Question

Charts avilable- Annual cash flow-( Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity

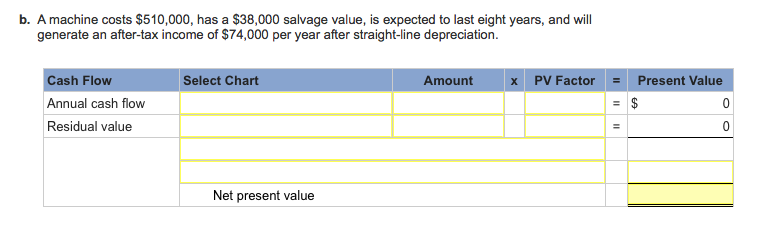

Charts avilable- Annual cash flow-( Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity of 1) Residual value-(Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity of 1) (Immediate cash outflows, Net present value, Present value of cash inflows)

Charts avilable- Annual cash flow-( Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity of 1) Residual value-(Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity of 1) (Immediate cash outflows, Net present value, Present value of cash inflows)

Charts avilable- Annual cash flow-( Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity of 1) Residual value-(Present value of 1, Future value of 1, Present value of an annuity of 1, Future value of an annuity of 1) ?(Immediate cash outflows, Net present value, Present value of cash inflows)

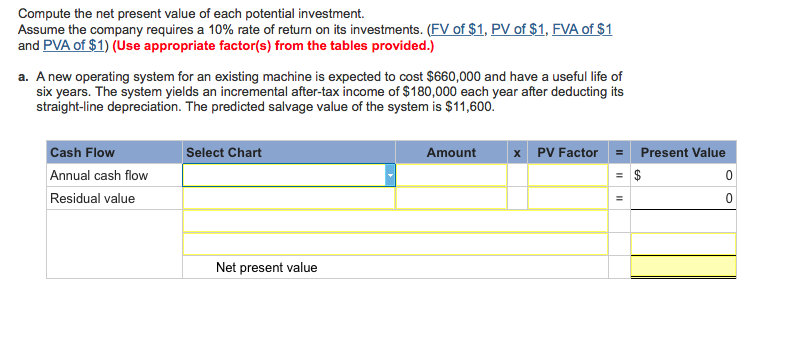

Compute the net present value of each potential investment Assume the company requires a 10% rate of return on its investments. (FV of $1, PV of $1, FVA of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) a. A new operating system for an existing machine is expected to cost $660,000 and have a useful life of six years. The system yields an incremental after-tax income of $180,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $11,600. X PV Factor Present Value Select Chart Cash Flow Amount Annual cash flow Residual value Net present valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started