Answered step by step

Verified Expert Solution

Question

1 Approved Answer

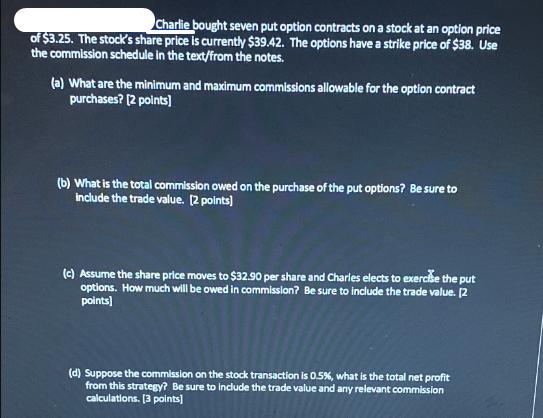

Charlie bought seven put option contracts on a stock at an option price of $3.25. The stock's share price is currently $39.42. The options

Charlie bought seven put option contracts on a stock at an option price of $3.25. The stock's share price is currently $39.42. The options have a strike price of $38. Use the commission schedule in the text/from the notes. (a) What are the minimum and maximum commissions allowable for the option contract purchases? [2 points] (b) What is the total commission owed on the purchase of the put options? Be sure to include the trade value. [2 points] (c) Assume the share price moves to $32.90 per share and Charles elects to exercise the put options. How much will be owed in commission? Be sure to include the trade value. [2 points] (d) Suppose the commission on the stock transaction is 0.5%, what is the total net profit from this strategy? Be sure to include the trade value and any relevant commission calculations. [3 points]

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The minimum commission allowable for the option contract purchases is 1050 and the maximum commiss...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started