Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CHECK FIGURE I COG: $207,200 Swit Corny as ovarized on March of the current year. Alter tre rotisol sartup osy, regress expected T 2. profil

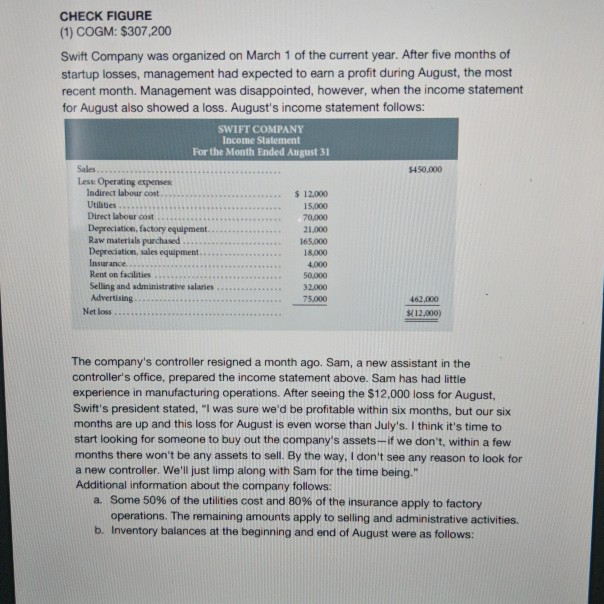

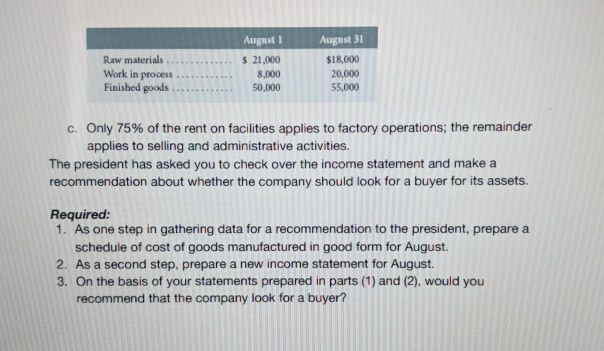

CHECK FIGURE I COG: $207,200 Swit Corny as ovarized on March of the current year. Alter tre rotisol sartup osy, regress expected T 2. profil duringAugus.. te moet recentiorili. Margerin. Aus dispovies, forever, uten trcorre statement ter August also somec aluss. Auguete incolle sement follows: SWIFT COMPANY In Sakinal Tell Mela Ladce Aul LO uda Darehe Duprecas y que... TWww Tlp www 13.000 70200 21.00 w TAS 4131 Tofa 72.00 462 12 The warperip's controler resigner 2. north ago Sair, a new startir the controlere uffice, prepsret rcorre uten above. Samtssted ittle superience in irar facturing operations. After seeing the $12000 oes for guet Swit's crecidert stated " was euro we'r be pruitbewone months, tutos sx merth are up and this oester Augustis er wore than July's. I think it e tire to sart lacking for voreo 19 to buy or the corporis sus-it we don't, wthr a few merthe there on: te any asyls to sl. Dy1119 zy, I der 't see any reason to lock for a certreler. Well Latime along with Sair for the time being dations information abou: the curpurry follows: a Sore 30% of the litere custard 80% of the insurance apply to factory overstore. The rearing arourts aputy to selling and administrare actrities 9. mentory arces at the begrning and end of August very 3 love: Awar Wuko Thaised $ 2.000 3.000 9.00 31 S16 21100 55.000 Coty 75% of the art or facilities speles to factay operation thermainder Aple to saling ang amativa viies. The president to you to artha namna stara nan And Me condation about whether the company should look for a brits Asorts. Required: 1 40 3. in gallering da lorerererek ono le preside echouls of cost of 2008 ranufactured in good lommor Auguel 2 As a second stars incorre eller for Luquel 3 One is oor sisterende progredir paris11 121. ade you r9 uredecorosy look lurs buyer? CHECK FIGURE (1) COGM: $307,200 Swift Company was organized on March 1 of the current year. After five months of startup losses, management had expected to earn a profit during August, the most recent month. Management was disappointed, however, when the income statement for August also showed a loss. August's income statement follows: SWIFT COMPANY Income Statement For the Month Ended August 31 Sales. $450.000 Less Operating expenses Indirect labour cost $ 12.000 Utilities 15.000 Direct labour cost 70,000 Depreciatice, factory equipment 21.000 Raw materials purchased 165.000 Depreciation, sales equipment 18.000 Insurance 4.000 Rent on facilities Selling and administrative salaries 32.000 Advertising 75.000 462,000 Net loss ${12,000) 50.000 The company's controller resigned a month ago. Sam, a new assistant in the controller's office, prepared the income statement above. Sam has had little experience in manufacturing operations. After seeing the $12,000 loss for August, Swift's president stated, "I was sure we'd be profitable within six months, but our six months are up and this loss for August is even worse than July's. I think it's time to start looking for someone to buy out the company's assets-if we don't, within a few months there won't be any assets to sell. By the way, I don't see any reason to look for a new controller. We'll just limp along with Sam for the time being." Additional information about the company follows: a. Some 50% of the utilities cost and 80% of the insurance apply to factory operations. The remaining amounts apply to selling and administrative activities. b. Inventory balances at the beginning and end of August were as follows: Raw materials Work in process Finished goods August 1 $ 21,000 8,000 50,000 August 31 $18,000 20,000 55,000 c. Only 75% of the rent on facilities applies to factory operations; the remainder applies to selling and administrative activities. The president has asked you to check over the income statement and make a recommendation about whether the company should look for a buyer for its assets. Required: 1. As one step in gathering data for a recommendation to the president, prepare a schedule of cost of goods manufactured in good form for August 2. As a second step, prepare a new income statement for August. 3. On the basis of your statements prepared in parts (1) and (2), would you recommend that the company look for a buyer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started