Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Characteristics of bonds To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's refers

Characteristics of bonds

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential.

For example:

A bond's

refers to its face value and the amount of money that the issuing entity borrows and promises to repay on the

maturity date.

A bond issuer is said to be in

If it does not pay the interest or the principal in accordance with the terms of the indenture

agreement or if it violates one or more of the issue's restrictive covenants.

A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called ;

A bond's

gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions.

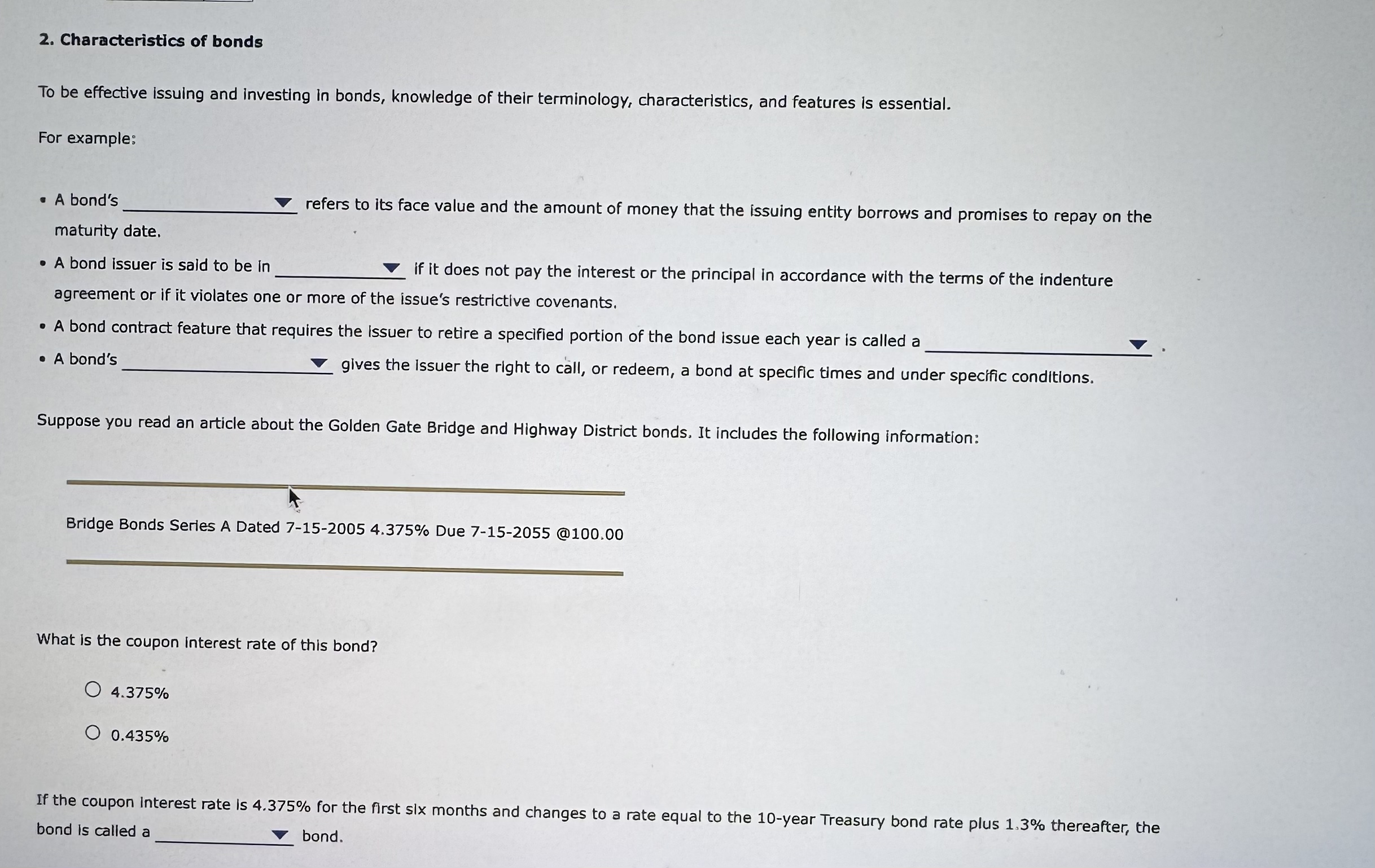

Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information:

Bridge Bonds Series A Dated Due @

What is the coupon interest rate of this bond?

If the coupon interest rate is for the first slx months and changes to a rate equal to the year Treasury bond rate plus thereafter, the

bond is called a

bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started