Need G, H on the top. and F, G, H on the bottom and all of the correct decimals on 3,4,5,6.

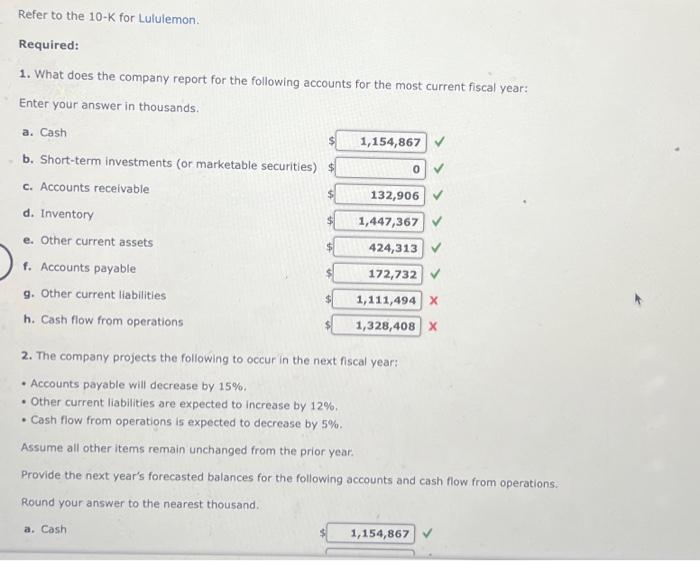

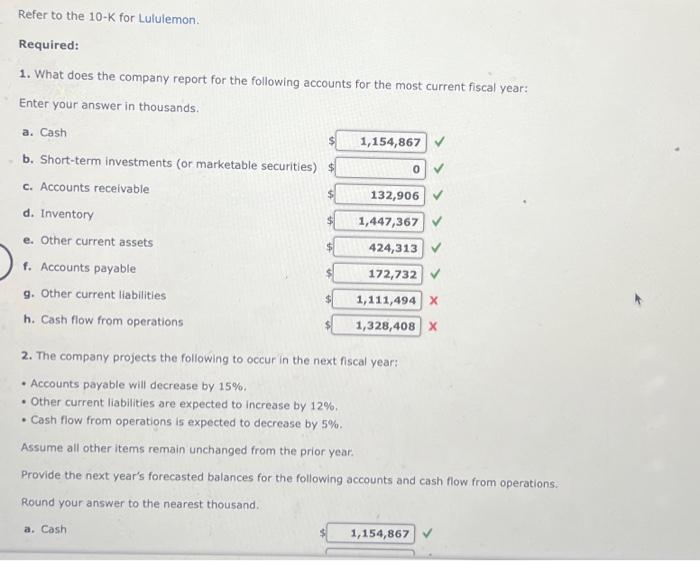

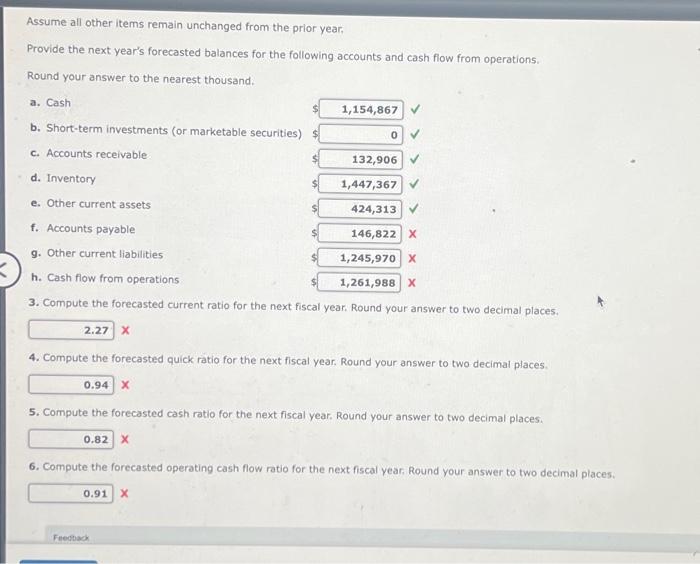

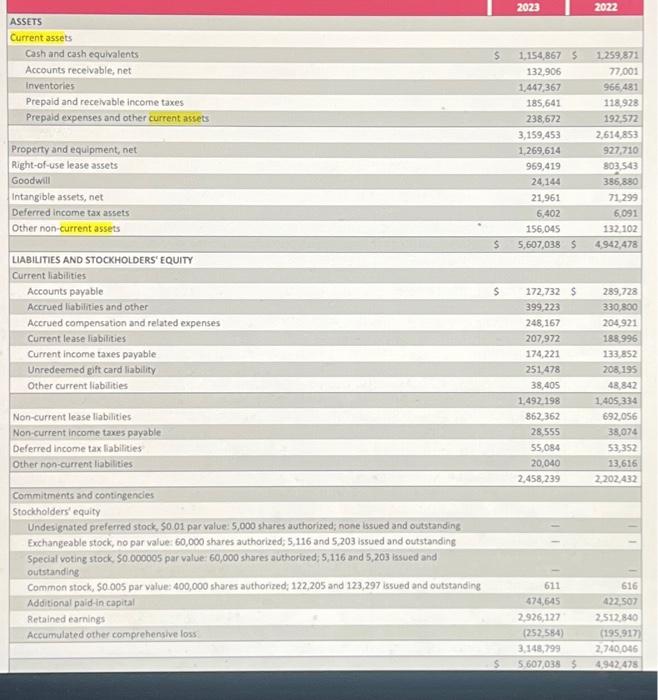

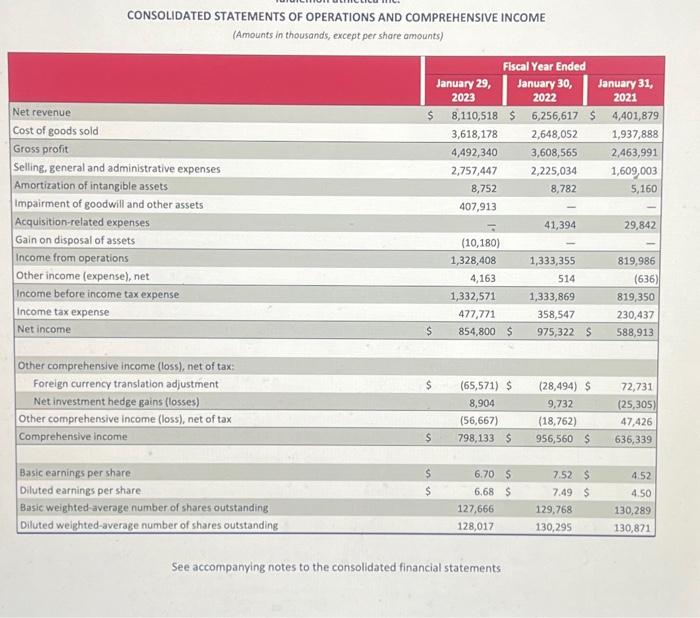

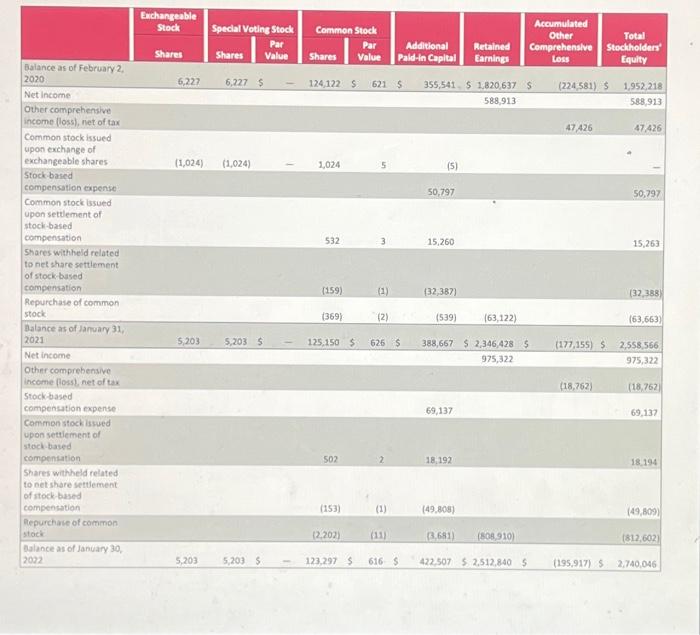

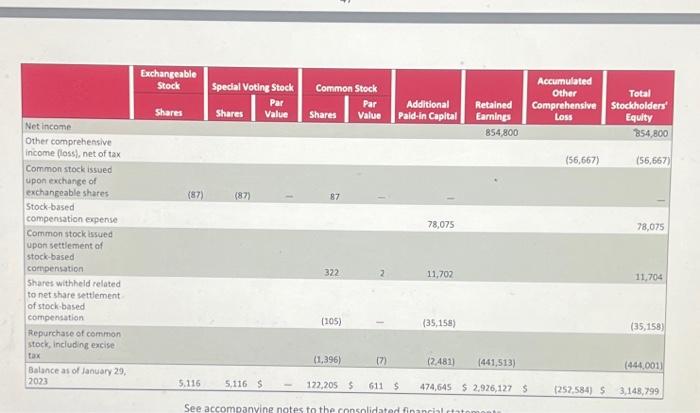

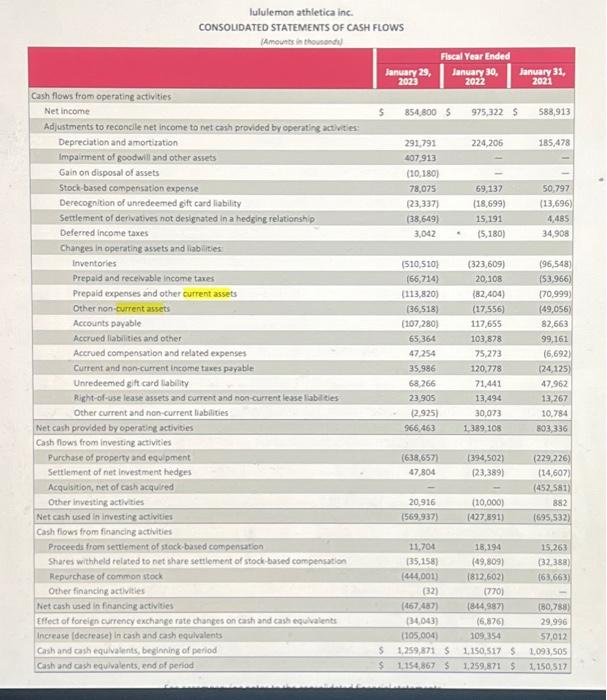

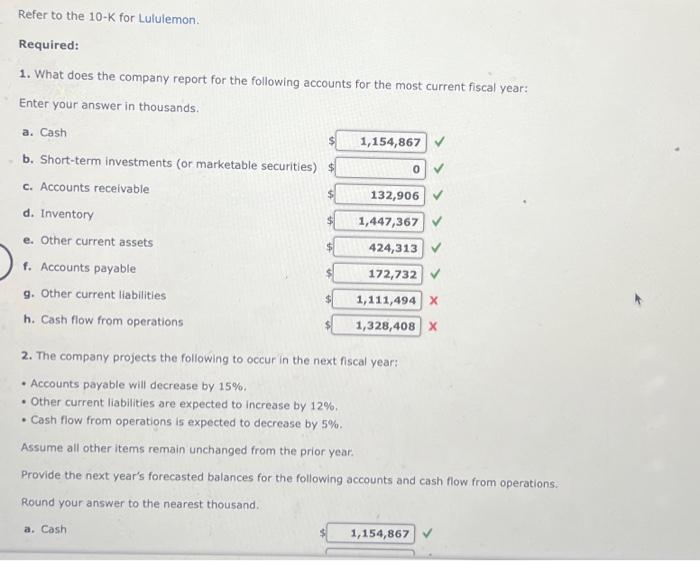

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & \begin{tabular}{c} Exchangeable \\ Stock \\ Shares \end{tabular} & \begin{tabular}{l} Spedal Vot \\ Shares \end{tabular} & \begin{tabular}{l} Int Stock \\ Par \\ Value \end{tabular} & \begin{tabular}{l} Commo \\ Shares \end{tabular} & \begin{tabular}{l} Stock \\ Par \\ Value \end{tabular} & \begin{tabular}{c} Additional \\ Pald-in Capital \end{tabular} & \begin{tabular}{l} Retained \\ Earnings \end{tabular} & \begin{tabular}{l} Accumulated \\ Other \\ Comprehensive \\ Loss \end{tabular} & \begin{tabular}{l} Total \\ Stockholders' \\ Equity \end{tabular} \\ \hline Net income & & & & & & & 854,800 & & 854,800 \\ \hline \begin{tabular}{l} Other comprehensive \\ income (loss), net of tax \end{tabular} & & & & & & & & (56,667) & (56,667) \\ \hline \begin{tabular}{l} Common stock issued \\ upon exchange of \\ exchangeable shates \end{tabular} & (87) & (87) & - & 87 & - & - & & & - \\ \hline \begin{tabular}{l} Stock-based \\ compenation expense \end{tabular} & & & & = & & 78,075 & & & 78,075 \\ \hline \begin{tabular}{l} Common stock issued \\ Upon settlement of \\ stock-based \\ compensation \end{tabular} & & & t. & 322 & 2 & 11,702 & & & 11,704 \\ \hline \begin{tabular}{l} Shares withheld related \\ to net share settlement \\ of stock-based \\ compensation \end{tabular} & & 2 & = & (105) & - & (35,158) & + & & (35,158) \\ \hline \begin{tabular}{l} Repurchase of common \\ stock, including excise \\ tax \end{tabular} & & & & (1,396) & (7) & (2.481) & (441,513) & & (444,001) \\ \hline \begin{tabular}{l} Balance as of January 29 . \\ 2023 \end{tabular} & 5,116 & 5,116 & - & 122,205 & 611 & 474,645 & $2,926,127 & (25,584) & 3,148,799 \\ \hline \end{tabular} Iululemon athletica inc. CONSOUDATFD STATFMFNTS OF CASH FIOWS Assume all other items remain unchanged from the prior year, Provide the next year's forecasted balances for the following accounts and cash flow from operations. Round your answer to the nearest thousand. 3. Compute the forecasted current ratio for the next fiscal year. Round your answer to two decimal places. 4. Compute the forecasted quick ratio for the next fiscal year. Round your answer to two decimal places. x 5. Compute the forecasted cash ratio for the next fiscal year. Round your answer to two decimal places. x 6. Compute the forecasted operating cash flow ratio for the next fiscal year. Round your answer to two decimal places. Refer to the 10K for Lululemon. Required: 1. What does the company report for the following accounts for the most current fiscal year: Enter your answer in thousands. 