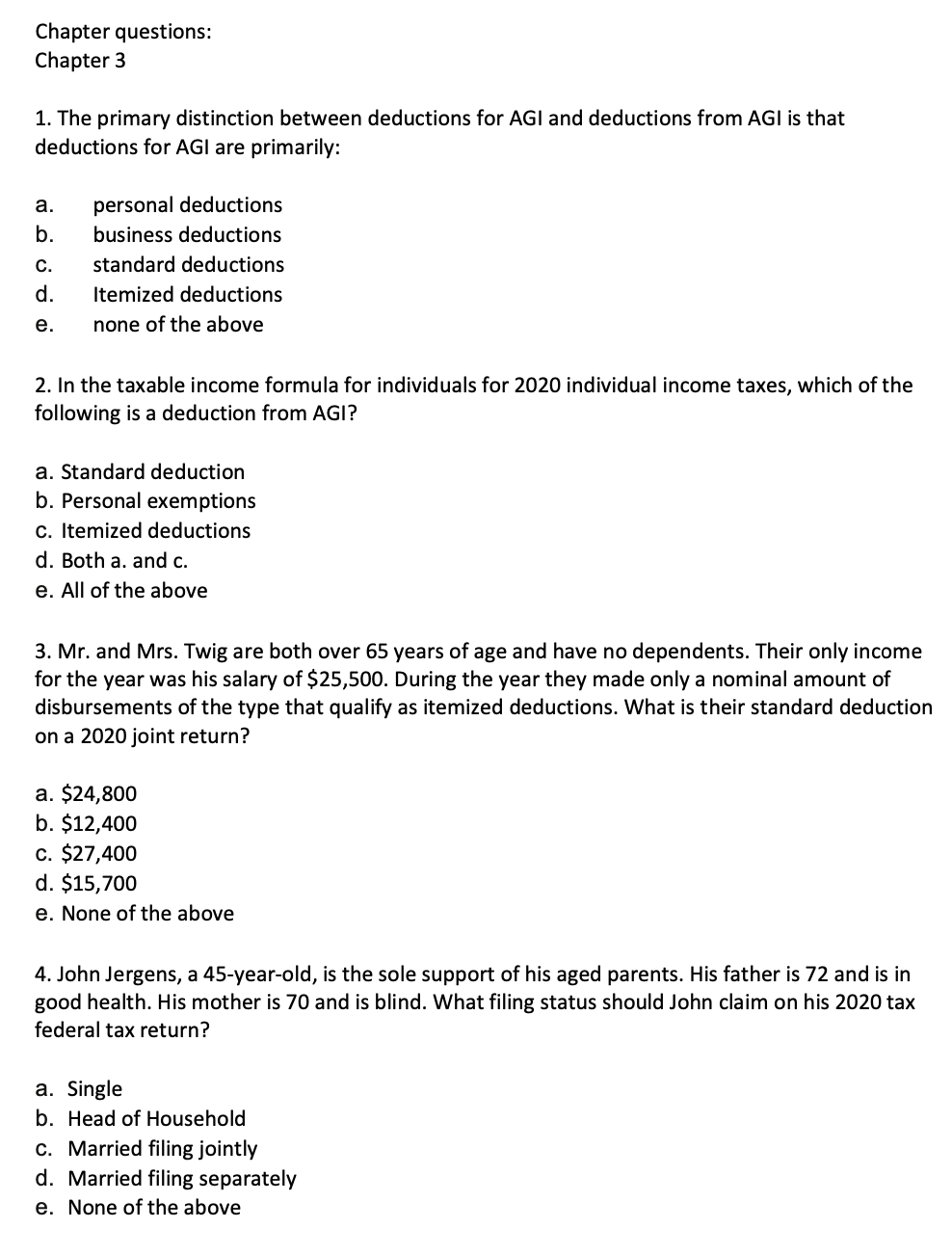

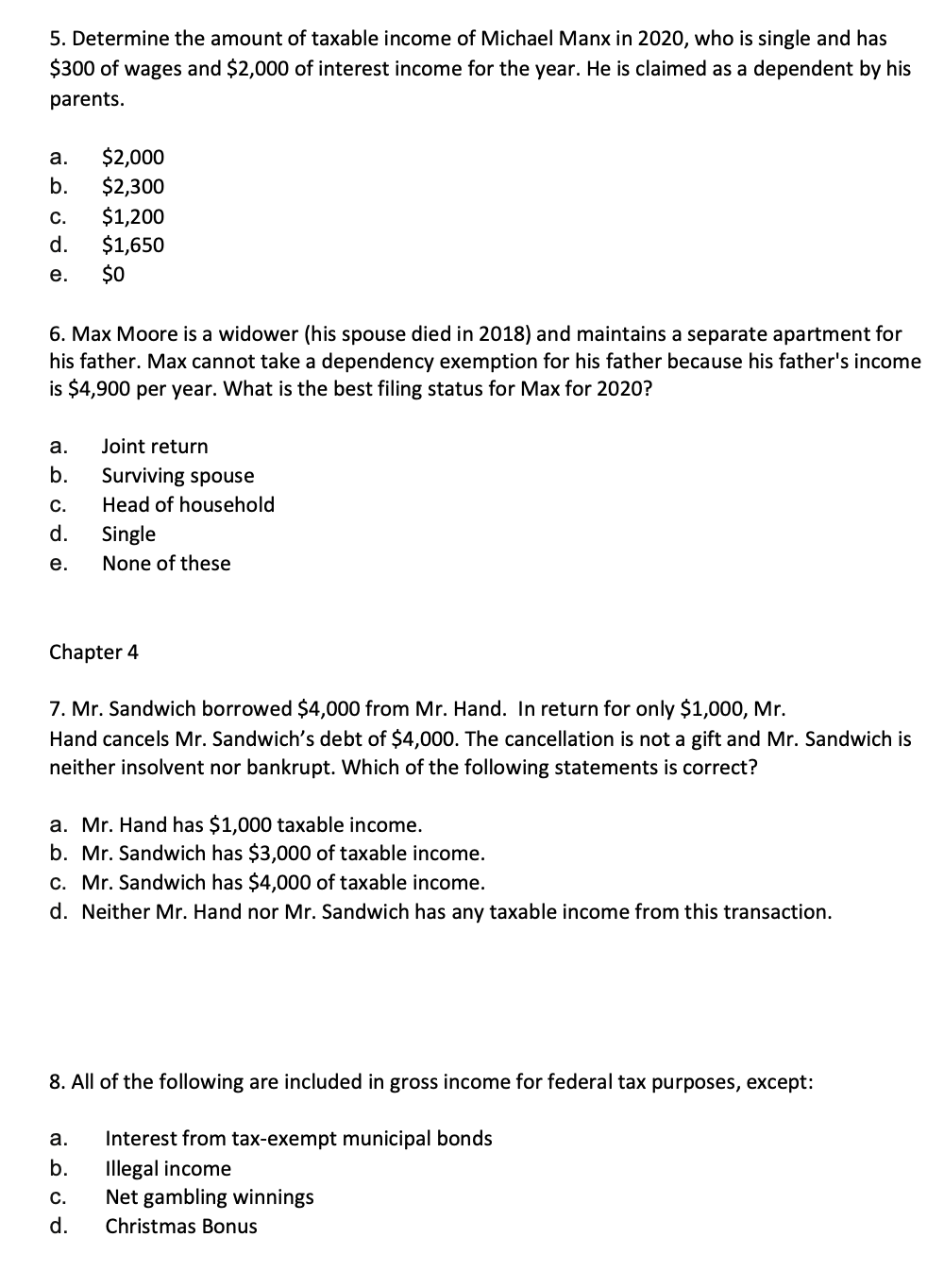

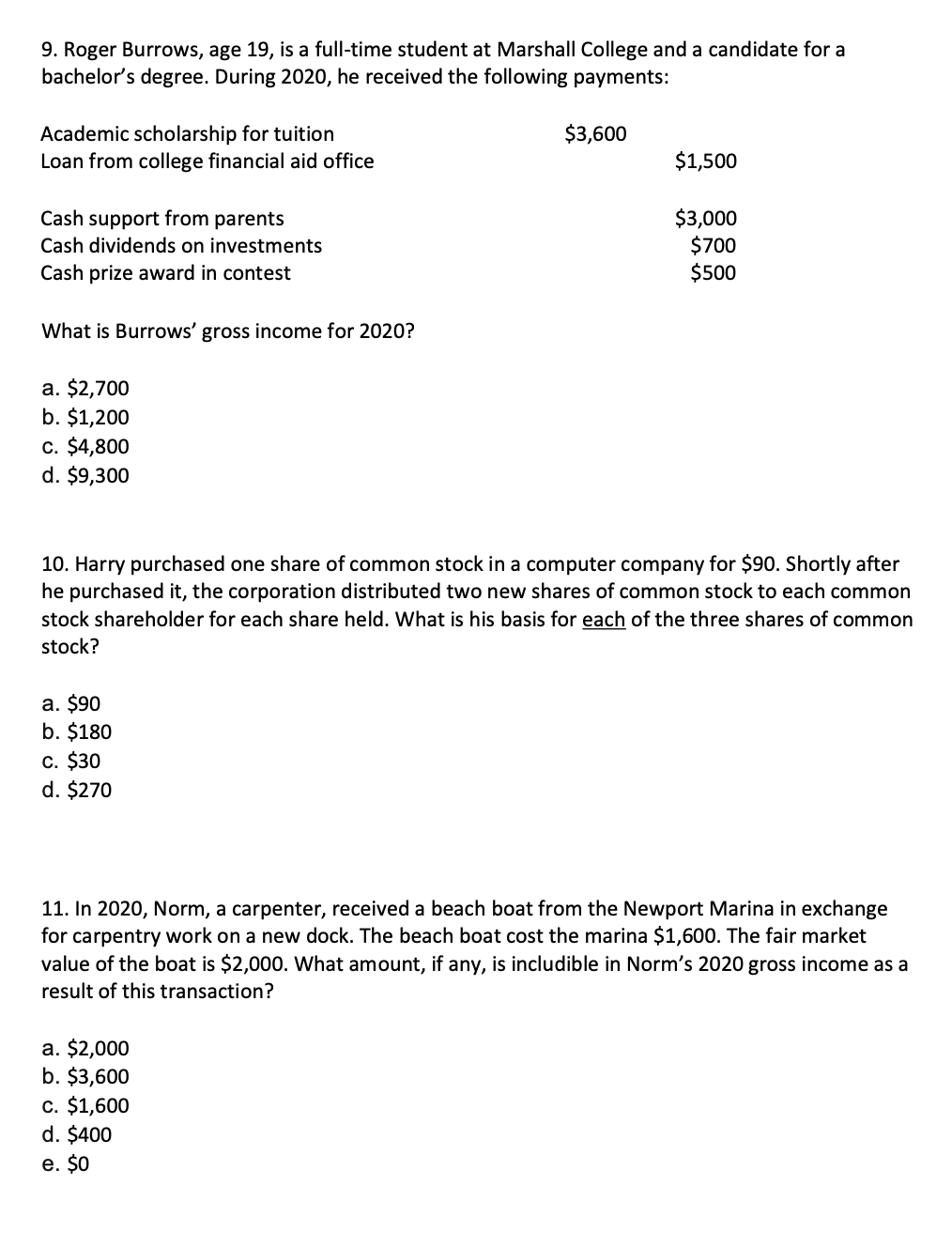

Chapter questions: Chapter 3 1. The primary distinction between deductions for AGI and deductions from AGI is that deductions for AGI are primarily: a. b. C. d. personal deductions business deductions standard deductions Itemized deductions none of the above e. 2. In the taxable income formula for individuals for 2020 individual income taxes, which of the following is a deduction from AGI? a. Standard deduction b. Personal exemptions c. Itemized deductions d. Both a. and c. e. All of the above 3. Mr. and Mrs. Twig are both over 65 years of age and have no dependents. Their only income for the year was his salary of $25,500. During the year they made only a nominal amount of disbursements of the type that qualify as itemized deductions. What is their standard deduction on a 2020 joint return? a. $24,800 b. $12,400 c. $27,400 d. $15,700 e. None of the above 4. John Jergens, a 45-year-old, is the sole support of his aged parents. His father is 72 and is in good health. His mother is 70 and is blind. What filing status should John claim on his 2020 tax federal tax return? a. Single