Answered step by step

Verified Expert Solution

Question

1 Approved Answer

p9-1A please help with this as I am stuck X 135243633/cfi/6/396/4/2/26/4/2/2/12/2@0:0 & 2 A B D E F Age of Accounts Recelvable 1-30 31-60 61-90

p9-1A please help with this as I am stuck

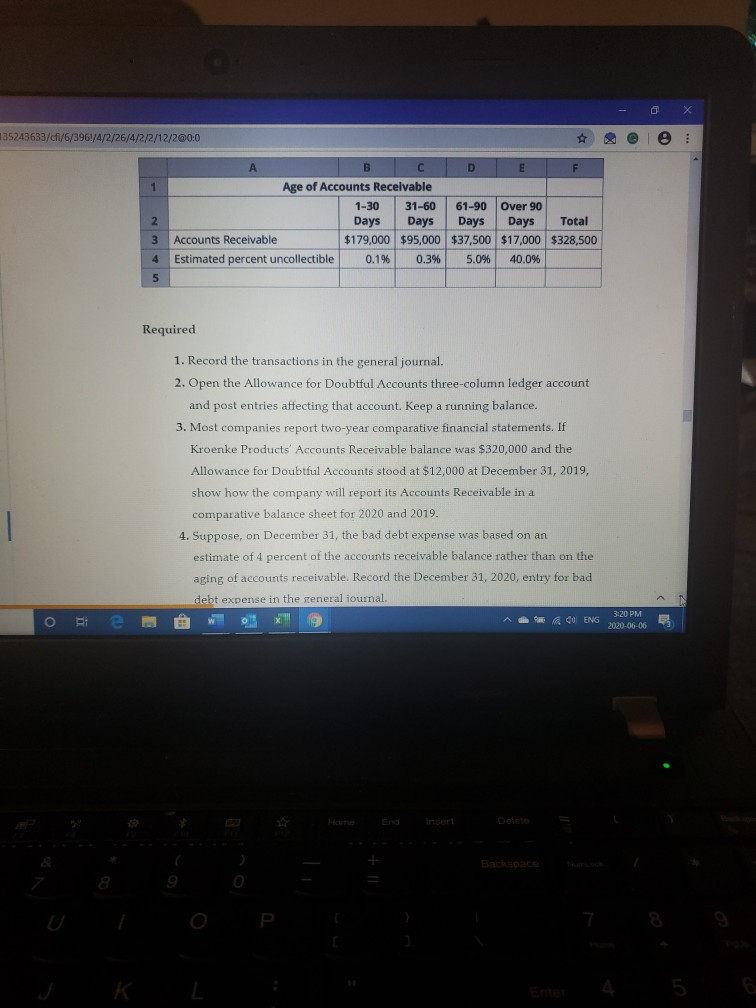

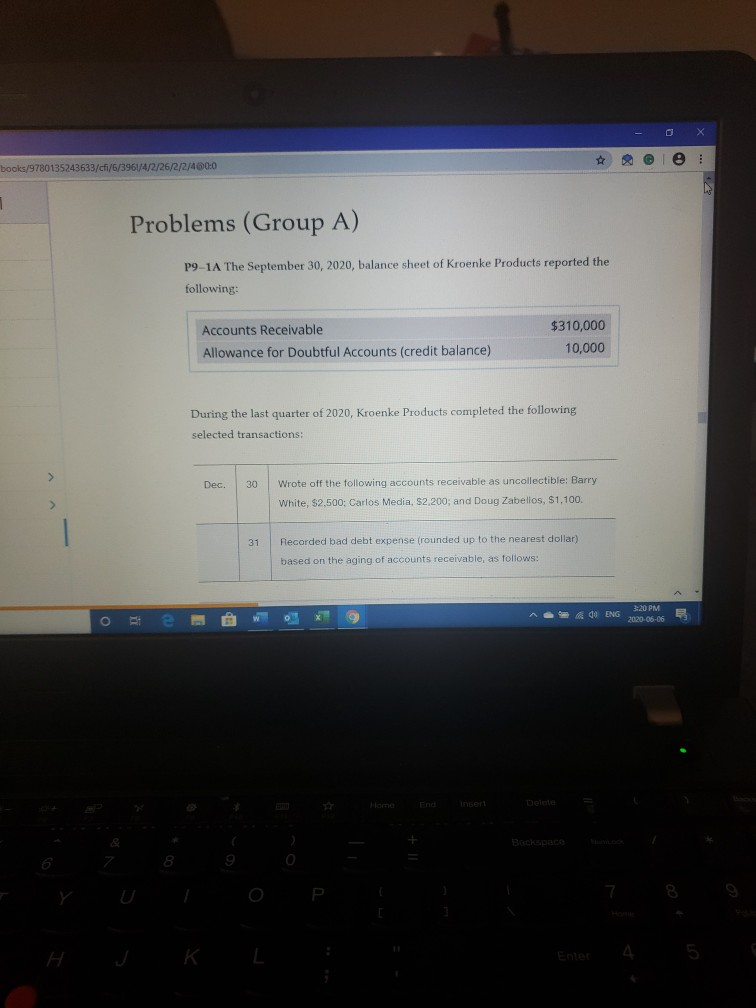

X 135243633/cfi/6/396/4/2/26/4/2/2/12/2@0:0 & 2 A B D E F Age of Accounts Recelvable 1-30 31-60 61-90 Over 90 Days Days Days Days Total Accounts Receivable $179,000 $95,000 $37,500 $17,000 $328,500 Estimated percent uncollectible 0.196 0.3% 5.0% 40.0% 3 4 5 Required 1. Record the transactions in the general journal. 2. Open the Allowance for Doubtful Accounts three-column ledger account and post entries affecting that account. Keep a running balance. 3. Most companies report two-year comparative financial statements. If Kroenke Products Accounts Receivable balance was $320,000 and the Allowance for Doubtful Accounts stood at $12,000 at December 31, 2019, show how the company will report its Accounts Receivable in a comparative balance sheet for 2020 and 2019. 4. Suppose, on December 31, the bad debt expense was based on an estimate of 4 percent of the accounts receivable balance rather than on the aging of accounts receivable. Record the December 31, 2020, entry for bad debt expense in the seneral iournal. o 40 ENG 3:20 PM 2020-06-06 Backspace P G e books/9780135243633/cfi/6/396/4/2/26/2/2/4 0:0 Problems (Group A) P9-1A The September 30, 2020, balance sheet of Kroenke Products reported the following Accounts Receivable Allowance for Doubtful Accounts (credit balance) $310,000 10,000 During the last quarter of 2020, Kroenke Products completed the following selected transactions: Dec. 30 Wrote off the following accounts receivable as uncollectible: Barry White, $2,500: Carlos Media, S2,200; and Doug Zabellos, $1,100. 