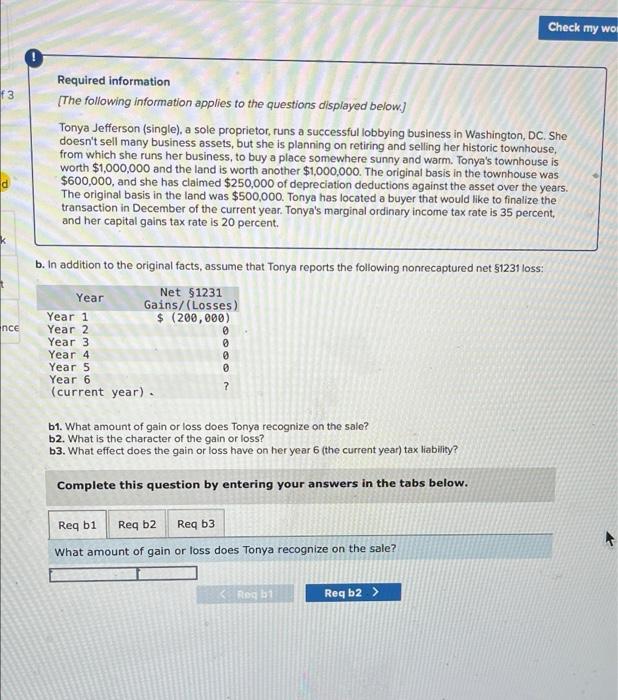

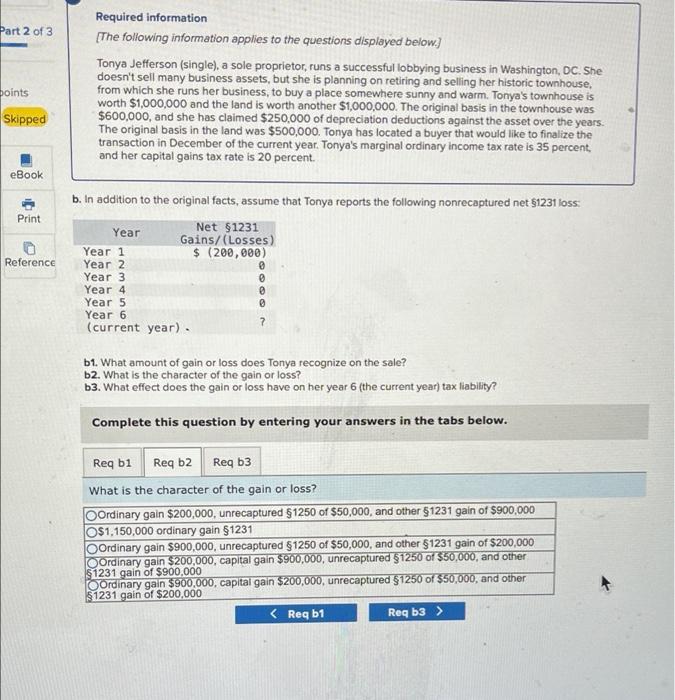

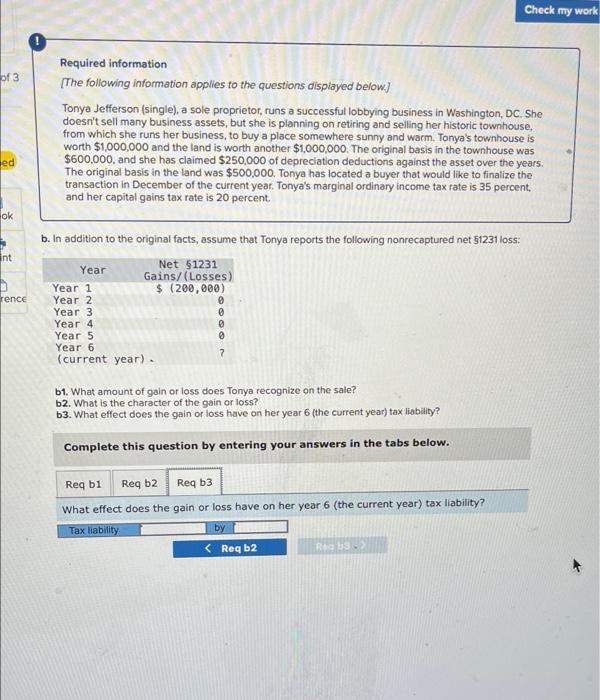

Check my wol 0 3 Required information [The following information applies to the questions displayed below) Tonya Jefferson (single), a sole proprietor, runs a successful lobbying business in Washington, DC. She doesn't sell many business assets, but she is planning on retiring and selling her historic townhouse, from which she runs her business, to buy a place somewhere sunny and warm. Tonya's townhouse is worth $1,000,000 and the land is worth another $1,000,000. The original basis in the townhouse was $600,000, and she has claimed $250,000 of depreciation deductions against the asset over the years. The original basis in the land was $500,000. Tonya has located a buyer that would like to finalize the transaction in December of the current year . Tonya's marginal ordinary income tax rate is 35 percent, and her capital gains tax rate is 20 percent. nce b. In addition to the original facts, assume that Tonya reports the following nonrecaptured net 51231 loss: Year Net $1231 Gains/(Losses) Year 1 $ (200,000) Year 2 @ Year 3 Year 4 Year 5 Year 6 ? (current year). @ b1. What amount of gain or loss does Tonya recognize on the sale? b2. What is the character of the gain or loss? b3. What effect does the gain or loss have on her year 6 (the current year) tax liability? Complete this question by entering your answers in the tabs below. Req bi Req b2 Req b3 What amount of gain or loss does Tonya recognize on the sale? Rog b1 Reqb2 > Part 2 of 3 boints Skipped Required information [The following information applies to the questions displayed below. Tonya Jefferson (single), a sole proprietor, runs a successful lobbying business in Washington, DC. She doesn't sell many business assets, but she is planning on retiring and selling her historic townhouse, from which she runs her business, to buy a place somewhere sunny and warm. Tonya's townhouse is worth $1,000,000 and the land is worth another $1,000,000. The original basis in the townhouse was $600,000, and she has claimed $250,000 of depreciation deductions against the asset over the years. The original basis in the land was $500,000. Tonya has located a buyer that would like to finalize the transaction in December of the current year. Tonya's marginal ordinary income tax rate is 35 percent and her capital gains tax rate is 20 percent. eBook Print Reference b. In addition to the original facts, assume that Tonya reports the following nonrecaptured net $1231 loss Year Net $1231 Gains/(Losses) Year 1 $ (200,000) Year 2 Year 3 Year 4 Year 5 Year 6 (current year). 