b. Head of Household c. Married filing jointly d. Married filing separately e. None of the above 5. Determine the amount of taxable income of Michael Manx in 2020, who is single and has $300 of wages and $2,000 of interest income for the year. He is claimed as a dependent by his parents. a. b. $2,000 $2,300 $1,200 $1,650 $0 6. Max Moore is a widower (his spouse died in 2018) and maintains a separate apartment for his father. Max cannot take a dependency exemption for his father because his father's income is $4,900 per year. What is the best filing status for Max for 2020? a. b. C. d. Joint return Surviving spouse Head of household Single None of these e. Chapter 4 7. Mr. Sandwich borrowed $4,000 from Mr. Hand. In return for only $1,000, Mr. Hand cancels Mr. Sandwich's debt of $4,000. The cancellation is not a gift and Mr. Sandwich is neither insolvent nor bankrupt. Which of the following statements is correct? a. Mr. Hand has $1,000 taxable income. b. Mr. Sandwich has $3,000 of taxable income. c. Mr. Sandwich has $4,000 of taxable income. d. Neither Mr. Hand nor Mr. Sandwich has any taxable income from this transaction. 8. All of the following are included in gross income for federal tax purposes, except: a. b. Interest from tax-exempt municipal bonds Illegal income Net gambling winnings Christmas Bonus d. 9. Roger Burrows, age 19, is a full-time student at Marshall College and a candidate for a bachelor's degree. During 2020, he received the following payments: $3,600 Academic scholarship for tuition Loan from college financial aid office $1,500 Cash support from parents Cash dividends on investments Cash prize award in contest $3,000 $700 $500 What is Burrows' gross income for 2020? a. $2,700 b. $1,200 C. $4,800 d. $9,300 10. Harry purchased one share of common stock in a computer company for $90. Shortly after he purchased it, the corporation distributed two new shares of common stock to each common stock shareholder for each share held. What is his basis for each of the three shares of common stock? a. $90 b. $180 c. $30 d. $270 11. In 2020, Norm, a carpenter, received a beach boat from the Newport Marina in exchange for carpentry work on a new dock. The beach boat cost the marina $1,600. The fair market value of the boat is $2,000. What amount, if any, is includible in Norm's 2020 gross income as a result of this transaction? a. $2,000 b. $3,600 c. $1,600 d. $400 e. $0