Question

Charles Allen, the accountant for Sue Bee Inc., was asked to make a presentation to the board of directors concerning the corporations year-end financial position.

Charles Allen, the accountant for Sue Bee Inc., was asked to make a presentation to the board of directors concerning the corporations year-end financial position. While flying to the meeting on Saturday morning, Allen checked the papers in his briefcase and realized he had left the revised income statement on his desk back at the office and did not have a copy in his e-mail. Because he knew there was no one at the office to send him the document, he examined the rest of the material in his briefcase to see what information was available. From memory, Allen recalled that net income after income taxes for the year was $410,000. From some notes he had made for the presentation, he knew that the corporations gross profit on sales was 40 percent and net income as a percentage of net sales was 10 percent. The income tax rate for the corporation is 25 percent. Allen also remembered that the selling and administrative expenses were the same amount. With this information, he was able to reconstruct the income statement for the corporation before the plane reached its destination.

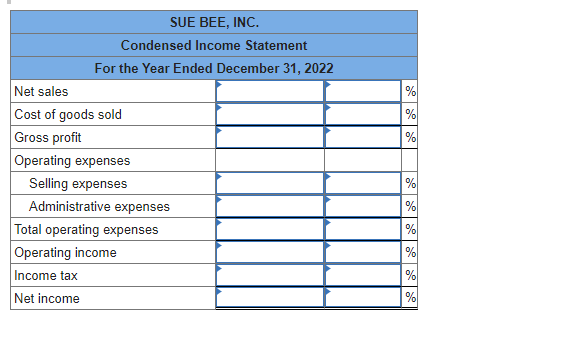

Required: Using the same information given above, prepare an income statement for Sue Bee Inc. for the current year. Starting with the net income figure, work to fill in the dollar amounts based on the percentage relationships given. (Round your dollar answers to the nearest dollars. Round your percentage answers to 1 decimal place. i.e., 0.123 should be entered as 12.3.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started