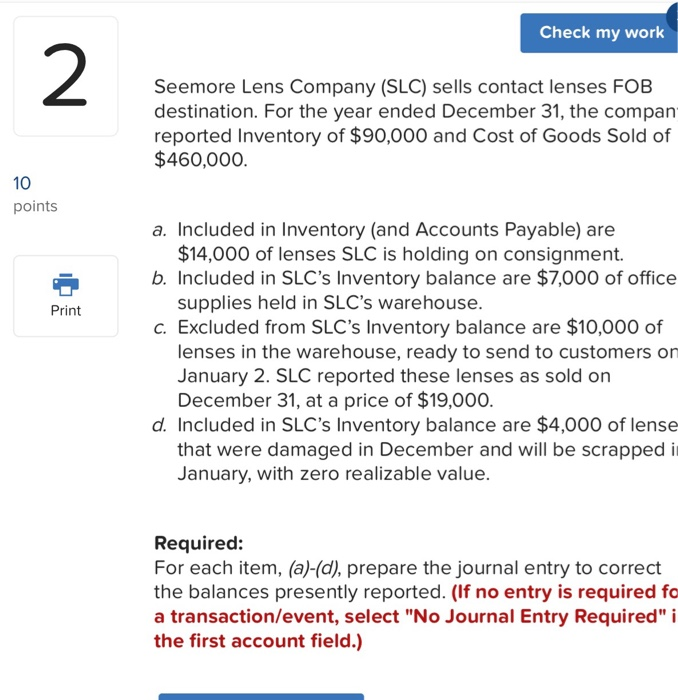

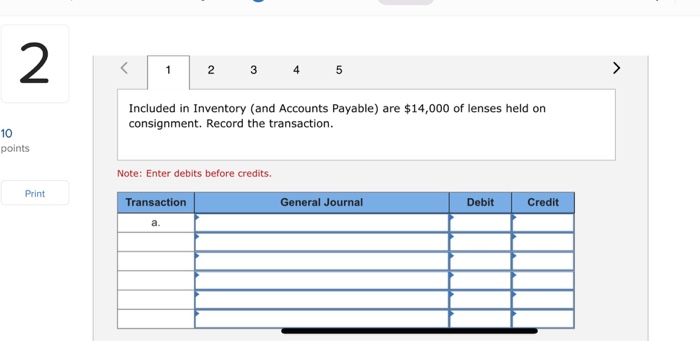

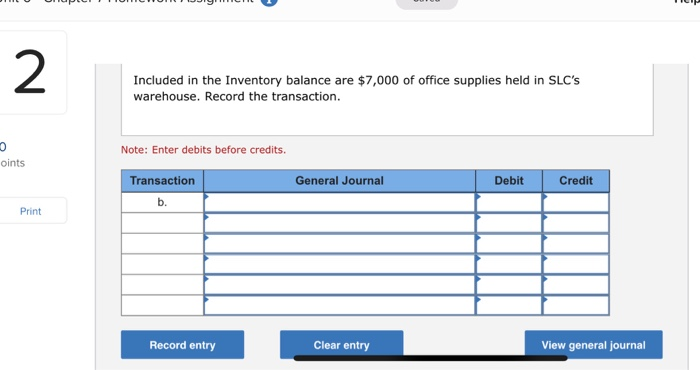

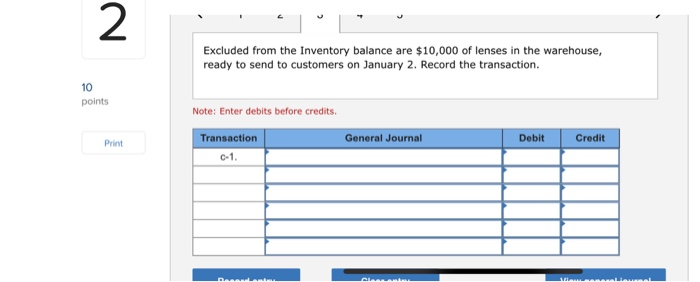

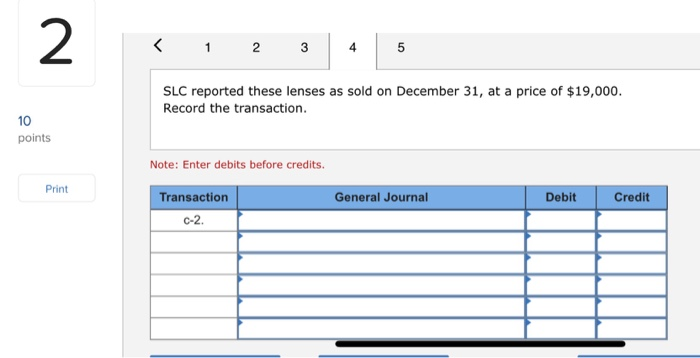

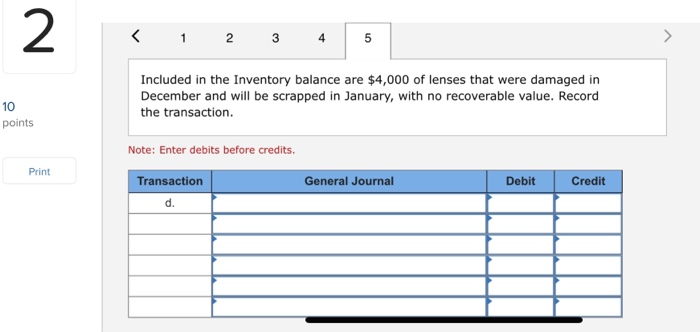

Check my work 2 Seemore Lens Company (SLC) sells contact lenses FOB destination. For the year ended December 31, the compan reported Inventory of $90,000 and Cost of Goods Sold of $460,000. 10 points Print a. Included in Inventory (and Accounts Payable) are $14,000 of lenses SLC is holding on consignment. b. Included in SLC's Inventory balance are $7,000 of office supplies held in SLC's warehouse. C. Excluded from SLC's Inventory balance are $10,000 of lenses in the warehouse, ready to send to customers on January 2. SLC reported these lenses as sold on December 31, at a price of $19,000. d. Included in SLC's Inventory balance are $4,000 of lense that were damaged in December and will be scrapped i January, with zero realizable value. Required: For each item, (a)-(d), prepare the journal entry to correct the balances presently reported. (If no entry is required fo a transaction/event, select "No Journal Entry Required" i the first account field.) 2 3 4 5 N Included in Inventory (and Accounts Payable) are $14,000 of lenses held on consignment. Record the transaction. 10 points Note: Enter debits before credits. Print Transaction General Journal Debit Credit 2 Included in the Inventory balance are $7,000 of office supplies held in SLC's warehouse. Record the transaction. Note: Enter debits before credits. oints General Journal Debit Credit Transaction b. Print Record entry Clear entry View general journal 2 Excluded from the Inventory balance are $10,000 of lenses in the warehouse, ready to send to customers on January 2. Record the transaction. 10 points Note: Enter debits before credits. Transaction General Journal C-1 Print Debit Credit 2 1 2 3 4 5 SLC reported these lenses as sold on December 31, at a price of $19,000. Record the transaction. 10 points Note: Enter debits before credits. Print General Journal Debit Credit Transaction C-2 2 1 2 3 5 Included in the Inventory balance are $4,000 of lenses that were damaged in December and will be scrapped in January, with no recoverable value. Record the transaction. 10 points Note: Enter debits before credits. Print General Journal Debit Credit Transaction d