Chapter: Specific Deductions

How can we solve the following MCQ

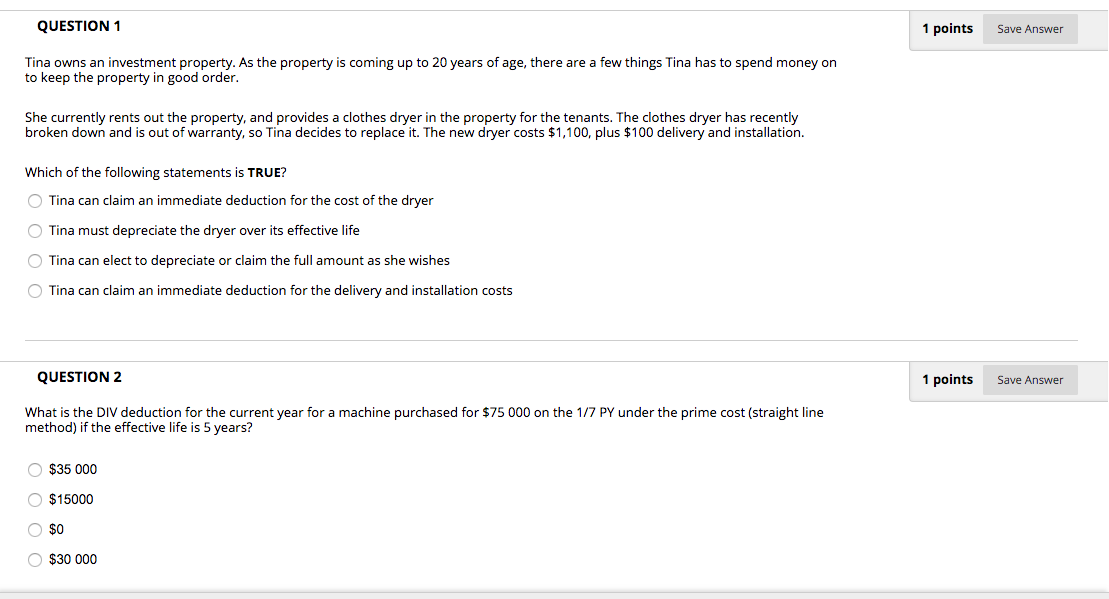

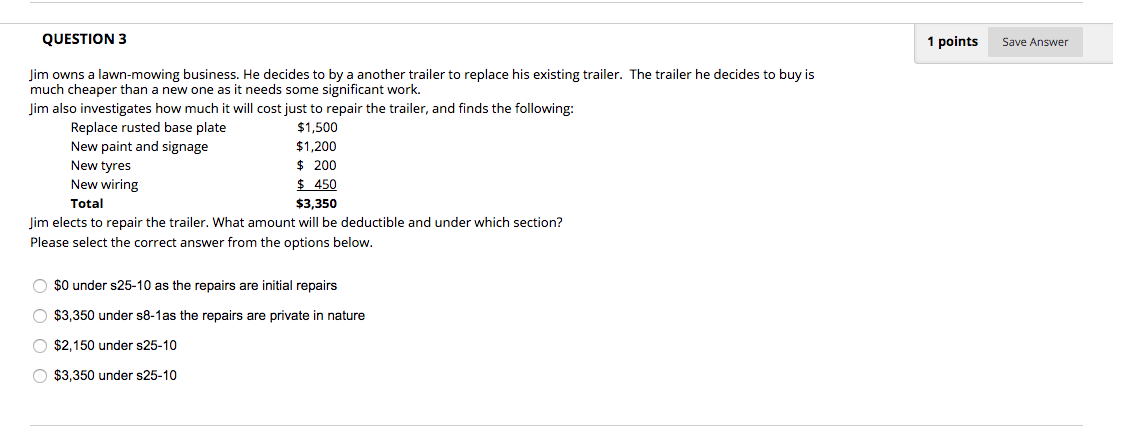

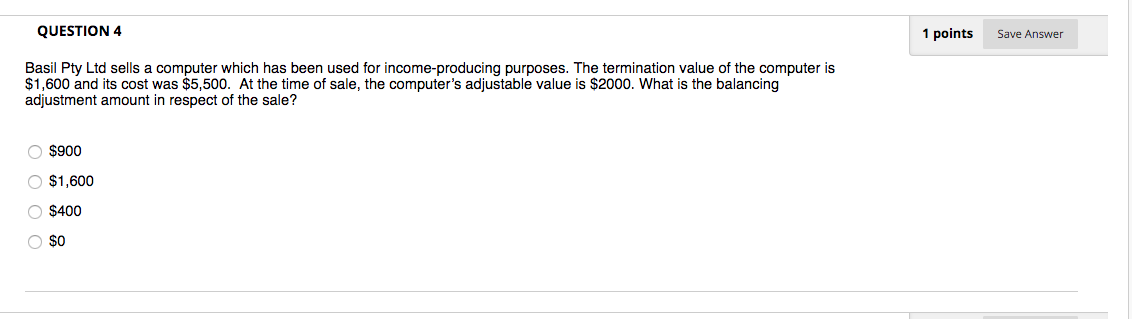

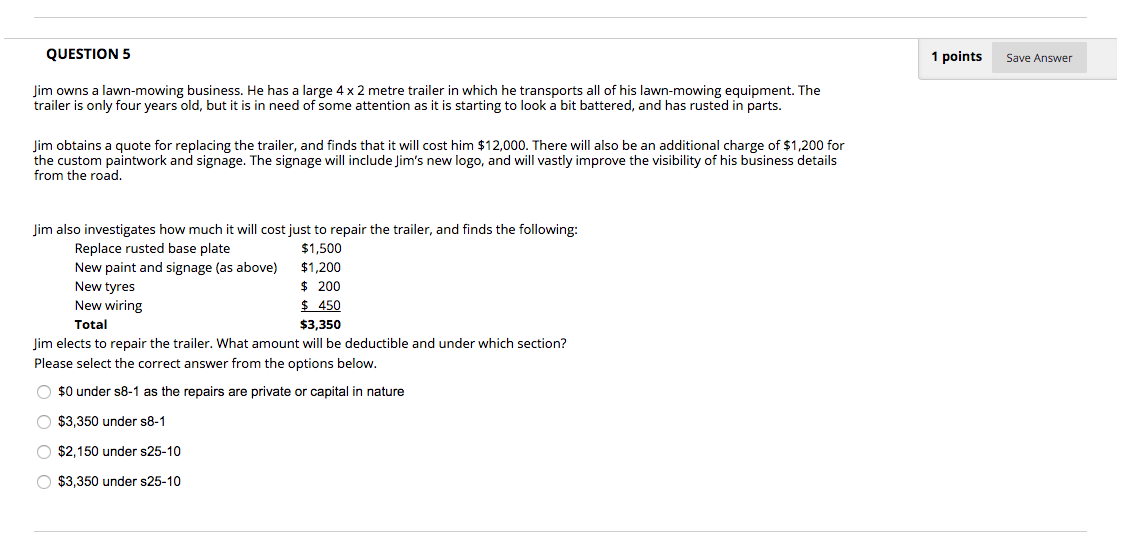

QUESTION 1 1 points Save Answer Tina owns an investment property. As the property is coming up to 20 years of age, there are a few things Tina has to spend money on to keep the property in good order. She currently rents out the property, and provides a clothes dryer in the property for the tenants. The clothes dryer has recently broken down and is out of warranty, so Tina decides to replace it. The new dryer costs $1,100, plus $100 delivery and installation. Which of the following statements is TRUE? O Tina can claim an immediate deduction for the cost of the dryer Tina must depreciate the dryer over its effective life O Tina can elect to depreciate or claim the full amount as she wishes O Tina can claim an immediate deduction for the delivery and installation costs QUESTION 2 1 points Save Answer What is the DIV deduction for the current year for a machine purchased for $75 000 on the 1/7 PY under the prime cost (straight line method) if the effective life is 5 years? O $35 000 $15000 $0 $30 000QUESTION 3 1 points Save Answer Jim owns a lawn-mowing business. He decides to by a another trailer to replace his existing trailer. The trailer he decides to buy is much cheaper than a new one as it needs some significant work. Jim also investigates how much it will cost just to repair the trailer, and finds the following: Replace rusted base plate $1,500 New paint and signage $1,200 New tyres $ 200 New wiring $ 450 Total $3,350 Jim elects to