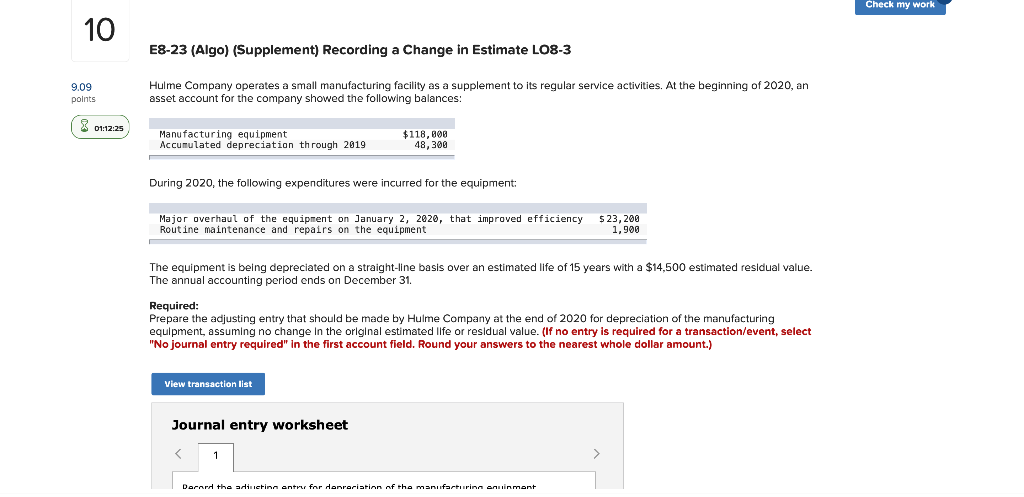

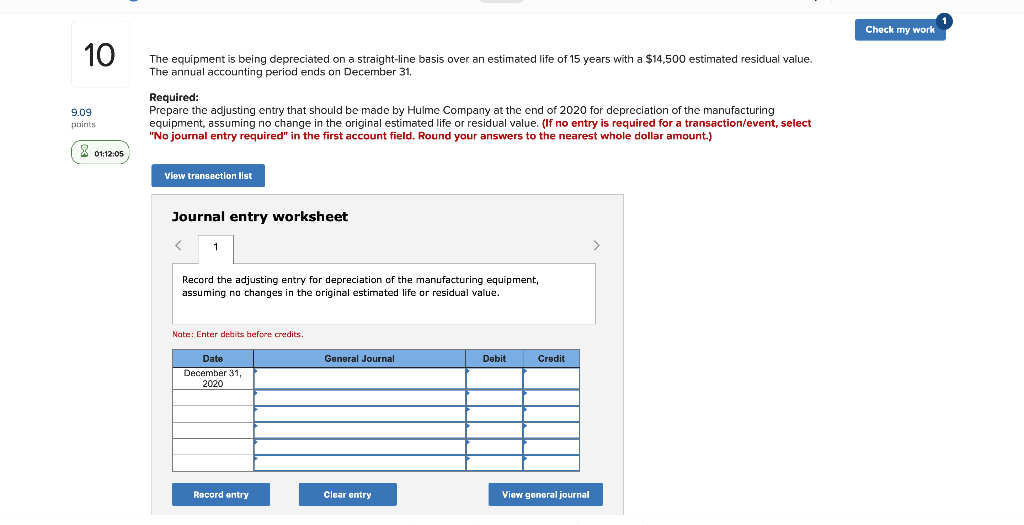

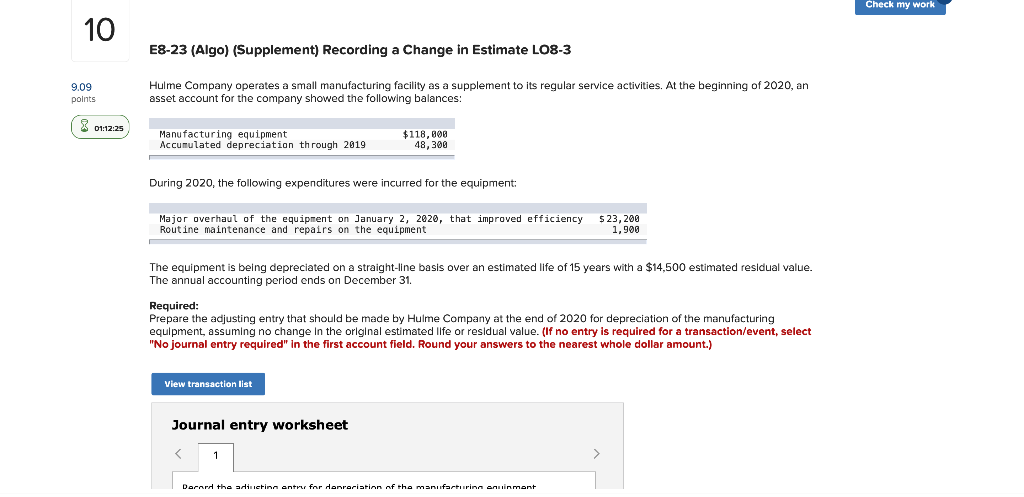

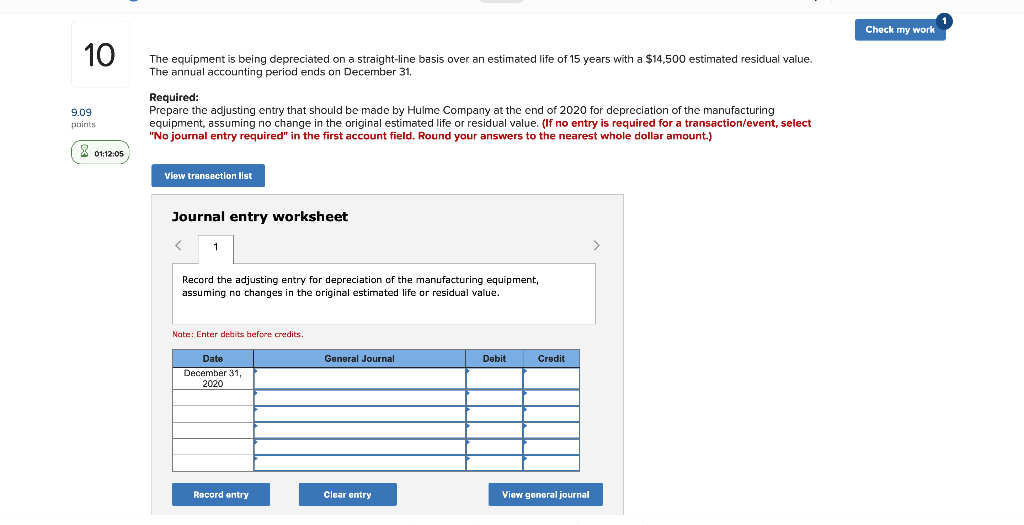

Check my work 10 E8-23 (Algo) (Supplement) Recording a Change in Estimate L08-3 9.09 points Hulme Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of 2020, an asset account for the company showed the following balances: X 01:12:25 Manufacturing equipment Accumulated depreciation through 2019 $118,808 48,300 During 2020, the following expenditures were incurred for the equipment: Major overhaul of the equipment on January 2, 2020, that improved efficiency Routine maintenance and repairs on the equipment $ 23, 200 1,900 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $14,500 estimated residual value. The annual accounting period ends on December 31. Required: Prepare the adjusting entry that should be made by Hulme Company at the end of 2020 for depreciation of the manufacturing equipment, assuming no change in the original estimated life or residual value. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 Derard the adictin antri for danrariation of the manufacturino animant Check my work 10 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $14,500 estimated residual value. The annual accounting period ends on December 31, Required: Prepare the adjusting entry that should be made by Hulme Company at the end of 2020 for depreciation of the manufacturing equipment, assuming no change in the original estimated life or residual value. (If no entry required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amount.) 9.09 points X 01:12:05 View transaction list Journal entry worksheet 1 Record the adjusting entry for depreciation of the manufacturing equipment, assuming no changes in the original estimated life or residual value. Nate: Enter debits before credits General Journal Debit Credit Date December 31 2020 Record entry Clear entry View general journal