Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check figures- Sales revenue on the income statement of the worksheet is 922101 the difference between revenues and expenses on the worksheet were 845 merchandise

Check figures-

Sales revenue on the income statement of the worksheet is 922101

the difference between revenues and expenses on the worksheet were 845

merchandise inventory on the balance sheet is 101,350

Please submit all the worksheets, income statement, retained earnings, and balance sheet. Promised thumbs up if so. Don't submit an incomplete project.

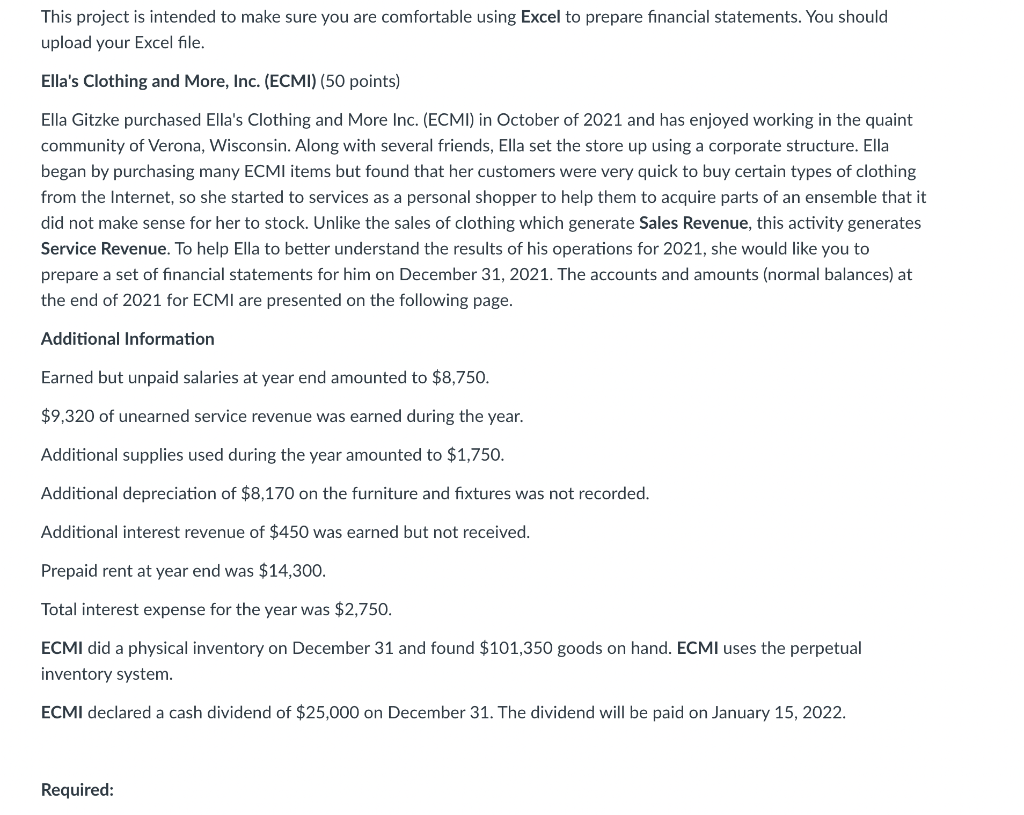

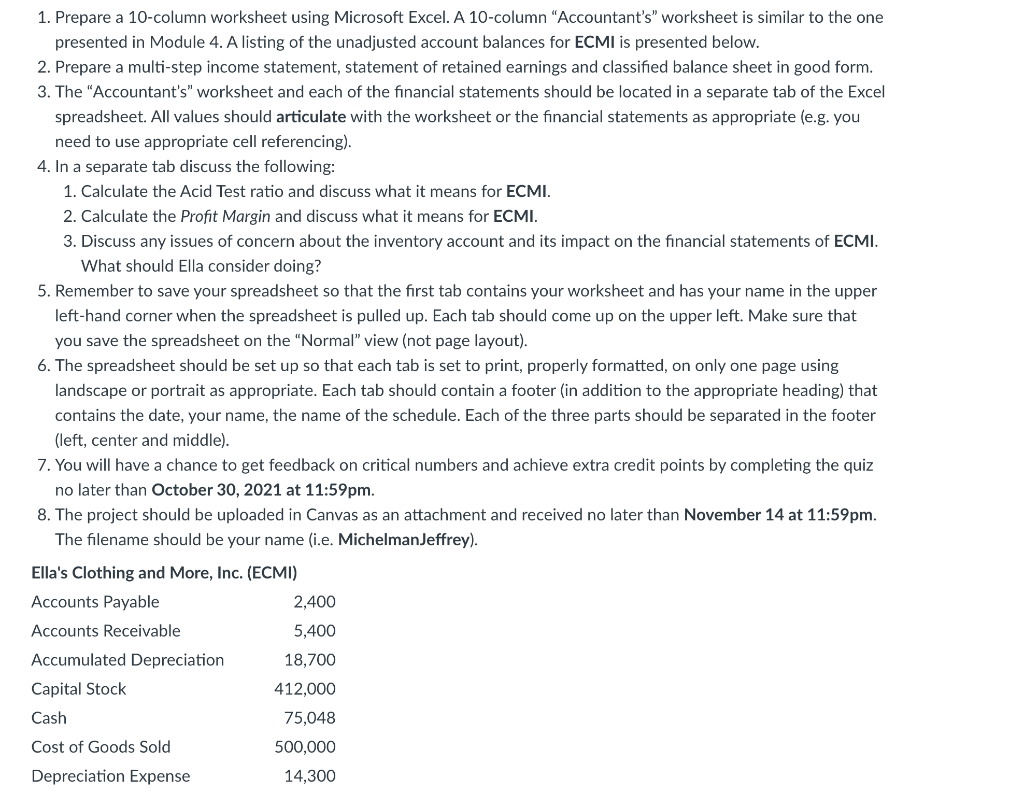

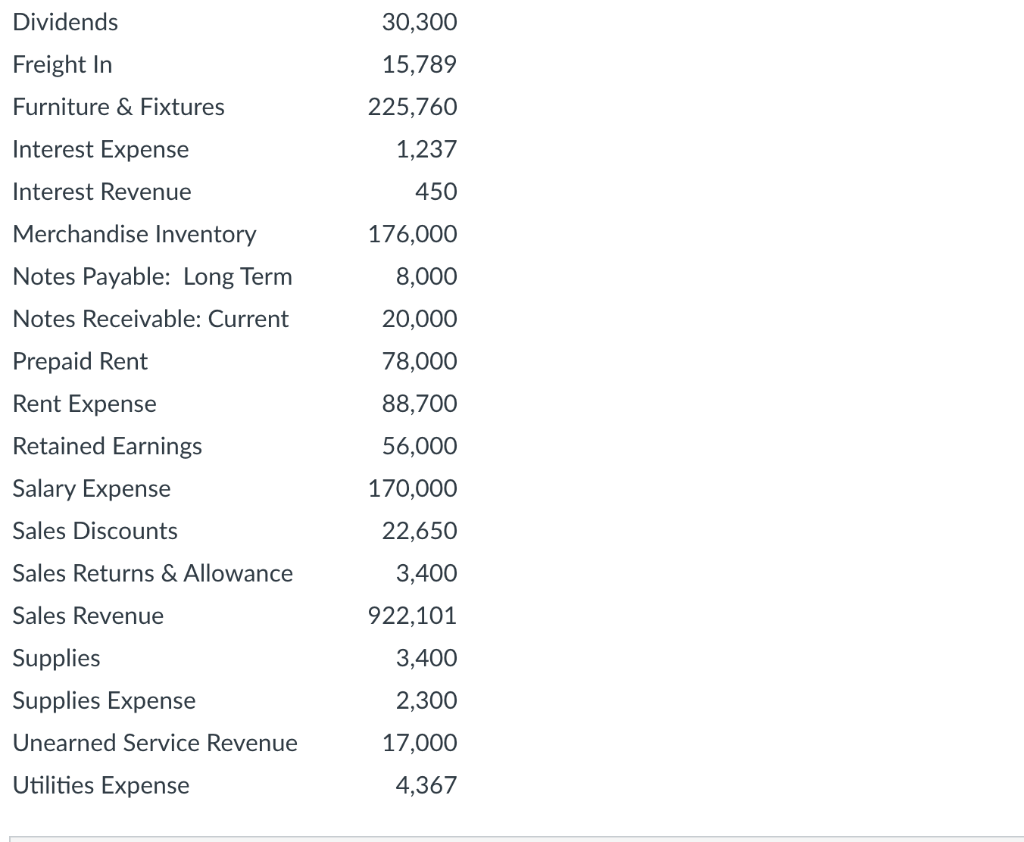

This project is intended to make sure you are comfortable using Excel to prepare financial statements. You should upload your Excel file. Ella's Clothing and More, Inc. (ECMI) (50 points) Ella Gitzke purchased Ella's Clothing and More Inc. (ECMI) in October of 2021 and has enjoyed working in the quaint community of Verona, Wisconsin. Along with several friends, Ella set the store up using a corporate structure. Ella began by purchasing many ECMI items but found that her customers were very quick to buy certain types of clothing from the Internet, so she started to services as a personal shopper to help them to acquire parts of an ensemble that it did not make sense for her to stock. Unlike the sales of clothing which generate Sales Revenue, this activity generates Service Revenue. To help Ella to better understand the results of his operations for 2021, she would like you to prepare a set of financial statements for him on December 31, 2021. The accounts and amounts (normal