7 61. What amount of gain or loss does Tonya recognize on the sale? b2. What is the character of the gain or loss? 63. What effect does the gain or loss have on her year 6 (the current year) tax liability? Complete this question by entering your answers in the tabs below. Reqbi Reqb2 Reg 63 What is the character of the gain or loss? Ordinary gain $200,000, unrecaptured 91250 of $50,000, and other $1231 gain of $900,000 O$1,150,000 ordinary gain $1231 Ordinary gain $900,000, unrecaptured $1250 of $50,000, and other $1231 gain of $200,000 Ordinary gain $200,000, capital gain $900,000, unrecaptured $1250 of $50,000, and other $1231 gain of $900,000 Ordinary gain $900,000, capital gain $200,000, unrecaptured $1250 of $50,000, and other $1231 gain of $200,000 Check my work of 3 Required information [The following information applies to the questions displayed below) Tonya Jefferson (single), a sole proprietor, runs a successful lobbying business in Washington, DC. She doesn't sell many business assets, but she is planning on retiring and selling her historic townhouse, from which she runs her business, to buy a place somewhere sunny and warm. Tonya's townhouse is worth $1,000,000 and the land is worth another $1,000,000. The original basis in the townhouse was $600,000, and she has claimed $250,000 of depreciation deductions against the asset over the years. The original basis in the land was $500,000. Tonya has located a buyer that would like to finalize the transaction in December of the current year. Tonya's marginal ordinary income tax rate is 35 percent, and her capital gains tax rate is 20 percent ed ok int rence b. In addition to the original facts, assume that Tonya reports the following nonrecaptured net $1231 loss: Net 51231 Year Gains/(Losses) Year 1 $ (200,000) Year 2 Year 3 Year 4 Year 5 Year 6 (current year). 7 61. What amount of gain or loss does Tonya recognize on the sale? b2. What is the character of the gain or loss? b3. What effect does the gain or loss have on her year 6 (the current year) tax liability ? Complete this question by entering your answers in the tabs below. Req bi Req b2 Reqb3 What effect does the gain or loss have on her year 6 (the current year) tax liability? Tax liability by