Answered step by step

Verified Expert Solution

Question

1 Approved Answer

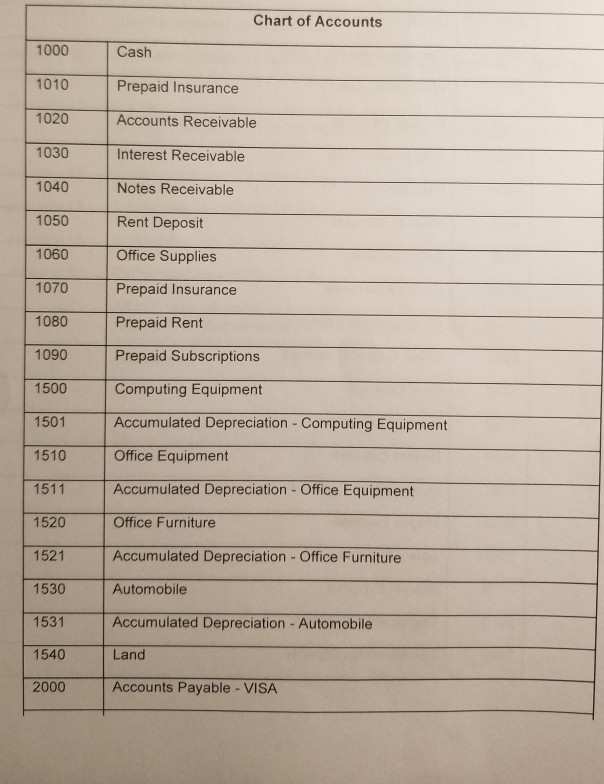

Chart of Accounts 1000 Cash 1010 Prepaid Insurance 1020 Accounts Receivable 1030 Interest Receivable 1040 Notes Receivable 1050 Rent Deposit Office Supplies 1060 1070 Prepaid

