Answered step by step

Verified Expert Solution

Question

1 Approved Answer

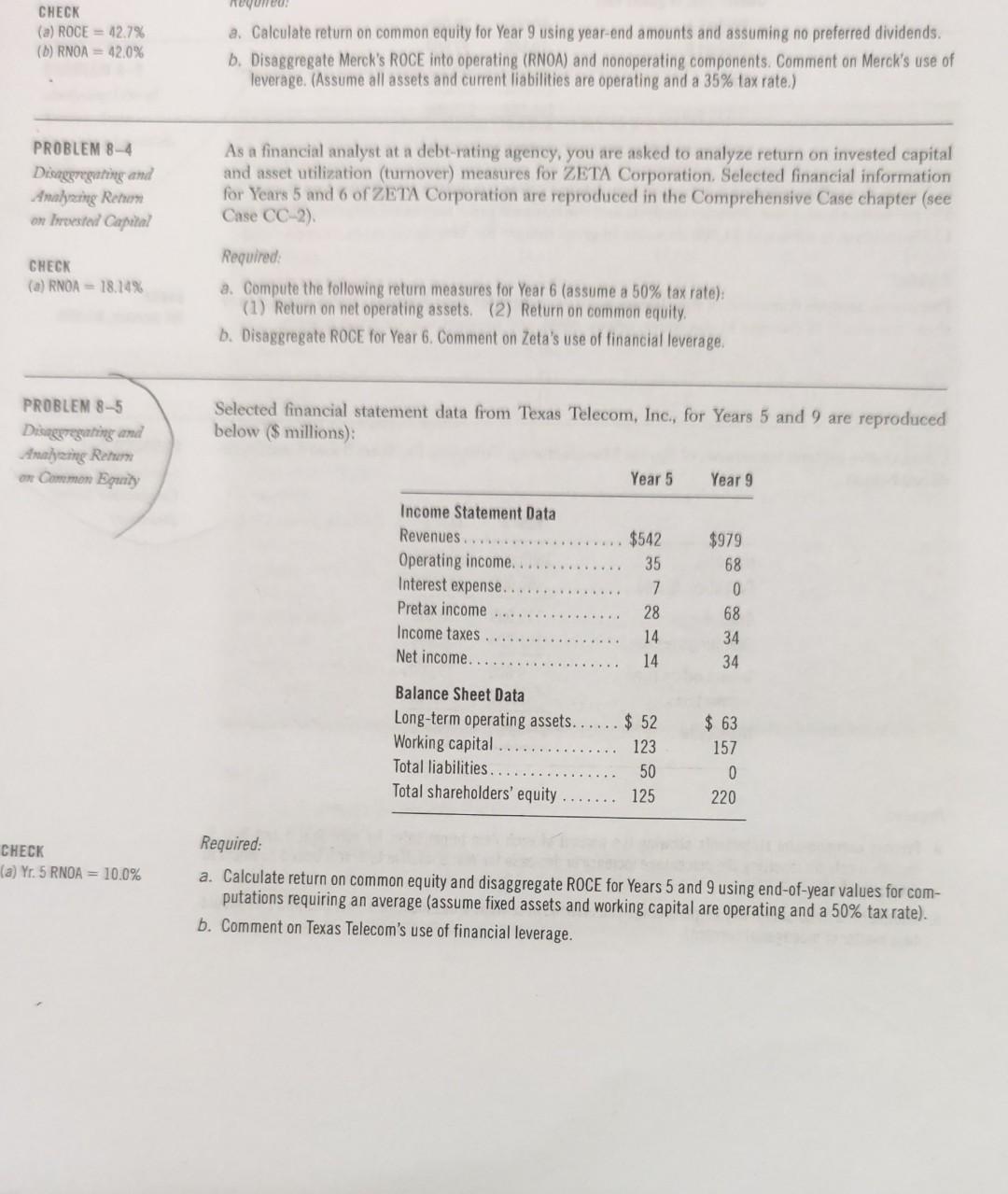

CHECK (a) ROCE=42.7% (b) RNOA=42.0% a. Calculate retum on common equity for Year 9 using year-end amounts and assuming no preferred dividends. b. Disaggregate Merck's

CHECK (a) ROCE=42.7% (b) RNOA=42.0% a. Calculate retum on common equity for Year 9 using year-end amounts and assuming no preferred dividends. b. Disaggregate Merck's ROCE into operating (RNOA) and nonoperating components. Comment on Merck's use of leverage. (Assume all assets and current liabilities are operating and a 35% tax rate.) PROBLEM 8-4 Disaggrergating and Analyaing Rehom on lroesided Caputal CHECK (a) RNOA=18.14% As a financial analyst at a debt-rating agency, you are asked to analyze return on invested capital and asset utilization (tumover) measures for ZETA Corporation. Selected financial information for Years 5 and 6 of ZETA Corporation are reproduced in the Comprehensive Case chapter (see Case (CC2) Required: a. Compute the following return measures for Year 6 (assume a 50% tax rate): (1) Return on net operating assets. (2) Return on common equity. b. Disaggregate ROCE for Year 6. Comment on Zeta's use of financial leverage. PROBLEN 85 Diviggrestathing and Atalyeing Retom on Common Bquily Selected financial statement data from Texas Telecom, Inc., for Years 5 and 9 are reproduced below ( $ millions): Required: CHECK a) Y r. 5 RNOA =10.0% a. Calculate return on common equity and disaggregate ROCE for Years 5 and 9 using end-of-year values for computations requiring an average (assume fixed assets and working capital are operating and a 50% tax rate). b. Comment on Texas Telecom's use of financial leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started