31 Recorded bad debt expense (rounded up to the nearest dollar) based on the aging of accounts receivable, as follows: 3:20 PM 2020-06-06 O Amado ENG Enter 4 X 135243633/cfi/6/396/4/2/26/4/2/2/12/2@0:0 & 2 A B D E F Age of Accounts Recelvable 1-30 31-60 61-90 Over 90 Days Days Days Days Total Accounts Receivable $179,000 $95,000 $37,500 $17,000 $328,500 Estimated percent uncollectible 0.196 0.3% 5.0% 40.0% 3 4 5 Required 1. Record the transactions in the general journal. 2. Open the Allowance for Doubtful Accounts three-column ledger account and post entries affecting that account. Keep a running balance. 3. Most companies report two-year comparative financial statements. If Kroenke Products Accounts Receivable balance was $320,000 and the Allowance for Doubtful Accounts stood at $12,000 at December 31, 2019, show how the company will report its Accounts Receivable in a comparative balance sheet for 2020 and 2019. 4. Suppose, on December 31, the bad debt expense was based on an estimate of 4 percent of the accounts receivable balance rather than on the aging of accounts receivable. Record the December 31, 2020, entry for bad debt expense in the seneral iournal. o 40 ENG 3:20 PM 2020-06-06 Backspace P G e books/9780135243633/cfi/6/396/4/2/26/2/2/4 0:0 Problems (Group A) P9-1A The September 30, 2020, balance sheet of Kroenke Products reported the following Accounts Receivable Allowance for Doubtful Accounts (credit balance) $310,000 10,000 During the last quarter of 2020, Kroenke Products completed the following selected transactions: Dec. 30 Wrote off the following accounts receivable as uncollectible: Barry White, $2,500: Carlos Media, S2,200; and Doug Zabellos, $1,100. 31 Recorded bad debt expense (rounded up to the nearest dollar) based on the aging of accounts receivable, as follows: 3:20 PM 2020-06-06 O Amado ENG Enter 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started