balances) at the end of 2021 for ECMI are presented on the following page. Additional Information Earned but unpaid salaries at year end amounted to $8,750. $9,320 of unearned service revenue was earned during the year. Additional supplies used during the year amounted to $1,750. Additional depreciation of $8,170 on the furniture and fixtures was not recorded. Additional interest revenue of $450 was earned but not received. Prepaid rent at year end was $14,300. Total interest expense for the year was $2,750. ECMI did a physical inventory on December 31 and found $101,350 goods on hand. ECMI uses the perpetual inventory system. ECMI declared a cash dividend of $25,000 on December 31. The dividend will be paid on January 15, 2022. Required: 1. Prepare a 10-column worksheet using Microsoft Excel. A 10-column "Accountant's" worksheet is similar to the one presented in Module 4. A listing of the unadjusted account balances for ECMI is presented below. 2. Prepare a multi-step income statement, statement of retained earnings and classified balance sheet in good form. 3. The "Accountant's" worksheet and each of the financial statements should be located in a separate tab of the Excel spreadsheet. All values should articulate with the worksheet or the financial statements as appropriate (e.g. you need to use appropriate cell referencing). 4. In a separate tab discuss the following: 1. Calculate the Acid Test ratio and discuss what it means for ECMI. 2. Calculate the Profit Margin and discuss what it means for ECMI. 3. Discuss any issues of concern about the inventory account and its impact on the financial statements of ECMI. What should Ella consider doing? 