Answered step by step

Verified Expert Solution

Question

1 Approved Answer

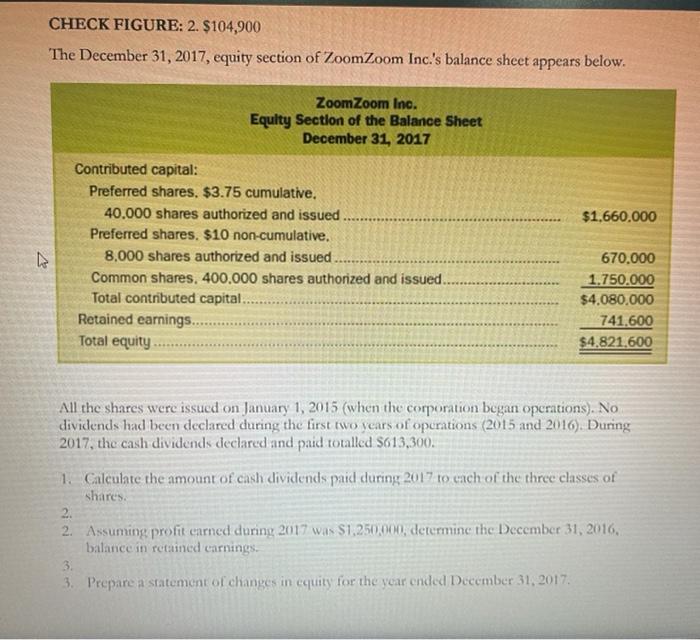

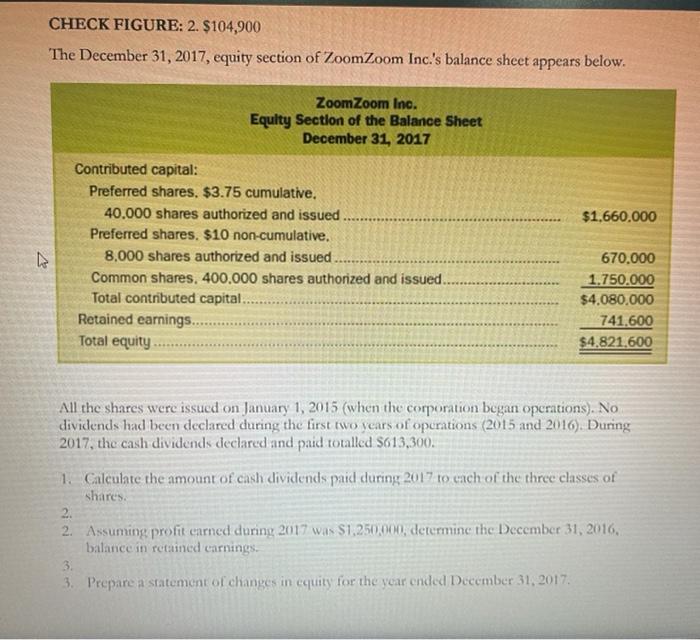

CHECK FIGURE: 2. $104,900 The December 31, 2017, equity section of Zoom Zoom Inc.'s balance sheet appears below. Zoom Zoom Inc. Equity Section of the