repair the trailer. What amount will be deductible and under which section? Please select the correct answer from the options below. $0 under s25-10 as the repairs are initial repairs $3,350 under s8-1as the repairs are private in nature $2,150 under s25-10 $3,350 under s25-10QUESTION 4 1 palms SaueAnswer Basil Pty Ltd sells a computer which has been used for income-producing purposes. The termination value of the computer is $1,800 and its cost was $5,500. At the time of sale. the computer's adjustable value is $2000. What is the balancing adjustment amount in respect of the sale? 0, $900 O $1.800 OM00 O$0 QUESTION 5 1 points Save Answer Jim owns a lawn-mowing business. He has a large 4 x 2 metre trailer in which he transports all of his lawn-mowing equipment. The trailer is only four years old, but it is in need of some attention as it is starting to look a bit battered, and has rusted in parts. Jim obtains a quote for replacing the trailer, and finds that it will cost him $12,000. There will also be an additional charge of $1,200 for the custom paintwork and signage. The signage will include Jim's new logo, and will vastly improve the visibility of his business details from the road. Jim also investigates how much it will cost just to repair the trailer, and finds the following: Replace rusted base plate $1,500 New paint and signage (as above) $1,200 New tyres $ 200 New wiring $ 450 Total $3,350 Jim elects to repair the trailer. What amount will be deductible and under which section? Please select the correct answer from the options below. $0 under s8-1 as the repairs are private or capital in nature $3,350 under s8-1 O $2,150 under s25-10 O $3,350 under s25-10