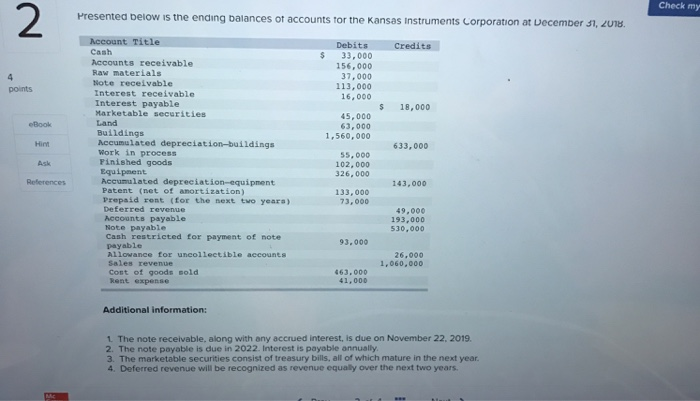

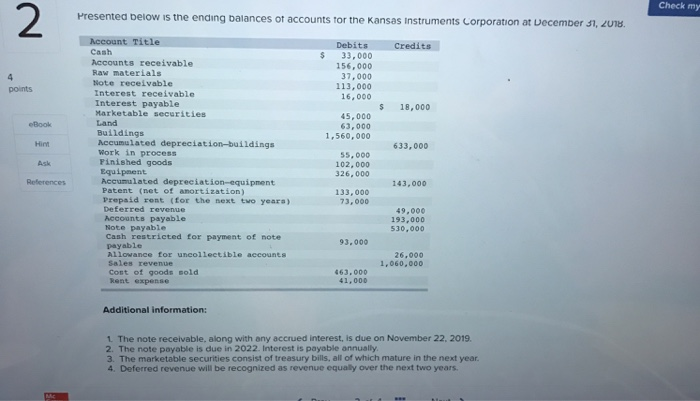

Check my 2 Presented below is the ending balances ot accounts or the Kansas instruments corporation at December 51, zUns. Account Title Debits Credits Cash Accounts receivable $ 33,000 156,000 37,000 113,000 16,000 Raw materials Note receivable Interest receivable Interest payable Marketable securities Land Buildings Accumulated depreciation-buildings Work in process Pinished goods points s 18,000 45,000 63,000 1,560,000 eBook Him 633,000 55, 000 102, 000 326, 000 Ask Equipment Accumulated depreciation-equipment Patent (net of anortization) Prepaid ront (for the next tvo yeara) Deferred revenue Accounts payable Note payable 143,000 133,000 73,000 9,000 193,000 530,000 Cash restricted for payment of note payable 93.000 Allowance for uncollectible accounts Sales revenue Cost of goods sold kent expense 26,000 1,060,000 63.000 Additional information: 1 The note receivable, along with any accrued interest, is due on November 22, 2019. 2. The note payable is due in 2022. Interest is payable annually 3. The marketable securities consist of treasury bills, all of which mature in the next year. 4. Deferred revenue will be recognized as revenue equally over the next two years Check my 2 Presented below is the ending balances ot accounts or the Kansas instruments corporation at December 51, zUns. Account Title Debits Credits Cash Accounts receivable $ 33,000 156,000 37,000 113,000 16,000 Raw materials Note receivable Interest receivable Interest payable Marketable securities Land Buildings Accumulated depreciation-buildings Work in process Pinished goods points s 18,000 45,000 63,000 1,560,000 eBook Him 633,000 55, 000 102, 000 326, 000 Ask Equipment Accumulated depreciation-equipment Patent (net of anortization) Prepaid ront (for the next tvo yeara) Deferred revenue Accounts payable Note payable 143,000 133,000 73,000 9,000 193,000 530,000 Cash restricted for payment of note payable 93.000 Allowance for uncollectible accounts Sales revenue Cost of goods sold kent expense 26,000 1,060,000 63.000 Additional information: 1 The note receivable, along with any accrued interest, is due on November 22, 2019. 2. The note payable is due in 2022. Interest is payable annually 3. The marketable securities consist of treasury bills, all of which mature in the next year. 4. Deferred revenue will be recognized as revenue equally over the next two years