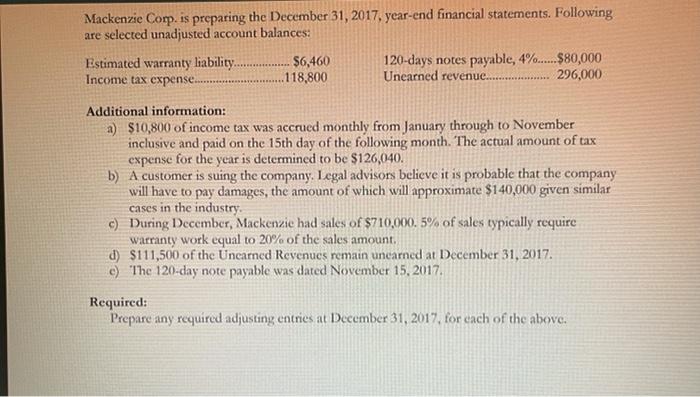

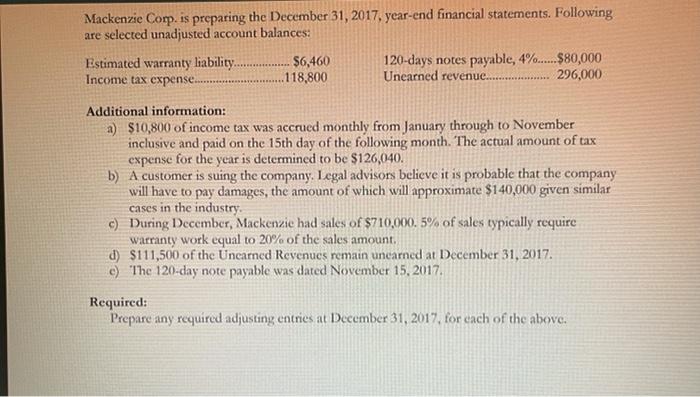

CHECK FIGURE: 2. $104,900 The December 31, 2017, equity section of Zoom Zoom Inc.'s balance sheet appears below. Zoom Zoom Inc. Equity Section of the Balance Sheet December 31, 2017 $1,660,000 V Contributed capital: Preferred shares. $3.75 cumulative. 40.000 shares authorized and issued Preferred shares. $10 non-cumulative. 8,000 shares authorized and issued Common shares, 400,000 shares authorized and issued. Total contributed capital.. Retained earnings... Total equity 670.000 1.750.000 $4.080.000 741.600 $4,821,600 All the shares were issued on January 1, 2015 (when the corporation began operations). No dividends had been declared during the first two years of operations (2015 and 2016). During 2017, the cash dividends declared and paid totalled S613,300. 1. Calculate the amount of cash dividends paid during 2017 to cach of the three classes of shares 2. 2. Assuming profit earned during 2017 was $1,250,000, determine the December 31, 2016. balance in retained carnings. 3 3. Prepare a statement of changes in equity for the year ended December 31, 2017 Mackenzie Corp. is preparing the December 31, 2017 year-end financial statements. Following are selected unadjusted account balances: Estimated warranty liability.. $6,460 120-days notes payable, 4%.....$80,000 Income tax expense. 118,800 Unearned revenue........ 296,000 Additional information: a) $10,800 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $126,040. b) A customer is suing the company. Legal advisors believe it is probable that the company will have to pay damages, the amount of which will approximate $140,000 given similar cases in the industry c) During December, Mackenzie had sales of $710,000. 5% of sales typically require warranty work equal to 20% of the sales amount d) $111,500 of the Unearned Revenues remain uncarned at December 31, 2017. e) The 120-day note payable was dated November 15, 2017. Required: Prepare any required adjusting entries at December 31, 2017, for each of the above

CHECK FIGURE: 2. $104,900 The December 31, 2017, equity section of Zoom Zoom Inc.'s balance sheet appears below. Zoom Zoom Inc. Equity Section of the Balance Sheet December 31, 2017 $1,660,000 V Contributed capital: Preferred shares. $3.75 cumulative. 40.000 shares authorized and issued Preferred shares. $10 non-cumulative. 8,000 shares authorized and issued Common shares, 400,000 shares authorized and issued. Total contributed capital.. Retained earnings... Total equity 670.000 1.750.000 $4.080.000 741.600 $4,821,600 All the shares were issued on January 1, 2015 (when the corporation began operations). No dividends had been declared during the first two years of operations (2015 and 2016). During 2017, the cash dividends declared and paid totalled S613,300. 1. Calculate the amount of cash dividends paid during 2017 to cach of the three classes of shares 2. 2. Assuming profit earned during 2017 was $1,250,000, determine the December 31, 2016. balance in retained carnings. 3 3. Prepare a statement of changes in equity for the year ended December 31, 2017 Mackenzie Corp. is preparing the December 31, 2017 year-end financial statements. Following are selected unadjusted account balances: Estimated warranty liability.. $6,460 120-days notes payable, 4%.....$80,000 Income tax expense. 118,800 Unearned revenue........ 296,000 Additional information: a) $10,800 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $126,040. b) A customer is suing the company. Legal advisors believe it is probable that the company will have to pay damages, the amount of which will approximate $140,000 given similar cases in the industry c) During December, Mackenzie had sales of $710,000. 5% of sales typically require warranty work equal to 20% of the sales amount d) $111,500 of the Unearned Revenues remain uncarned at December 31, 2017. e) The 120-day note payable was dated November 15, 2017. Required: Prepare any required adjusting entries at December 31, 2017, for each of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started