2. The company projects the following to occur in the next fiscal year: - Accounts payable will decrease by 15%. - Other current liabilities are expected to increase by 12%. - Cash fiow from operations is expected to decrease by 5%. Assume all other items remain unchanged from the prior year. Provide the next year's forecasted balances for the following accounts and cash flow from operations. Round your answer to the nearest thousand. a. Cash CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Amounts in thousands, except per shore amounts) \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{6}{|c|}{ Fiscal Year Ended } \\ \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} 2023J \\ 29, \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} January 30 \\ 2022 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} January 31; \\ 2021 \end{tabular}} \\ \hline Net revenue & $ & 8,110,518 & $ & 6,256,617 & $ & 4,401,879 \\ \hline Cost of goods sold & & 3,618,178 & & 2,648,052 & & 1,937,888 \\ \hline Gross profit & & 4,492,340 & & 3,608,565 & & 2,463,991 \\ \hline Selling, general and administrative expenses & & 2,757,447 & & 2,225,034 & & 1,609,003 \\ \hline Amortization of intangible assets & & 8,752 & & 8,782 & & 5,160 \\ \hline Impairment of goodwill and other assets & & 407,913 & & - & & - \\ \hline Acquisition-related expenses & & - & & 41,394 & & 29,842 \\ \hline Gain on disposal of assets & & (10,180) & & - & & - \\ \hline Income from operations & & 1,328,408 & & 1,333,355 & & 819,986 \\ \hline Other income (expense), net & & 4,163 & & 514 & & (636) \\ \hline Income before income tax expense & & 1,332,571 & & 1,333,869 & & 819,350 \\ \hline Income tax expense & & 477,771 & & 358,547 & & 230,437 \\ \hline Net income & $ & 854,800 & $ & 975,322 & s & 588,913 \\ \hline & x & & & & & 5 \\ \hline \multicolumn{7}{|l|}{ Other comprehensive income (loss), net of tax: } \\ \hline Foreign currency translation adjustment & $ & (65,571) & $ & (28,494) & $ & 72,731 \\ \hline Net investment hedge gains (losses) & & 8,904 & & 9,732 & & (25,305) \\ \hline Other comprehensive income (loss), net of tax & & (56,667) & & (18,762) & & 47,426 \\ \hline Comprehensive income & $ & 798,133 & \$ & 956,560 & $ & 636,339 \\ \hline+ & & & & & & \\ \hline Basic earnings per share & $ & 6.70 & $ & 7.52 & $ & 4.52 \\ \hline Diluted earnings per share. & $ & 6.68 & $ & 7.49 & $ & 4.50 \\ \hline Basic weighted-average number of shares outstanding & & 127,666 & & 129,768 & & 130,289 \\ \hline Diluted weighted-average number of shares outstanding & & 128,017 & & 130,295 & & 130,871 \\ \hline \end{tabular} See accompanying notes to the consolidated financial statements