000 $ 4,500 $4,500 2nd 1,250,000 9,600 3,000 $6,600 3rd 1,500,000 12,800 1,000 3,700 $8,100 4th 2,200,000 16,550 1,500 4,300 $10,750 Instructions 1. Assemble the desired data, using the following column headings: Balance of year, PR 9-3A Compare two methods of accounting for uncollectible receivables OBJ. 3,4,5 Call Systems Company, a telephone service and supply company, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales volume and the amount of uncollectible accounts, the company is considering changing to the allowance method. Information is requested as to the effect that an annual provision of 1% of sales would have had on the amount of bad debt expense reported for each of the past four years. It is also considered desirable to know what the balance of Allowance for Doubtful Accounts would have been at the end of each year. The following data have been obtained from the accounts: Year of Origin of Accounts Receivable Written Off as Uncollectible Uncollectible Accounts Year Sales Written Off 1st 2nd 3rd 4th 1st $ 900,000 $ 4,500 $4,500 2nd 1,250,000 9,600 3,000 $6,600 3rd 1,500,000 12,800 1,000 3,700 $8,100 4th 2,200,000 16,550 1,500 4,300 $10,750 Instructions 1. Assemble the desired data, using the following column headings: Expense Actually Reported Bad Debt Expense Expense Increase (Decrease) Based on in Amount Estimate of Expense Balance of Allowance Account End of Year Year (Continued) Copyright 2018 Cangage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. WCN 02-200-203 C2 X & fx G H 9 A B D E F Ariswers are emnere e tens wat gray wackyTUUTUS 10 Cells with non-gray backgrounds are protected and cannot be edited. 11 An asterisk () will appear to the right of an incorrect entry. 12 Enter a zero in cells you would otherwise leave blank. 13 1. 14 15 16 Customer Number of Days Past Due Due Date 17 18 19 20 Adams Sports and Flies Blue Dun Files Cicada Fish Co. Deschutes Sports Green River Sports Smith River Co. Westem Trout Company Wolfe Sports 21 22 23 24 25 26 27 May 22, 20Y6 Oct 10, 2016 Sept. 29, 20Y6 Oct. 20, 20Y6 Nov. 7. 2016 Nov. 28, 20Y6 Dec. 7. 20Y6 Jan 20, 2017 + 28 2., 3. 29 Aging of Receivables December 31, 2 30 31 32 33 34 Customer Balance Not Past Due 1-30 AAA Mutfittom xv fx Formato Dar formato Estilo condicional como tal de celd 8 c D E N P B Deschutes Sports Green River Sports Smith River Co Westem Trout Company Wolfe Sport Oct 20, 2018 Nov. 7, 2018 Nov. 28, 2016 Dec. 7. 2018 Jan 20, 2017 Aging of Receivables Schedule December 31, 2016 Days Past Due Customer Balance Not Past Due 31.00 61.90 91 - 120 Over 120 $ AAA Outfitters Brown Trout Fy Shop 20,000 7.500 $ 20,000 $ 7,500 $750,000 4000 $ 290,000 $ 120,000 $ 40.000 5 20.000 $ 30.000 Zign Fish Adventures Subtotale Adam Sports and Flies Bu Dun Files Cicada Fish Co Deschtes Sports Green River Sports Smith River Co Westem Trout Company Wole Sports Totals Percent uncollectible Estimate of uncollectible accounts 4.000 $ 1,300,000 5,000 4,900 5.400 7,000 3,500 2.400 6.800 4.400 $ 1,342 400 On the balance sheet, the omission would cause C2 A B D F G H J L 45 46 E 2,400 6.800 4,400 $ 1,342 400 Smith River Co. Westem Trout Company Wole Sports Total Percent uncolectible Estimate of uncollectible counts 48 49 50 53 53 st 55 56 58 50 52 On the balance sheet, the omission would cause: 54 by assets to be owners capital to be On the income statement, the mission would cause: 67 by IN TO 70 71 expenses to be by net income to be 73 by 75 16 79 80 63 34 85 88