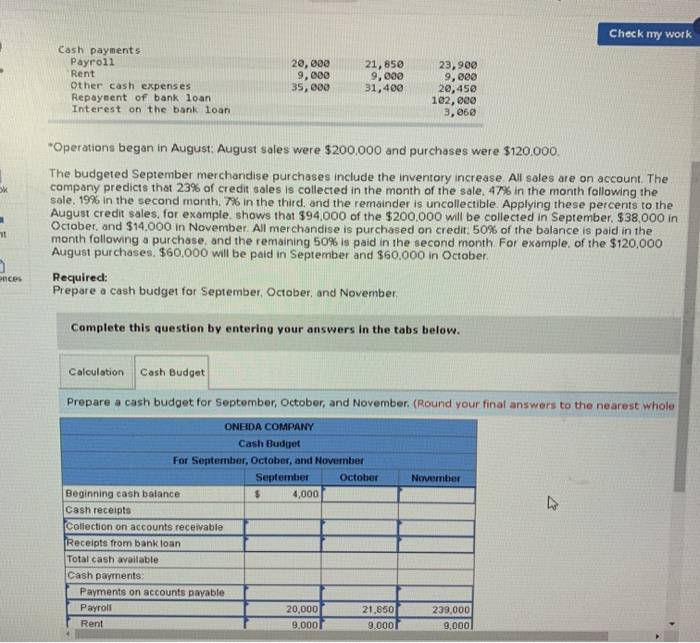

Check my work Cash payments Payroll Rent Other cash expenses Repayment of bank loan Interest on the bank loan 20,000 9,000 35,000 21,850 9,000 31,400 23,900 9,000 20,450 102,000 3,60 *Operations began in August: August sales were $200,000 and purchases were $120,000 The budgeted September merchandise purchases include the inventory increase. All sales are on account. The company predicts that 23% of credit sales is collected in the month of the sale, 47% in the month following the sale, 19% in the second month, 7% in the third, and the remainder is uncollectible. Applying these percents to the August credit sales, for example, shows that $94.000 of the $200,000 will be collected in September, $38,000 in October, and $14.000 in November. All merchandise is purchased on credit: 50% of the balance is paid in the month following a purchase, and the remaining 50% is paid in the second month. For example of the $120,000 August purchases. $60,000 will be paid in September and $60,000 in October Required: Prepare a cash budget for September October, and November, ences Complete this question by entering your answers in the tabs below. Calculation Cash Budget Prepare a cash budget for September, October, and November (Round your final answers to the nearest whole November ONEIDA COMPANY Cash Budget For September, October, and November September October Beginning cash balance $ 4,000 Cash receipts Collection on accounts receivable Receipts from bank loan Total cash available Cash payments: Payments on accounts payable Payroll 20,000 21,850 Rent 9.000 9.000 239,000 9,000 Check my work Cash payments Payroll Rent Other cash expenses Repayment of bank loan Interest on the bank loan 20,000 9,000 35,000 21,850 9,000 31,400 23,900 9,000 20,450 102,000 3,60 *Operations began in August: August sales were $200,000 and purchases were $120,000 The budgeted September merchandise purchases include the inventory increase. All sales are on account. The company predicts that 23% of credit sales is collected in the month of the sale, 47% in the month following the sale, 19% in the second month, 7% in the third, and the remainder is uncollectible. Applying these percents to the August credit sales, for example, shows that $94.000 of the $200,000 will be collected in September, $38,000 in October, and $14.000 in November. All merchandise is purchased on credit: 50% of the balance is paid in the month following a purchase, and the remaining 50% is paid in the second month. For example of the $120,000 August purchases. $60,000 will be paid in September and $60,000 in October Required: Prepare a cash budget for September October, and November, ences Complete this question by entering your answers in the tabs below. Calculation Cash Budget Prepare a cash budget for September, October, and November (Round your final answers to the nearest whole November ONEIDA COMPANY Cash Budget For September, October, and November September October Beginning cash balance $ 4,000 Cash receipts Collection on accounts receivable Receipts from bank loan Total cash available Cash payments: Payments on accounts payable Payroll 20,000 21,850 Rent 9.000 9.000 239,000 9,000