5. Remember to save your spreadsheet so that the first tab contains your worksheet and has your name in the upper left-hand corner when the spreadsheet is pulled up. Each tab should come up on the upper left. Make sure that you save the spreadsheet on the "Normal" view (not page layout). 6. The spreadsheet should be set up so that each tab is set to print, properly formatted, on only one page using landscape or portrait as appropriate. Each tab should contain a footer (in addition to the appropriate heading) that contains the date, your name, the name of the schedule. Each of the three parts should be separated in the footer (left, center and middle). 7. You will have a chance to get feedback on critical numbers and achieve extra credit points by completing the quiz no later than October 30, 2021 at 11:59pm. 8. The project should be uploaded in Canvas as an attachment and received no later than November 14 at 11:59pm. The filename should be your name (i.e. Michelman Jeffrey). Ella's Clothing and More, Inc. (ECMI) Accounts Payable 2,400 Accounts Receivable 5,400 Accumulated Depreciation 18,700 Capital Stock 412,000 Cash 75,048 500,000 Cost of Goods Sold Depreciation Expense 14,300 Dividends 30,300 Freight In 15,789 Furniture & Fixtures 225,760 Interest Expense 1,237 Interest Revenue 450 176,000 Merchandise Inventory Notes Payable: Long Term 8,000 Notes Receivable: Current 20,000 78,000 88,700 Prepaid Rent Rent Expense Retained Earnings Salary Expense 56,000 170,000 Sales Discounts 22,650 Sales Returns & Allowance 3,400 922,101 Sales Revenue 3,400 Supplies Supplies Expense Unearned Service Revenue 2,300 17,000 Utilities Expense 4,367Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started