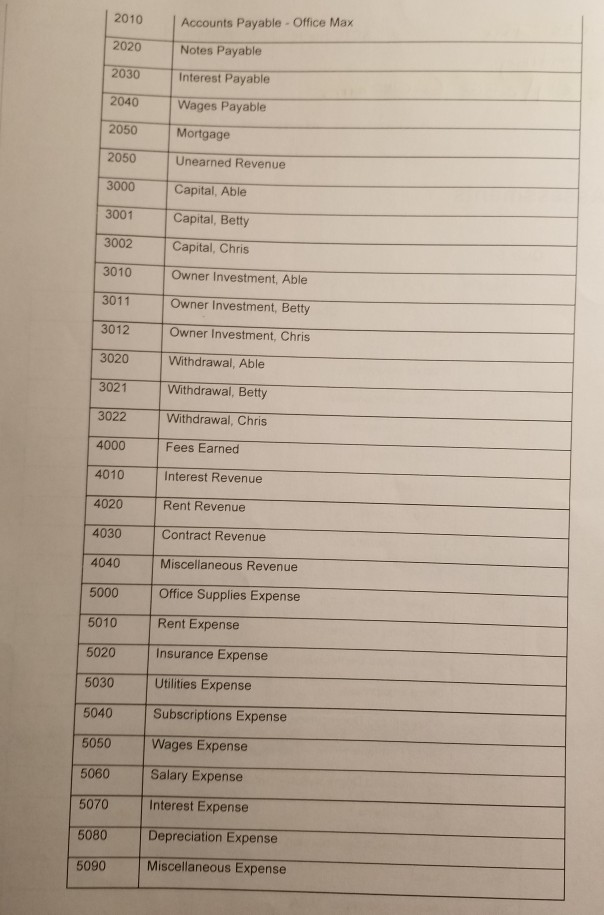

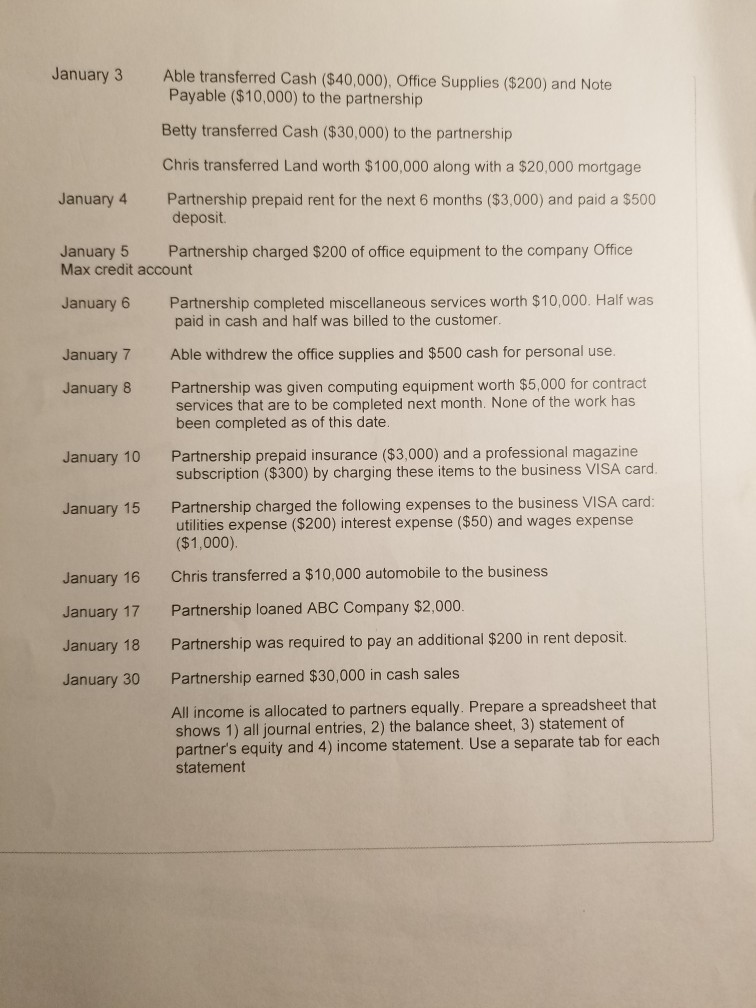

Chart of Accounts 1000 Cash 1010 Prepaid Insurance 1020 Accounts Receivable 1030 Interest Receivable 1040 Notes Receivable 1050 Rent Deposit Office Supplies 1060 1070 Prepaid Insurance 1080 Prepaid Rent 1090 Prepaid Subscriptions 1500 Computing Equipment Accumulated Depreciation Computing Equipment 1501 Office Equipment 1510 Accumulated Depreciation Office Equipment 1511 1520 Office Furniture Accumulated Depreciation Office Furniture 1521 1530 Automobile 1531 Accumulated Depreciation - Automobile 1540 Land 2000 Accounts Payable - VISA 2010 Accounts Payable - Office Max 2020 Notes Payable 2030 Interest Payable 2040 Wages Payable 2050 Mortgage 2050 Unearned Revenue 3000 Capital, Able Capital, Betty 3001 3002 Capital, Chris 3010 Owner Investment, Able Owner Investment, Betty 3011 3012 Owner Investment, Chris 3020 Withdrawal, Able Withdrawal, Betty 3021 Withdrawal, Chris 3022 4000 Fees Earned 4010 Interest Revenue 4020 Rent Revenue Contract Revenue 4030 Miscellaneous Revenue 4040 Office Supplies Expense 5000 Rent Expense 5010 5020 Insurance Expense Utilities Expense 5030 Subscriptions Expense 5040 Wages Expense 5050 Salary Expense 5060 Interest Expense 5070 Depreciation Expense 5080 Miscellaneous Expense 5090 January 3 Able transferred Cash ($40,000), Office Supplies ($200) and Note Payable ($10,000) to the partnership Betty transferred Cash ($30,000) to the partnership Chris transferred Land worth $100,000 along with a $20,000 mortgage January 4 Partnership prepaid rent for the next 6 months ($3,000) and paid a $500 deposit. January 5 Max credit account Partnership charged $200 of office equipment to the company Office Partnership completed miscellaneous services worth $10,000. Half was paid in cash and half was billed to the customer January 6 Able withdrew the office supplies and $500 cash for personal use. January 7 Partnership was given computing equipment worth $5,000 for contract services that are to be completed next month. None of the work has been completed as of this date. January 8 Partnership prepaid insurance ($3,000) and a professional magazine subscription ($300) by charging these items to the business VISA card. January 10 Partnership charged the following expenses to the business VISA card: utilities expense ($200) interest expense ($50) and wages expense ($1,000). January 15 Chris transferred a $10,000 automobile to the business January 16 Partnership loaned ABC Company $2,000. January 17 Partnership was required to pay an additional $200 in rent deposit. January 18 Partnership earned $30,000 in cash sales January 30 All income is allocated to partners equally. Prepare a spreadsheet that shows 1) all journal entries, 2) the balance sheet, 3) statement of partner's equity and 4) income statement. Use a separate tab for each statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started