Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charlie Corporation (the Company) prepares its financial statements in accordance with US GAAP and files its C Corporation income tax return on an accrual

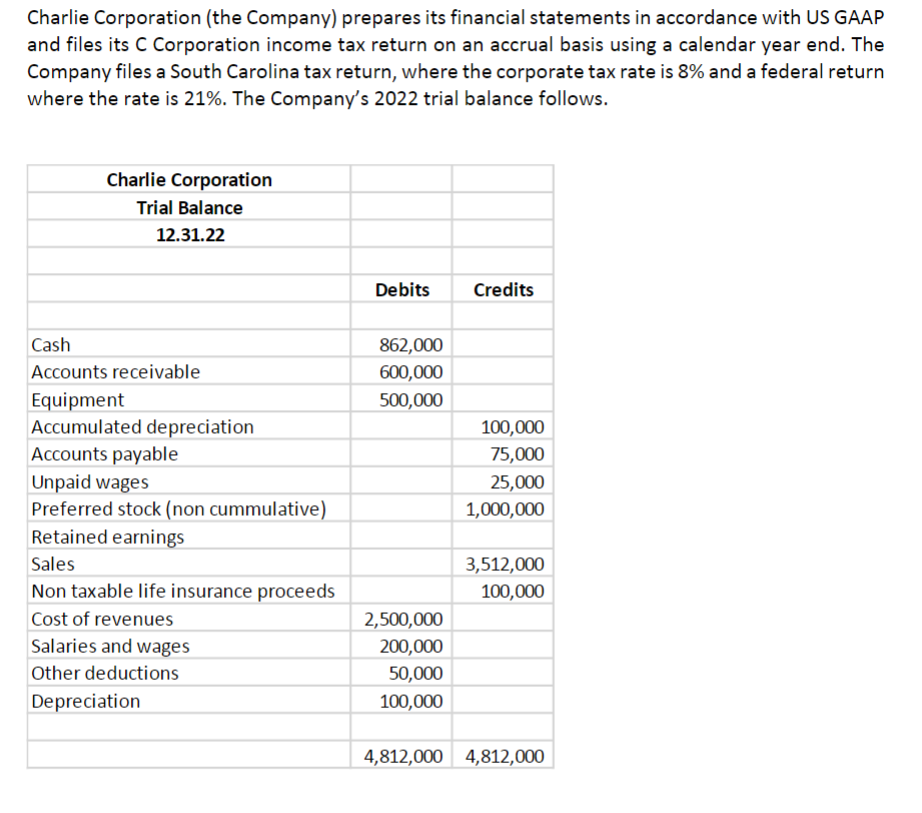

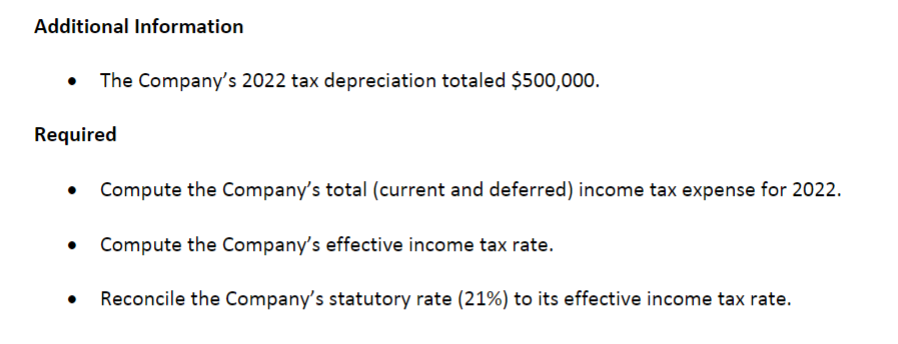

Charlie Corporation (the Company) prepares its financial statements in accordance with US GAAP and files its C Corporation income tax return on an accrual basis using a calendar year end. The Company files a South Carolina tax return, where the corporate tax rate is 8% and a federal return where the rate is 21%. The Company's 2022 trial balance follows. Charlie Corporation Trial Balance 12.31.22 Cash Accounts receivable Equipment Accumulated depreciation Accounts payable Unpaid wages Preferred stock (non cummulative) Retained earnings Sales Non taxable life insurance proceeds Cost of revenues Salaries and wages Other deductions Depreciation Debits Credits 862,000 600,000 500,000 100,000 75,000 25,000 1,000,000 3,512,000 100,000 2,500,000 200,000 50,000 100,000 4,812,000 4,812,000 Additional Information The Company's 2022 tax depreciation totaled $500,000. Required Compute the Company's total (current and deferred) income tax expense for 2022. Compute the Company's effective income tax rate. Reconcile the Company's statutory rate (21%) to its effective income tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started