Question

Check my work Check My Work button is now enabled2Item 1 Item 1 Time Remaining 4 hours 44 minutes 3 seconds 04:44:03 Casey Nelson is

Check my work Check My Work button is now enabled2Item 1 Item 1 Time Remaining 4 hours 44 minutes 3 seconds 04:44:03 Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his divisions return on investment (ROI), which has been above 23% each of the last three years. Casey is considering a capital budgeting project that would require a $4,100,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Companys discount rate is 19%. The project would provide net operating income each year for five years as follows:

| Sales | $ | 4,000,000 | ||

| Variable expenses | 1,840,000 | |||

| Contribution margin | 2,160,000 | |||

| Fixed expenses: | ||||

| Advertising, salaries, and other fixed out-of-pocket costs | $ | 760,000 | ||

| Depreciation | 820,000 | |||

| Total fixed expenses | 1,580,000 | |||

| Net operating income | $ | 580,000 | ||

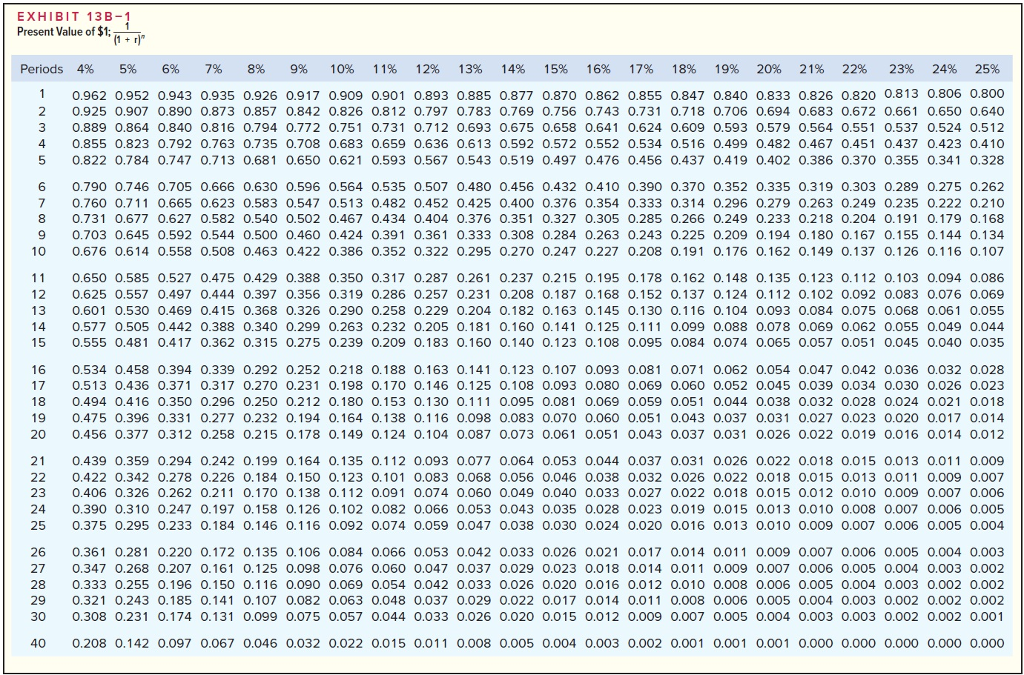

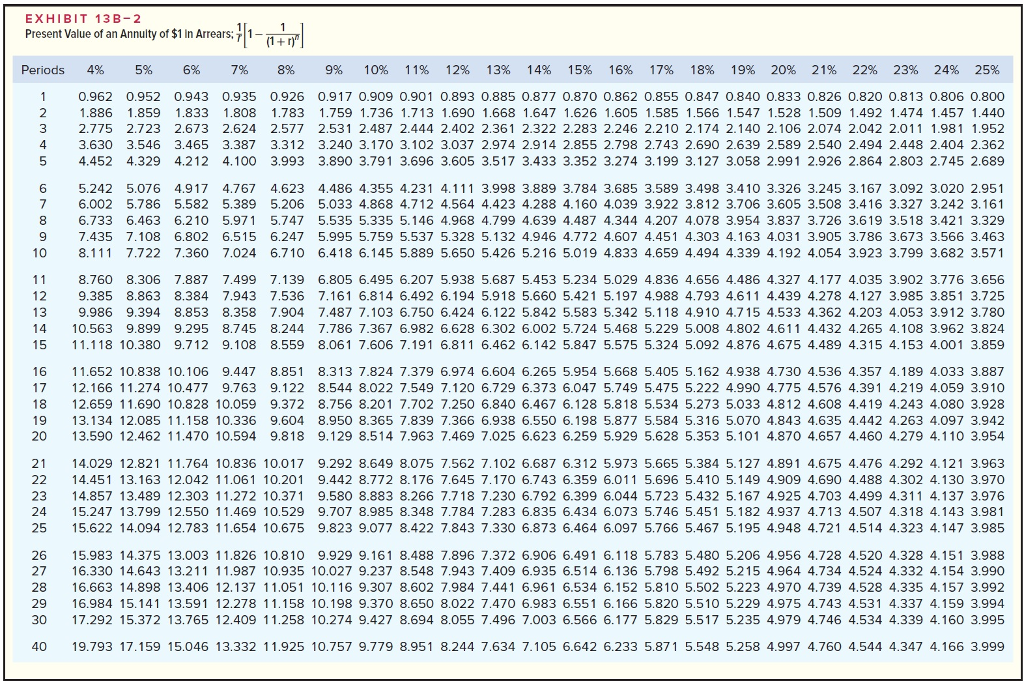

Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. What is the projects internal rate of return to the nearest whole percent?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started